Question: In its most recent annual report Briggs & Stratton reported sales of $3,186 million. It also reported that its days' sales in receivables for the

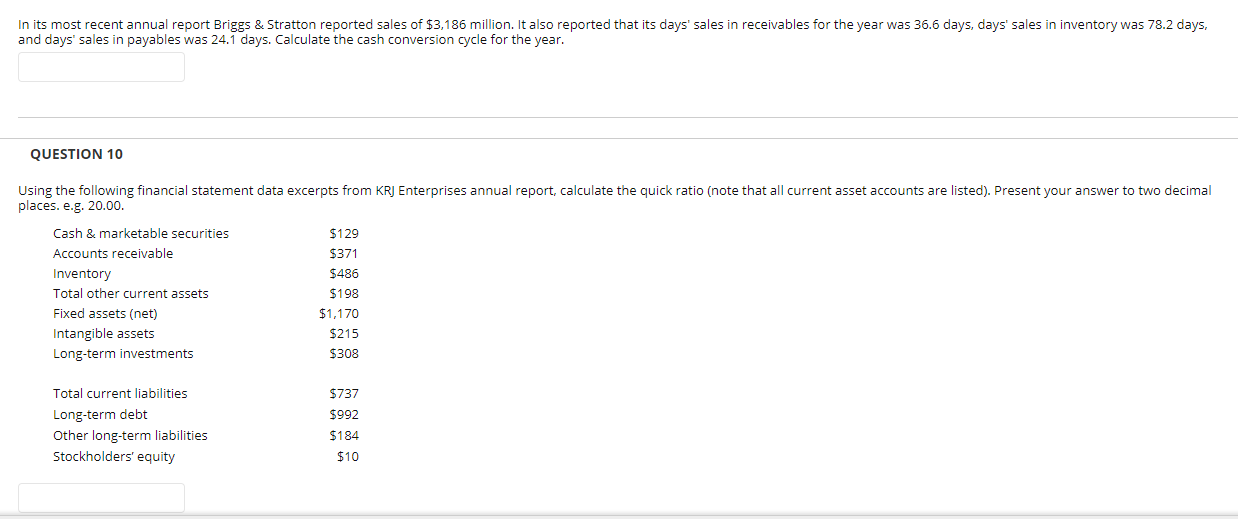

In its most recent annual report Briggs & Stratton reported sales of $3,186 million. It also reported that its days' sales in receivables for the year was 36.6 days, days' sales in inventory was 78.2 days, and days' sales in payables was 24.1 days. Calculate the cash conversion cycle for the year. QUESTION 10 Using the following financial statement data excerpts from KRJ Enterprises annual report, calculate the quick ratio (note that all current asset accounts are listed). Present your answer to two decimal places. e.g. 20.00. Cash & marketable securities $129 Accounts receivable $371 Inventory $486 Total other current assets $198 Fixed assets (net) $1,170 Intangible assets $215 Long-term investments $308 Total current liabilities Long-term debt Other long-term liabilities Stockholders' equity $737 $992 $184 $10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts