Question: in excel A 10 -year bond with a face value of $6000 is going to be purchased by you. Interest payments on the bond will

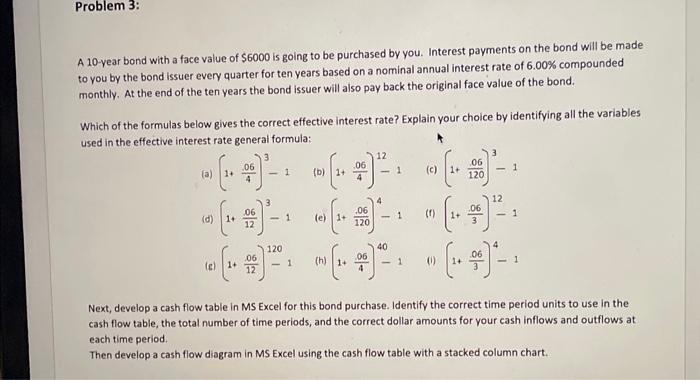

A 10 -year bond with a face value of $6000 is going to be purchased by you. Interest payments on the bond will be made to you by the bond issuer every quarter for ten years based on a nominal annual interest rate of 6.00% compounded monthly. At the end of the ten years the bond issuer will also pay back the original face value of the bond. Which of the formulas below gives the correct effective interest rate? Explain your choice by identifying all the variables used in the effective interest rate general formula: (a) (1+4.06)31 (b) (1+4.06)121 (c) [1+120.06)31 (d) (1+12.06)31 (e) (1+120.06)41 (f) (1+3.06)121 (e) (1+12.06)1201 (h) (1+4.06)401 (i) (1+3.06)41 Next, develop a cash flow table in MS Excel for this bond purchase. Identify the correct time period units to use in the cash flow table, the total number of time periods, and the correct dollar amounts for your cash inflows and outflows at each time period. Then develop a cash flow diagram in MS Excel using the cash flow table with a stacked column chart. A 10 -year bond with a face value of $6000 is going to be purchased by you. Interest payments on the bond will be made to you by the bond issuer every quarter for ten years based on a nominal annual interest rate of 6.00% compounded monthly. At the end of the ten years the bond issuer will also pay back the original face value of the bond. Which of the formulas below gives the correct effective interest rate? Explain your choice by identifying all the variables used in the effective interest rate general formula: (a) (1+4.06)31 (b) (1+4.06)121 (c) [1+120.06)31 (d) (1+12.06)31 (e) (1+120.06)41 (f) (1+3.06)121 (e) (1+12.06)1201 (h) (1+4.06)401 (i) (1+3.06)41 Next, develop a cash flow table in MS Excel for this bond purchase. Identify the correct time period units to use in the cash flow table, the total number of time periods, and the correct dollar amounts for your cash inflows and outflows at each time period. Then develop a cash flow diagram in MS Excel using the cash flow table with a stacked column chart

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts