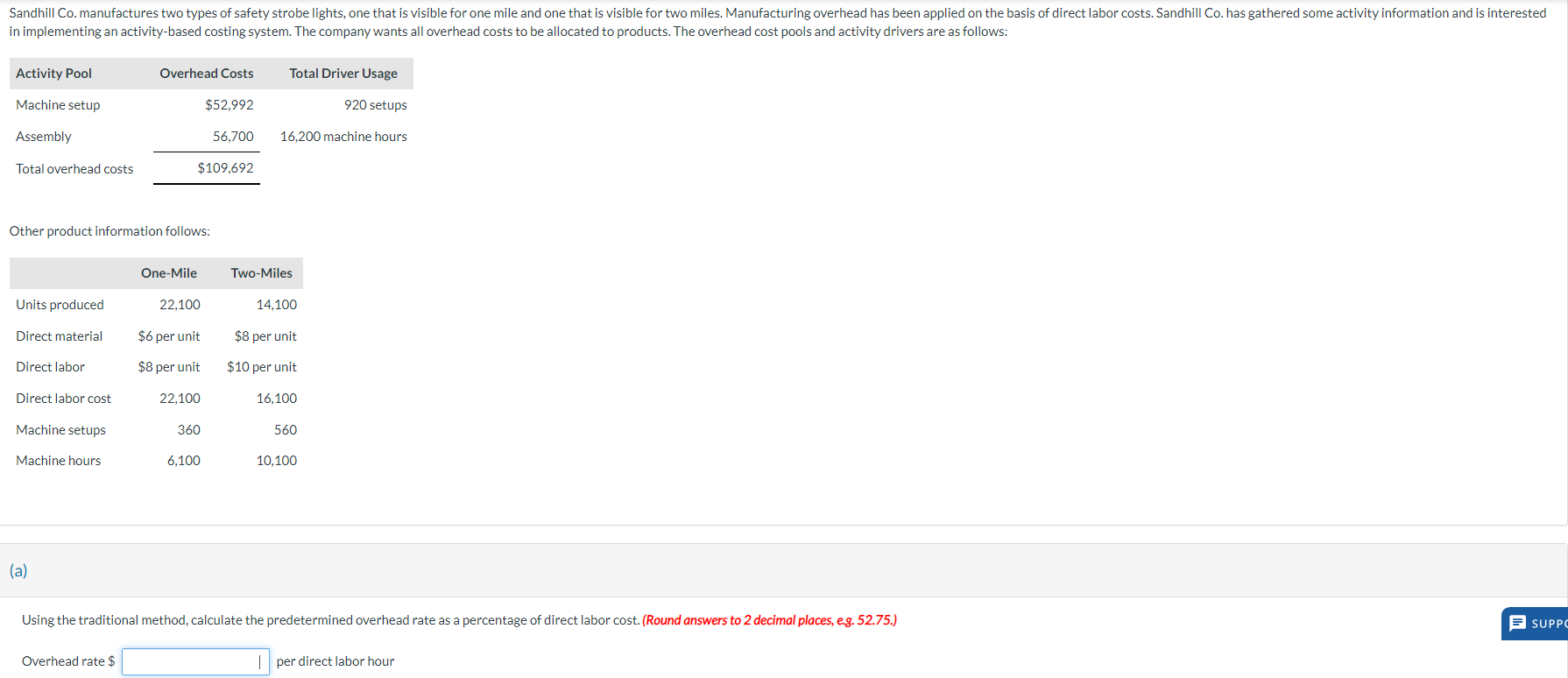

Question: in implementing an activity - based costing system. The company wants all overhead costs to be allocated to products. The overhead cost pools and activity

in implementing an activitybased costing system. The company wants all overhead costs to be allocated to products. The overhead cost pools and activity drivers are as follows:

tableActivity Pool,Overhead Costs,Total Driver UsageMachine setup,$ setupsAssembly machine hoursTotal overhead costs,$

Other product information follows:

tableOneMile,TwoMilesUnits produced,Direct material,$ per unit,$ per unitDirect labor,$ per unit,$ per unitDirect labor cost,Machine setups,Machine hours,

a

Using the traditional method, calculate the predetermined overhead rate as a percentage of direct labor cost. Round answers to decimal places, eg

Overhead rate $ per direct labor hour

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock