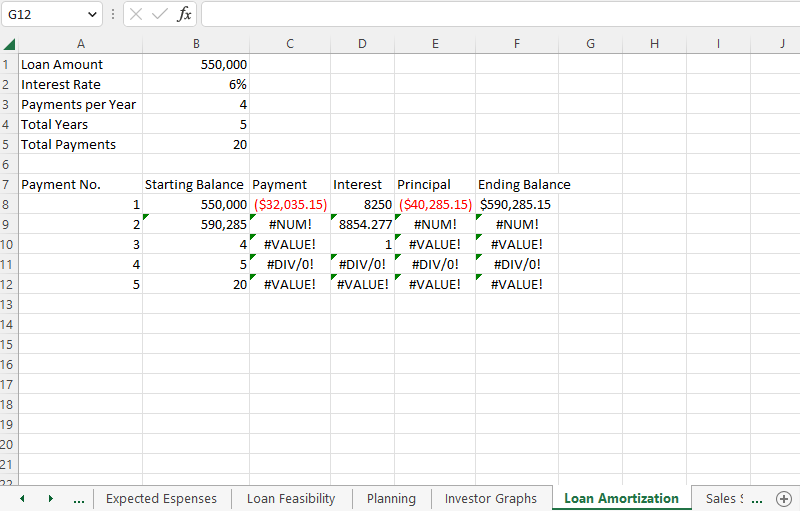

Question: In Excel, I need help with this, please. I have the worksheet created but it is not adding up correctly. Please look at the screenshots

In Excel, I need help with this, please. I have the worksheet created but it is not adding up correctly. Please look at the screenshots provided. THANKS

Loan Amortization Schedule Worksheet

- Create a new worksheet and name this new sheet to

Loan Amortization. - In cell

A1, typeLoan Amountand in cellB1, enter$550,000. - In cell

A2, typeInterest Rateand in cellB2, enter6%. - In cell

A3, typePayments per Yearand in cellB3, enter4(for quarterly payments). - In cell

A4, typeTotal Yearsand in cellB4, enter5. - In cell

A5, typeTotal Payments. - In cell

B5, enter the formula=B3 * B4. - Add the table headers

- In cell

A7, typePayment No. - In cell

B7, typeStarting Balance - In cell

C7, typePayment - In cell

D7, typeInterest - In cell

E7, typePrincipal - In cell

F7, typeEnding Balance

- In cell

- In cell

A8, type1. - In cell

B8, enter=B1(this refers back to your initial loan amount). - In cell

C8, enter the PMT formula:=PMT(B2/B3, B5, B1). This will calculate the quarterly payment. - In cell

D8, enter the formula=B8 * (B2/B3)to calculate the interest portion of the first payment. - In cell

E8, enter the formula=C8 - D8to calculate the principal portion of the first payment. - In cell

F8, enter the formula=B8 - E8to find the ending balance after the first payment. - Highlight cells

A8toF8. Drag the fill handle (small square at the bottom-right of the selection) down until you reach the row corresponding to your last payment (as perB5). - In the

Starting Balancecolumn (B), starting from cellB9, replace the formula with=F8(the ending balance from the previous payment). - In the

Interestcolumn (D), starting from cellD9, replace the formula with=B9 * (B2/B3). - In the

Principalcolumn (E), starting from cellE9, replace the formula with=C9 - D9. - In the

Ending Balancecolumn (F), starting from cellF9, replace the formula with=B9 - E9.

G12 fx \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline 4 & A & B & C & D & E & F & G & H & 1 \\ \hline & Loan Amount & 550,000 & & & & & & & \\ \hline & Interest Rate & 6% & & & & & & & \\ \hline & Payments per Year & 4 & & & & & & & \\ \hline & Total Years & 5 & & & & & & & \\ \hline & Total Payments & 20 & & & & & & & \\ \hline & & & & & & & & & \\ \hline & Payment No. & Starting Balance & Payment & Interest & Principal & Ending Balance & & & \\ \hline & 1 & 550,000 & ($32,035.15) & 8250 & ($40,285.15) & $590,285.15 & & & \\ \hline & 2 & 590,285 & \#NUM! & 8854.277 & \#NUM! & \#NUM! & & & \\ \hline & 3 & 4 & \#VALue! & 1 & \#VALUe! & \#VALUE! & & & \\ \hline & 4 & 5 & \#DIV/0! & \#DIV/0! & \#DIV/0! & \#DIV/0! & & & \\ \hline & 5 & 20 & \#VALUE! & \#VALUE! & \#VALUe! & \#VAlue! & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts