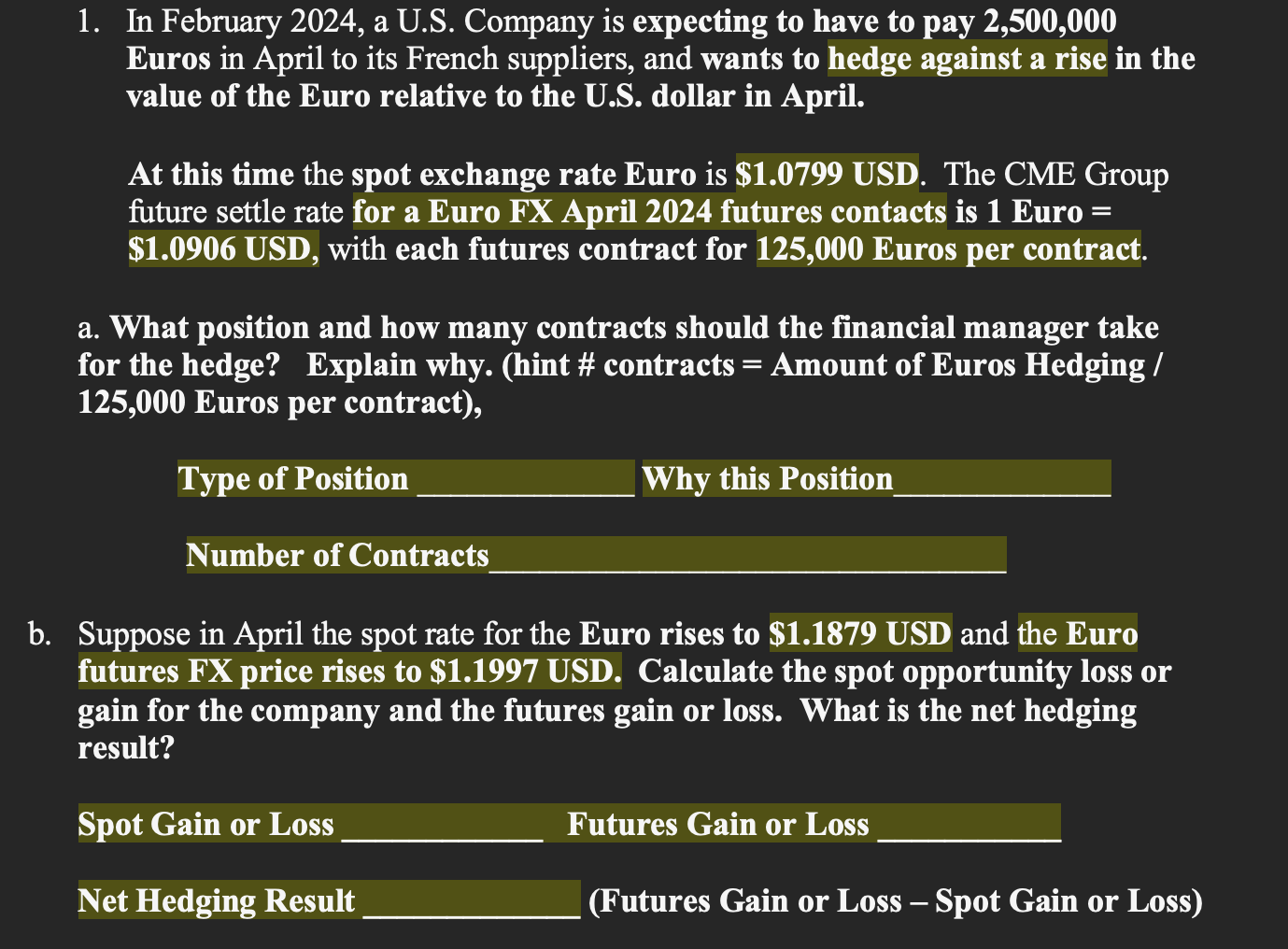

Question: In February 2 0 2 4 , a U . S . Company is expecting to have to pay 2 , 5 0 0 ,

In February a US Company is expecting to have to pay

Euros in April to its French suppliers, and wants to hedge against a rise in the

value of the Euro relative to the US dollar in April.

At this time the spot exchange rate Euro is $ USD. The CME Group

future settle rate for a Euro FX April futures contacts is Euro

$ USD, with each futures contract for Euros per contract.

a What position and how many contracts should the financial manager take

for the hedge? Explain why. hint # contracts Amount of Euros Hedging

Euros per contract

Type of Position

Why this Position

Number of Contracts

b Suppose in April the spot rate for the Euro rises to $ USD and the Euro

futures FX price rises to $ USD. Calculate the spot opportunity loss or

gain for the company and the futures gain or loss. What is the net hedging

result?

Spot Gain or Loss

Futures Gain or Loss

Net Hedging Result

Futures Gain or Loss Spot Gain or Loss

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock