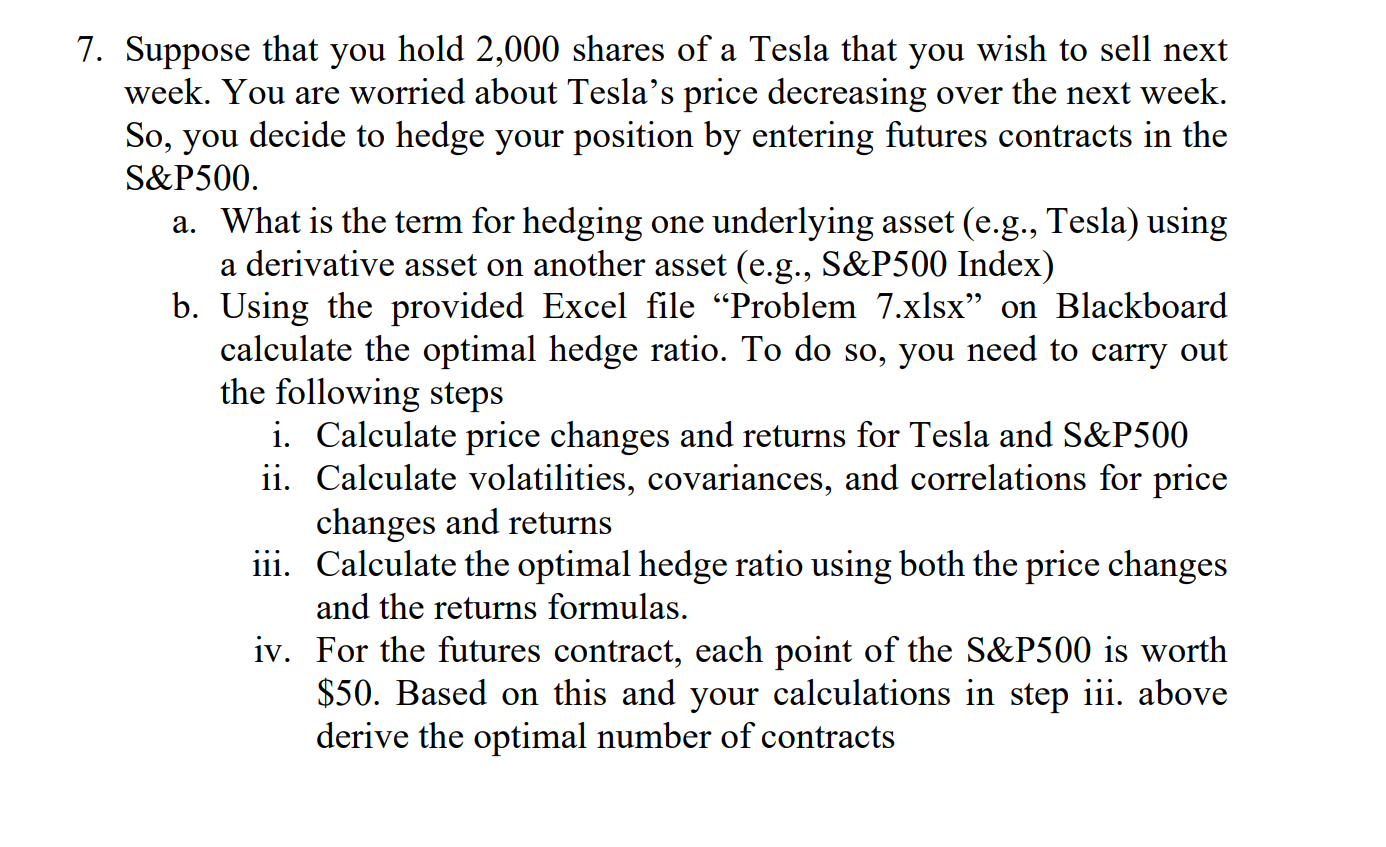

Question: IN EXCELSuppose that you hold 2 , 0 0 0 shares of a Tesla that you wish to sell next week. You are worried about

IN EXCELSuppose that you hold shares of a Tesla that you wish to sell next

week. You are worried about Tesla's price decreasing over the next week.

So you decide to hedge your position by entering futures contracts in the

S&P

a What is the term for hedging one underlying asset eg Tesla using

a derivative asset on another asset eg S&P Index

b Using the provided Excel file "Problem xlsx on Blackboard

calculate the optimal hedge ratio. To do so you need to carry out

the following steps

i Calculate price changes and returns for Tesla and S&P

ii Calculate volatilities, covariances, and correlations for price

changes and returns

iii. Calculate the optimal hedge ratio using both the price changes

and the returns formulas.

iv For the futures contract, each point of the S&P is worth

$ Based on this and your calculations in step iii. above

derive the optimal number of contracts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock