Question: In its 2016 income statement, Tow Inc. reported proceeds from an officer's life insurance policy of $90,000 and depreciation of $250,000. Tow was the owner

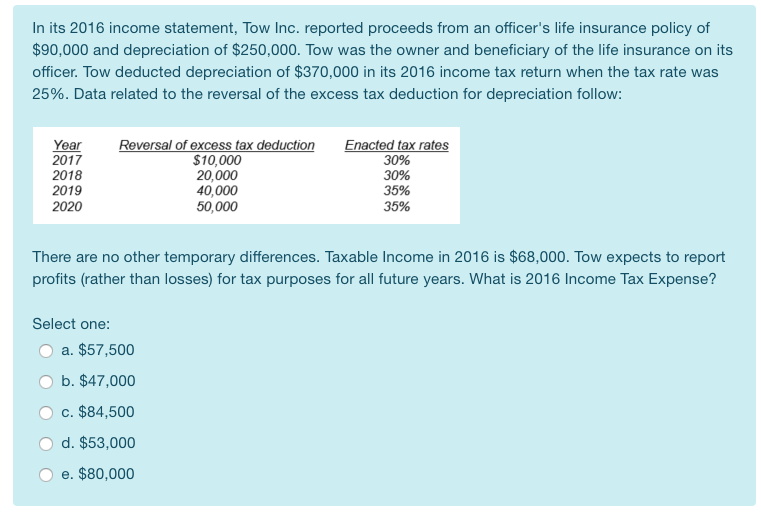

In its 2016 income statement, Tow Inc. reported proceeds from an officer's life insurance policy of $90,000 and depreciation of $250,000. Tow was the owner and beneficiary of the life insurance on its officer. Tow deducted depreciation of $370,000 in its 2016 income tax return when the tax rate was 25%. Data related to the reversal of the excess tax deduction for depreciation follow: Year 2017 2018 2019 2020 Reversal of excess tax deduction $10,000 20,000 40,000 50,000 Enacted tax rates 30% 30% 35% 35% There are no other temporary differences. Taxable income in 2016 is $68,000. Tow expects to report profits (rather than losses) for tax purposes for all future years. What is 2016 Income Tax Expense? Select one: a. $57,500 b. $47,000 c. $84,500 O d. $53,000 O e. $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts