Question: In Excel / show your work with formulas Intermountain Resources is a multidivisional company. It has three divisions with the following betas and proportion of

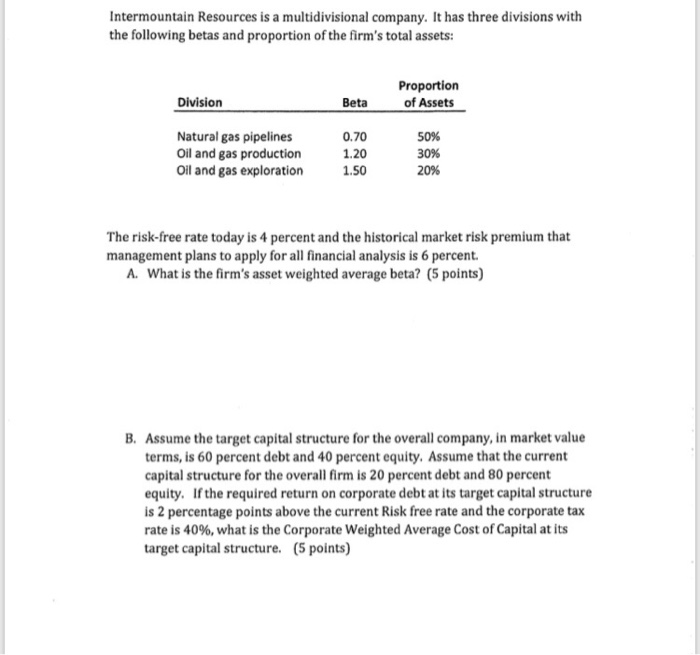

Intermountain Resources is a multidivisional company. It has three divisions with the following betas and proportion of the firm's total assets: Proportion of Assets Division Beta Natural gas pipelines Oil and gas production Oil and gas exploration 0.70 1.20 1.s0 50% 30% 20% The risk-free rate today is 4 percent and the historical market risk premium that management plans to apply for all financial analysis is 6 percent. A. What is the firm's asset weighted average beta? (5 points) B. Assume the target capital structure for the overall company, in market value terms, is 60 percent debt and 40 percent equity. Assume that the current capital structure for the overall firm is 20 percent debt and 80 percent equity. If the required return on corporate debt at its target capital structure is 2 percentage points above the current Risk free rate and the corporate tax rate is 40%, what is the Corporate Weighted Average Cost of Capital at its target capital structure. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts