Question: In Excel / show your work with formalas Creative Financing, Inc, is planning to offer a $1,000 par value 10-year maturity bond with a coupon

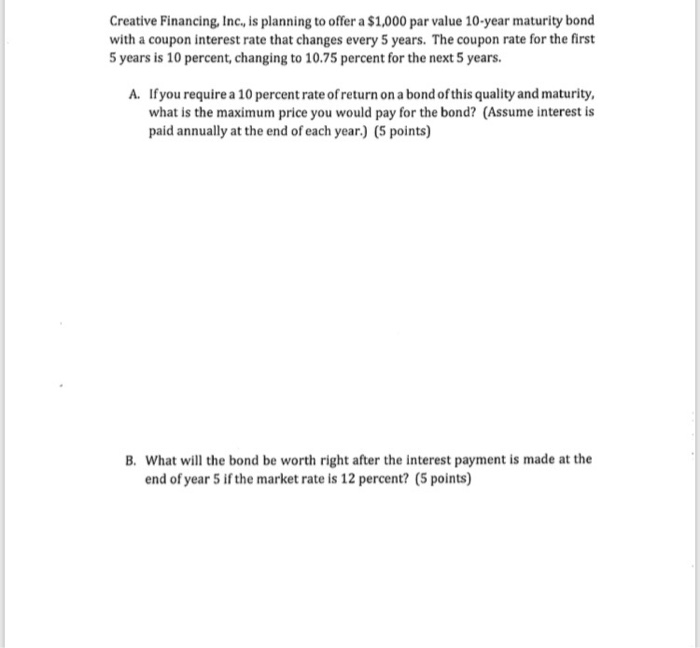

Creative Financing, Inc, is planning to offer a $1,000 par value 10-year maturity bond with a coupon interest rate that changes every 5 years. The coupon rate for the first 5 years is 10 percent, changing to 10.75 percent for the next 5 years. A. Ifyou require a 10 percent rate ofreturn on a bond of this quality and maturity, what is the maximum price you would pay for the bond? (Assume interest is paid annually at the end of each year.) (5 points) B. what will the bond be worth right after the interest payment is made at the end of year 5 if the market rate is 12 percent? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts