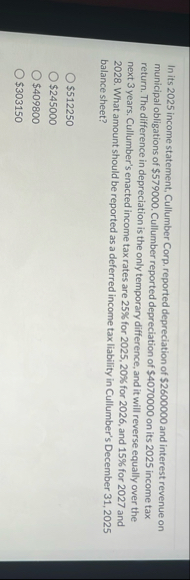

Question: In its 2 0 2 5 income statement, Cullumber Corp, reported depreciation of $ 2 6 0 0 0 0 0 and interest revenue on

In its income statement, Cullumber Corp, reported depreciation of $ and interest revenue on municipal obligations of $ Cullumber reported depreciation of $ on its income tax return. The difference in depreciation is the only temporary difference, and it will reverse equally over the next years. Cullumber's enacted income tax rates are for for and for and What amount should be reported as a deferred income tax liability in Cullumber's December balance sheet?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock