Question: in excel please 4 (10 Points) RATE of RETURN ANALYSIS 4.1. For the cash flow below, determine the ROR Year 0 1 2 3 4

in excel please

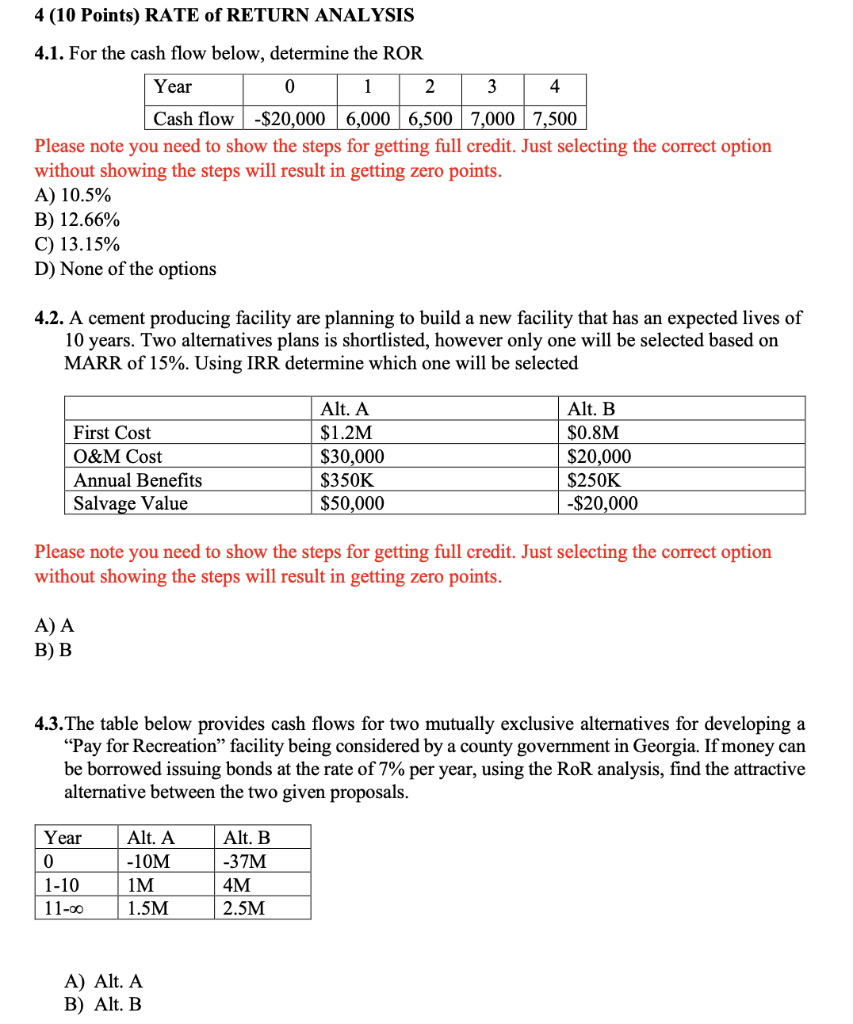

4 (10 Points) RATE of RETURN ANALYSIS 4.1. For the cash flow below, determine the ROR Year 0 1 2 3 4 Cash flow -$20,000 6,000 6,500 7,000 7,500 Please note you need to show the steps for getting full credit. Just selecting the correct option without showing the steps will result in getting zero points. A) 10.5% B) 12.66% C) 13.15% D) None of the options 4.2. A cement producing facility are planning to build a new facility that has an expected lives of 10 years. Two alternatives plans is shortlisted, however only one will be selected based on MARR of 15%. Using IRR determine which one will be selected First Cost O&M Cost Annual Benefits Salvage Value Alt. A $1.2M $30,000 $350K $50,000 Alt. B $0.8M $20,000 $250K -$20,000 Please note you need to show the steps for getting full credit. Just selecting the correct option without showing the steps will result in getting zero points. A) A BB 4.3.The table below provides cash flows for two mutually exclusive alternatives for developing a Pay for Recreation facility being considered by a county government in Georgia. If money can be borrowed issuing bonds at the rate of 7% per year, using the RoR analysis, find the attractive alternative between the two given proposals. Year 0 1-10 11-00 Alt. A -10M IM 1.5M Alt. B -37M 4M 2.5M A) Alt. A B) Alt. B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts