Question: IN excel Present Worth and Annual Worth Analyses In-Class Case Study Lab Background: You are investigating the purchase of a new vehicle, a Prius, a

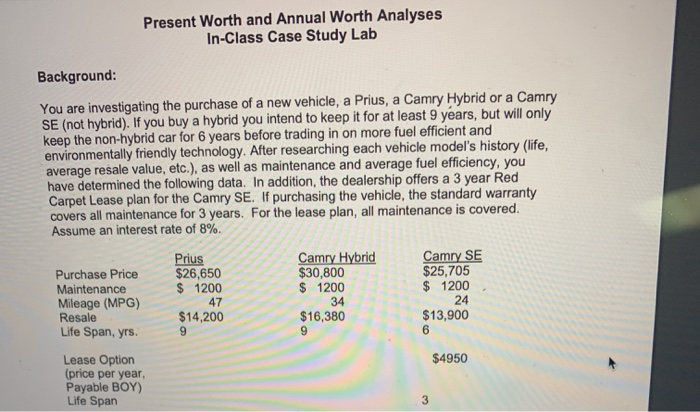

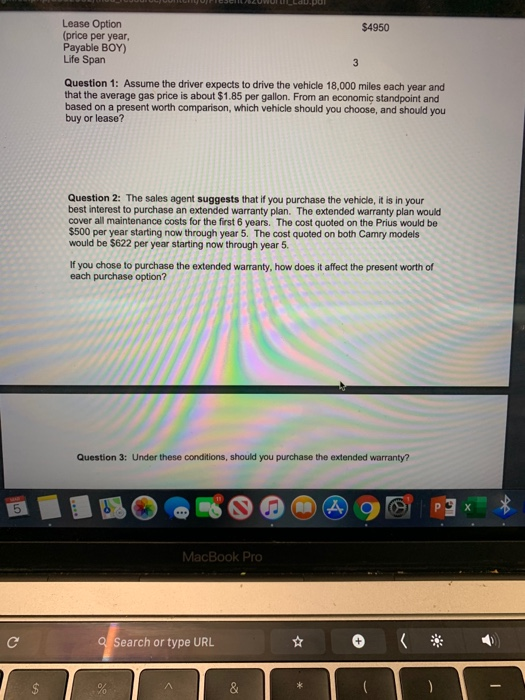

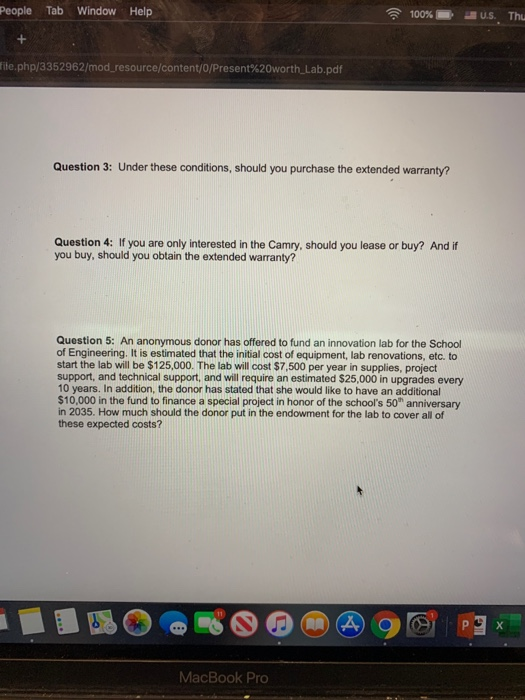

Present Worth and Annual Worth Analyses In-Class Case Study Lab Background: You are investigating the purchase of a new vehicle, a Prius, a Camry Hybrid or a Camry SE (not hybrid). If you buy a hybrid you intend to keep it for at least 9 years, but will only keep the non-hybrid car for 6 years before trading in on more fuel efficient and environmentally friendly technology. After researching each vehicle model's history (life, average resale value, etc.), as well as maintenance and average fuel efficiency, you have determined the following data. In addition, the dealership offers a 3 year Red Carpet Lease plan for the Camry SE. If purchasing the vehicle, the standard warranty covers all maintenance for 3 years. For the lease plan, all maintenance is covered. Assume an interest rate of 8%. Prius $26,650 $ 1200 47 $14,200 Camry Hybrid $30,800 $ 1200 Camry SE $25,705 $ 1200 Purchase Price Maintenance Mileage (MPG) Resale Life Span, yrs. 34 24 $16,380 $13,900 9 $4950 Lease Option (price per year, Payable BOY) Life Span $4950 Lease Option (price per year, Payable BOY) Life Span Question 1: Assume the driver expects to drive the vehicle 18.000 miles each year and that the average gas price is about $1.85 per gallon. From an economic standpoint and based on a present worth comparison, which vehicle should you choose, and should you buy or lease? Question 2: The sales agent suggests that if you purchase the vehicle. It is in your best interest to purchase an extended warranty plan. The extended warranty plan would cover all maintenance costs for the first 6 years. The cost quoted on the Prius would be $500 per year starting now through year 5. The cost quoted on both Camry models would be $622 per year starting now through year 5. If you chose to purchase the extended warranty, how does it affect the present worth of each purchase option? Question 3: Under these conditions, should you purchase the extended warranty? MacBook Pro c Search or type URL * ( * People Tab Window Help 100% us te.php/3352962/mod_resource/content/0/Present%20worth Lab.pdf Question 3: Under these conditions, should you purchase the extended warranty? Question 4: If you are only interested in the Camry, should you lease or buy? And if you buy, should you obtain the extended warranty? Question 5: An anonymous donor has offered to fund an innovation lab for the School of Engineering. It is estimated that the initial cost of equipment, lab renovations, etc. to start the lab will be $125,000. The lab will cost $7,500 per year in supplies, project support, and technical support, and will require an estimated $25,000 in upgrades every 10 years. In addition, the donor has stated that she would like to have an additional $10,000 in the fund to finance a special project in honor of the school's 50 anniversary in 2035. How much should the donor put in the endowment for the lab to cover all of these expected costs? MacBook Pro Present Worth and Annual Worth Analyses In-Class Case Study Lab Background: You are investigating the purchase of a new vehicle, a Prius, a Camry Hybrid or a Camry SE (not hybrid). If you buy a hybrid you intend to keep it for at least 9 years, but will only keep the non-hybrid car for 6 years before trading in on more fuel efficient and environmentally friendly technology. After researching each vehicle model's history (life, average resale value, etc.), as well as maintenance and average fuel efficiency, you have determined the following data. In addition, the dealership offers a 3 year Red Carpet Lease plan for the Camry SE. If purchasing the vehicle, the standard warranty covers all maintenance for 3 years. For the lease plan, all maintenance is covered. Assume an interest rate of 8%. Prius $26,650 $ 1200 47 $14,200 Camry Hybrid $30,800 $ 1200 Camry SE $25,705 $ 1200 Purchase Price Maintenance Mileage (MPG) Resale Life Span, yrs. 34 24 $16,380 $13,900 9 $4950 Lease Option (price per year, Payable BOY) Life Span $4950 Lease Option (price per year, Payable BOY) Life Span Question 1: Assume the driver expects to drive the vehicle 18.000 miles each year and that the average gas price is about $1.85 per gallon. From an economic standpoint and based on a present worth comparison, which vehicle should you choose, and should you buy or lease? Question 2: The sales agent suggests that if you purchase the vehicle. It is in your best interest to purchase an extended warranty plan. The extended warranty plan would cover all maintenance costs for the first 6 years. The cost quoted on the Prius would be $500 per year starting now through year 5. The cost quoted on both Camry models would be $622 per year starting now through year 5. If you chose to purchase the extended warranty, how does it affect the present worth of each purchase option? Question 3: Under these conditions, should you purchase the extended warranty? MacBook Pro c Search or type URL * ( * People Tab Window Help 100% us te.php/3352962/mod_resource/content/0/Present%20worth Lab.pdf Question 3: Under these conditions, should you purchase the extended warranty? Question 4: If you are only interested in the Camry, should you lease or buy? And if you buy, should you obtain the extended warranty? Question 5: An anonymous donor has offered to fund an innovation lab for the School of Engineering. It is estimated that the initial cost of equipment, lab renovations, etc. to start the lab will be $125,000. The lab will cost $7,500 per year in supplies, project support, and technical support, and will require an estimated $25,000 in upgrades every 10 years. In addition, the donor has stated that she would like to have an additional $10,000 in the fund to finance a special project in honor of the school's 50 anniversary in 2035. How much should the donor put in the endowment for the lab to cover all of these expected costs? MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts