Question: In excel using a PivotTable, please. A & B. b. How many franchises have more than 30,000 locations: 6. The file Mutual Funds contains a

In excel using a PivotTable, please. A & B.

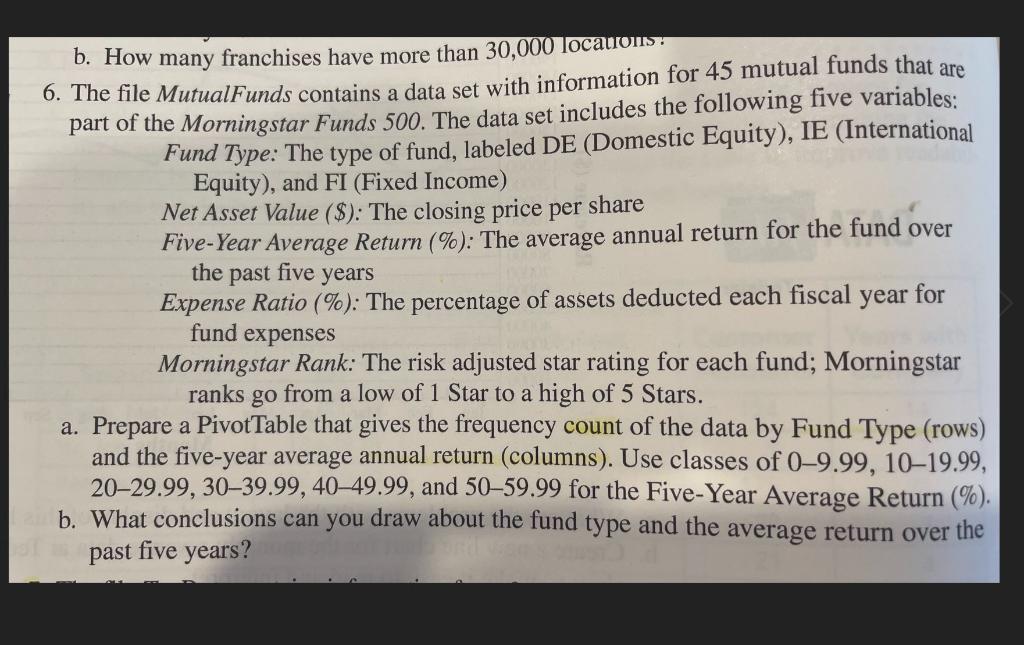

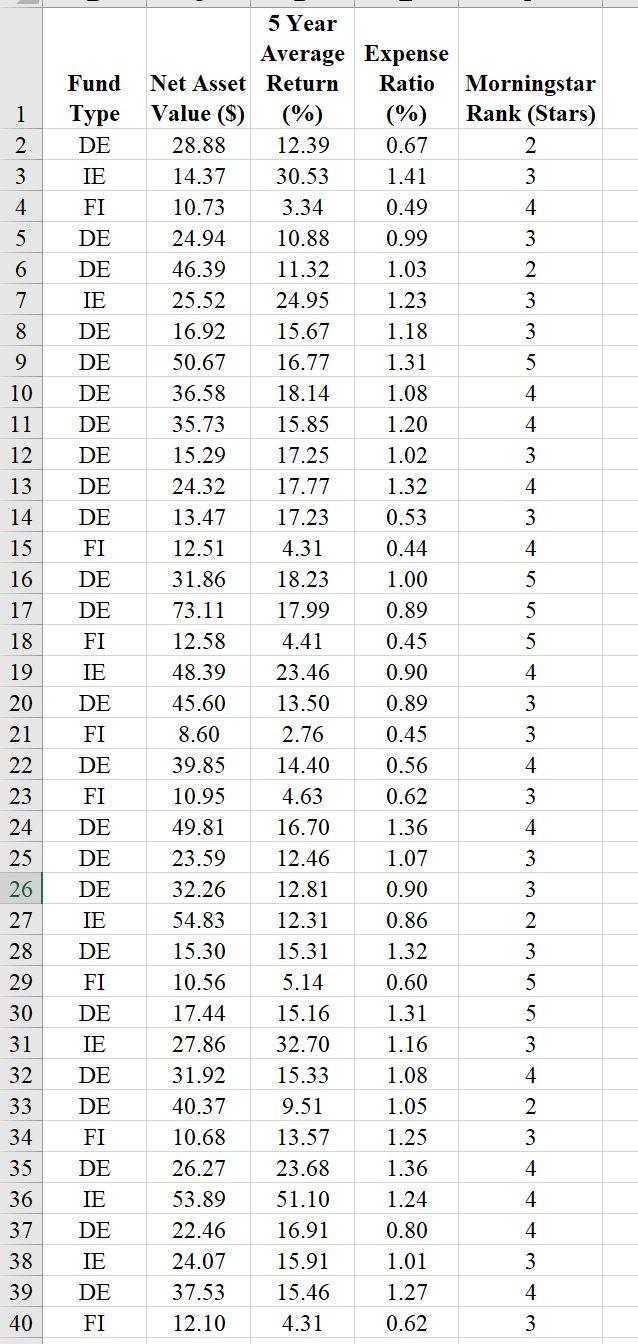

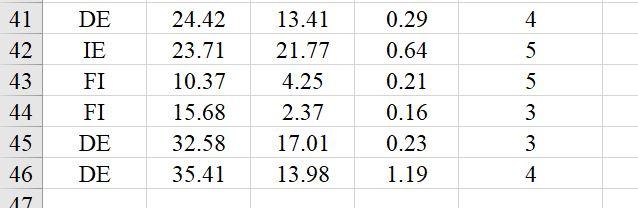

b. How many franchises have more than 30,000 locations: 6. The file Mutual Funds contains a data set with information for 45 mutual funds that are part of the Morningstar Funds 500. The data set includes the following five variables: Fund Type: The type of fund, labeled DE (Domestic Equity), IE (International Equity), and FI (Fixed Income) Net Asset Value ($): The closing price per share Five-Year Average Return (%): The average annual return for the fund over the past five years Expense Ratio (%): The percentage of assets deducted each fiscal year for fund expenses Morningstar Rank: The risk adjusted star rating for each fund; Morningstar ranks go from a low of 1 Star to a high of 5 Stars. a. Prepare a PivotTable that gives the frequency count of the data by Fund Type (rows) and the five-year average annual return (columns). Use classes of 0-9.99, 1019.99, 2029.99, 3039.99, 40-49.99, and 5059.99 for the Five-Year Average Return (%). b. What conclusions can you draw about the fund type and the average return over the past five years? 1 2 3 4 Morningstar Rank (Stars) 2 3 4 5 3 6 2 7 3 8 3 9 10 11 12 5 4 4 3 4 3 4 13 14 15 5 16 17 5 18 5 4 5 Year Average Expense Net Asset Return Ratio Value (S) (%) (%) 28.88 12.39 0.67 14.37 30.53 1.41 10.73 3.34 0.49 24.94 10.88 0.99 46.39 11.32 1.03 25.52 24.95 1.23 16.92 15.67 1.18 50.67 16.77 1.31 36.58 18.14 1.08 35.73 15.85 1.20 15.29 17.25 1.02 24.32 17.77 1.32 13.47 17.23 0.53 12.51 4.31 0.44 31.86 18.23 1.00 73.11 17.99 0.89 12.58 4.41 0.45 48.39 23.46 0.90 45.60 13.50 0.89 8.60 2.76 0.45 39.85 14.40 0.56 10.95 4.63 0.62 49.81 16.70 1.36 23.59 12.46 1.07 32.26 12.81 0.90 54.83 12.31 0.86 15.30 15.31 1.32 10.56 5.14 0.60 17.44 15.16 1.31 27.86 32.70 1.16 31.92 15.33 1.08 40.37 9.51 1.05 10.68 13.57 1.25 26.27 23.68 1.36 53.89 51.10 1.24 22.46 16.91 0.80 24.07 15.91 1.01 37.53 15.46 1.27 12.10 4.31 0.62 Fund Type DE IE FI DE DE IE DE DE DE DE DE DE DE FI DE DE FI IE DE FI DE FI DE DE DE IE DE FI DE IE DE DE FI DE IE DE IE DE FI 3 19 20 21 22 23 24 25 26 27 28 29 30 3 4 3 4 3 3 2 3 ani in 5 5 31 3 4 2 32 33 34 35 36 37 38 39 40 3 4 4 4 3 4 3 4 41 42 43 44 45 46 DE IE FI FI DE DE 24.42 23.71 10.37 15.68 32.58 35.41 13.41 21.77 4.25 2.37 17.01 13.98 0.29 0.64 0.21 0.16 0.23 1.19 5 5 3 3 4 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts