Question: In excel, how would I go about using the PV function to find the solution to the problem? I'm pretty sure my NPV and project

In excel, how would I go about using the PV function to find the solution to the problem? I'm pretty sure my NPV and project accept/reject is correct but wouldn't mind them being checked for correctness.

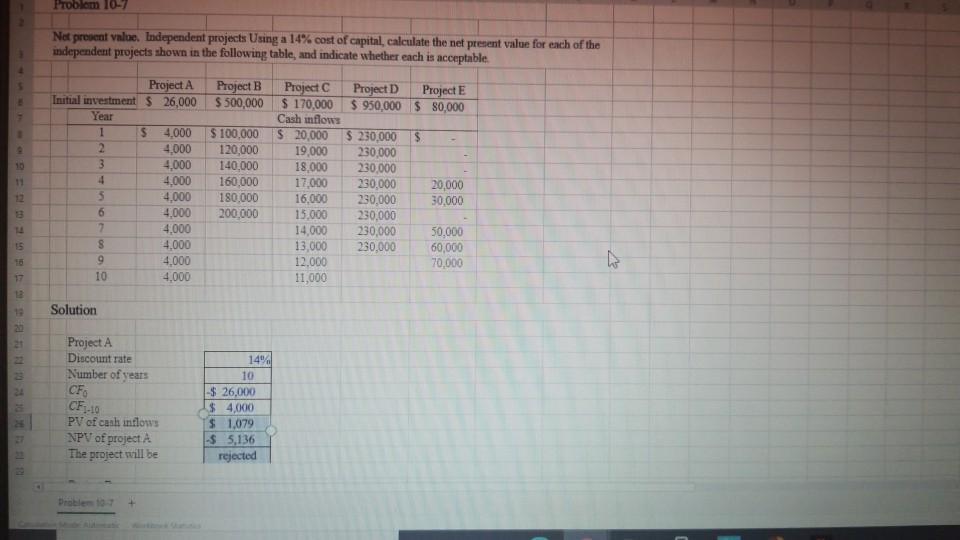

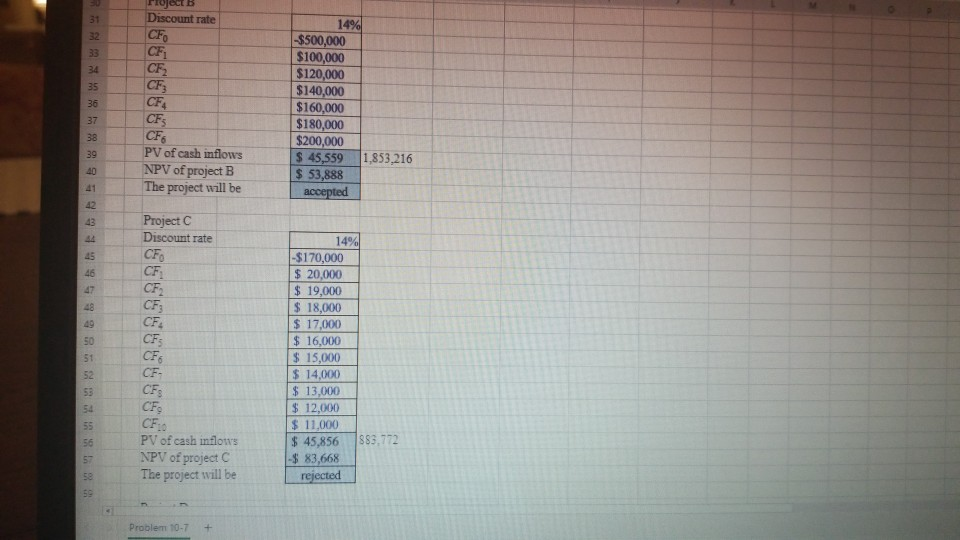

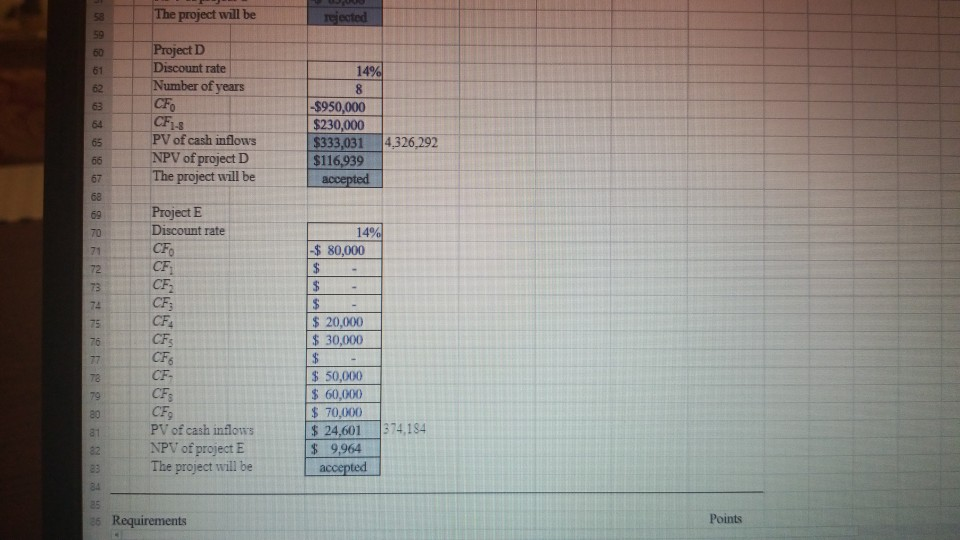

Problem 10-7 Net present value. Independent projects Using a 14% cost of capital calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. 4 5 6 7 Project A Project B Initial investment $ 26,000 $500,000 Year S 9 10 1 2 3 4 5 6 7 8 9 10 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 $ 100,000 120,000 140,000 160,000 180,000 200,000 12 13 Project C Project D Project E $ 170,000 $ 950,000 $80,000 Cash inflows $ 20,000 $ 230,000 $ 19,000 230,000 18,000 230,000 17,000 230,000 20,000 16.000 230,000 30,000 15,000 230,000 14,000 230,000 50.000 13,000 230,000 60,000 12,000 70,000 11,000 14 15 16 17 18 19 Solution 20 Project A Discount rate Number of years CF CF 1-10 14% 10 -$ 26,000 $ 4,000 $ 1,079 $ 5,136 rejected PV of cash inflows NPV of project The project will be Problem 10.7 + 31 32 oject Discount rate CFo CF CF2 33 34 35 36 37 CF 14% -$500,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 $ 45,559 1.853,216 $ 53,888 accepted 38 39 CFS CF PV of cash inflows NPV of project B The project will be 40 42 43 24 45 Project C Discount rate CFo CF CF CF; 46 CF4 CF CF 14% -$170,000 $ 20,000 $ 19,000 $ 18,000 $ 17,000 $ 16,000 $ 15,000 $ 14,000 $ 13,000 $ 12,000 $ 11,000 $ 45,856 883.772 $ 83,668 rejected CF 48 49 50 51 52 53 54 55 56 57 58 59 CFS CF CFO PV of cash inflows NPV of project C The project will be Problem 10-7 The project will be rejected 50 Project D Discount rate Number of years CF% CF1- 14% 8 -$950,000 $230,000 $333,031 4,326,292 $116,939 accepted PV of cash inflows NPV of project D The project will be BR 8 6 8 8 3 8 8 8 8 BNP 8 Project E Discount rate CFO CF CF: CF; CF, CFS CF CF- 14% $ 80,000 $ $ $ $ 20,000 $ 30,000 $ $ 50,000 $ 60,000 $ 70,000 $ 24,601 374,184 $ 9,964 accepted CFS 81 CF, PV of cash inflows NPV of project E The project will be 82 23 84 25 36 Requirements Points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts