Question: In general, when computing beta does it make sense to use the most data possible? For example, as General Electric Company (GE) has been a

- In general, when computing beta does it make sense to use the most data possible? For example, as General Electric Company (GE) has been a public company for more than 100 years, does it make sense to use 100 years of returns when computing GEs beta?

- Compute Apples beta and find Apples required rate of return on equity (RE).

- Compute the weights of debt and equity in Apples capital structure (i.e., wD and wE).

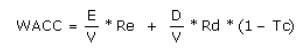

Compute Apples WACC using the following formula, where E/V is the percentage of the firm financed with equity and D/V is the percentage of the firm financed with debt. T is the tax bracket for the firm because interest payments are tax deductible, we reduce the cost by the percentage of the tax savings the company receives by deducting the interest from their tax liability.

Consider that the weighted average cost of capital refers to the cost of equity for the usual line of work of the firm, and is associated with that level of risk. If Apple were considering investing in a new project, say iFly that flies people to the moon and back, would it make sense for Apple to use the WACC you computed to evaluate that project?

WACC--* Re + --* Rd * (1-Tc)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts