Question: In its financial statements, Pulham Corp. uses the equity method of accounting for its 30% ownership of Angles Corp. At December 31, Year 4, Pulham

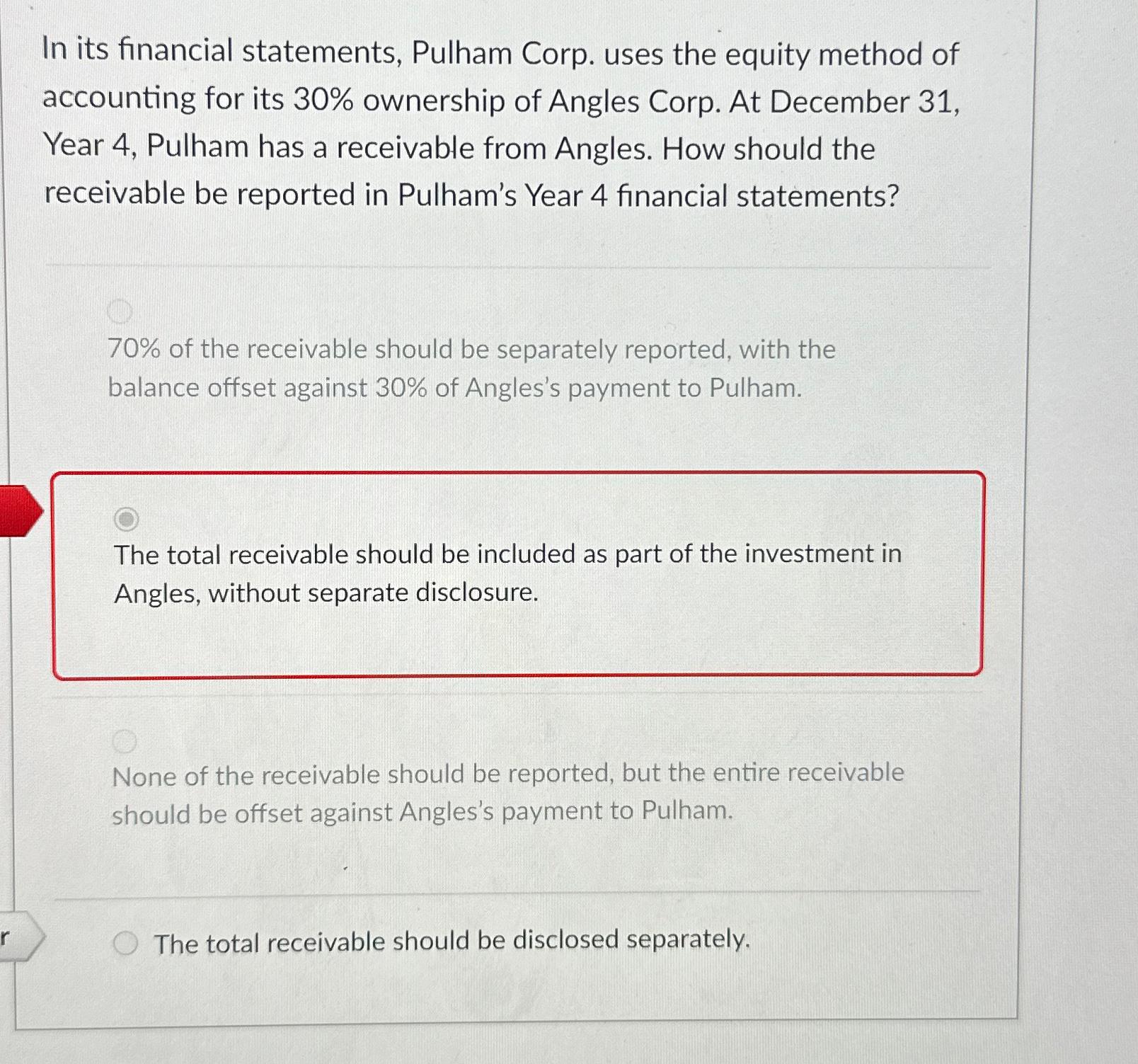

In its financial statements, Pulham Corp. uses the equity method of accounting for its 30% ownership of Angles Corp. At December 31, Year 4, Pulham has a receivable from Angles. How should the receivable be reported in Pulham's Year 4 financial statements?\

70%of the receivable should be separately reported, with the balance offset against

30%of Angles's payment to Pulham.\ The total receivable should be included as part of the investment in Angles, without separate disclosure.\ None of the receivable should be reported, but the entire receivable should be offset against Angles's payment to Pulham.\ The total receivable should be disclosed separately.

In its financial statements, Pulham Corp. uses the equity method of accounting for its 30\% ownership of Angles Corp. At December 31, Year 4, Pulham has a receivable from Angles. How should the receivable be reported in Pulham's Year 4 financial statements? 70% of the receivable should be separately reported, with the balance offset against 30% of Angles's payment to Pulham. The total receivable should be included as part of the investment in Angles, without separate disclosure. None of the receivable should be reported, but the entire receivable should be offset against Angles's payment to Pulham. The total receivable should be disclosed separately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts