Question: in excel with screen shot for excel work send the screenshot date Learning Outcomes Analyse comples information loy employing advanced technical and induction mit dem

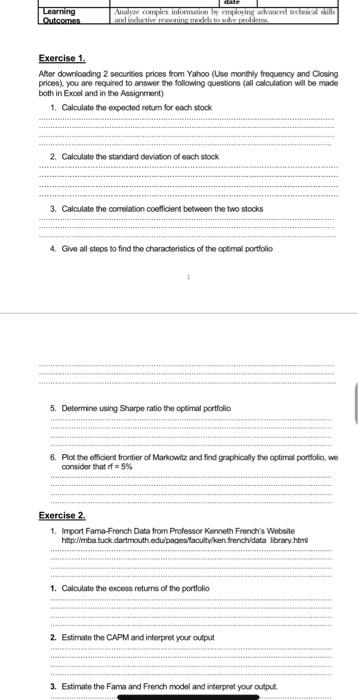

date Learning Outcomes Analyse comples information loy employing advanced technical and induction mit dem Exercise 1 Alter downloading 2 securities prices from Yahoo (Use monthly frequency and Closing prices), you are required to answer the following questions (all calculation will be made both in Excel and in the Assignment) 1. Calculate the expected retum for each stock 2. Calculate the standard deviation of each stock 3. Calculate the correlation coefficient between the two stocks 4. Give all steps to find the characteristics of the optimal portfolio 5. Determine using Sharpe ratio the optimal portfolio 6. Plot the efficient frontier of Markowitz and find graphically the optimal portfolio, we consider that if 5% Exercise 2 1. Import Fama-French Data from Professor Kenneth French's Website http://mba tuck.dartmouth.edu/pages faculty/ken frenchidata library.html 1. Calculate the excess returns of the portfolio 2. Estimate the CAPM and interpret your output 3. Estimate the Fama and French model and interpret your output date Learning Outcomes Analyse comples information loy employing advanced technical and induction mit dem Exercise 1 Alter downloading 2 securities prices from Yahoo (Use monthly frequency and Closing prices), you are required to answer the following questions (all calculation will be made both in Excel and in the Assignment) 1. Calculate the expected retum for each stock 2. Calculate the standard deviation of each stock 3. Calculate the correlation coefficient between the two stocks 4. Give all steps to find the characteristics of the optimal portfolio 5. Determine using Sharpe ratio the optimal portfolio 6. Plot the efficient frontier of Markowitz and find graphically the optimal portfolio, we consider that if 5% Exercise 2 1. Import Fama-French Data from Professor Kenneth French's Website http://mba tuck.dartmouth.edu/pages faculty/ken frenchidata library.html 1. Calculate the excess returns of the portfolio 2. Estimate the CAPM and interpret your output 3. Estimate the Fama and French model and interpret your output

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts