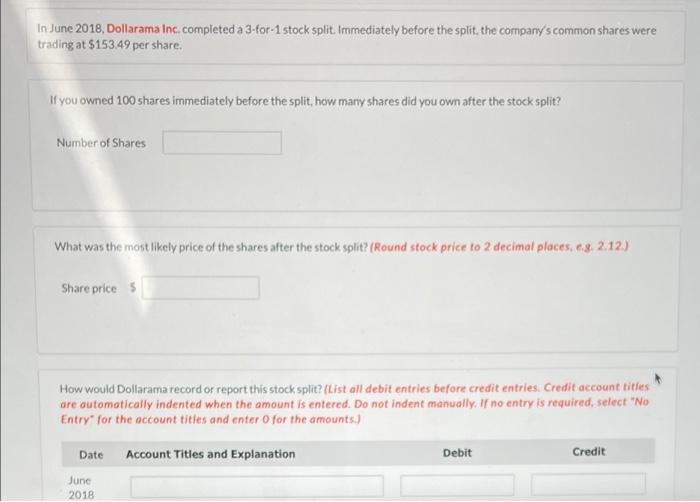

Question: In June 2018, Dollarama Inc. completed a 3-for-1 stock split. Immediately before the split the company's common shares were trading at $153.49 per share. If

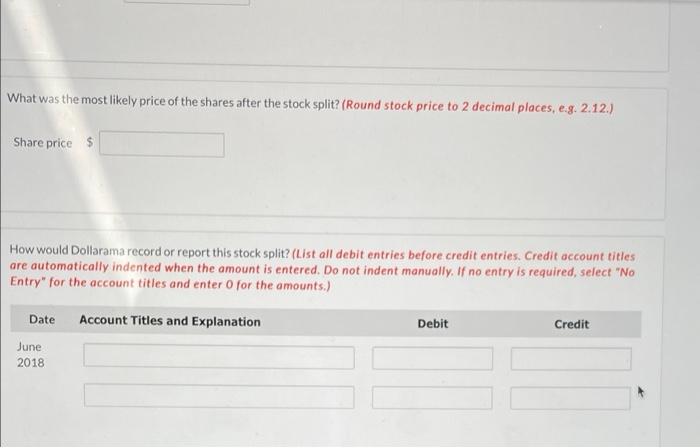

In June 2018, Dollarama Inc. completed a 3-for-1 stock split. Immediately before the split the company's common shares were trading at $153.49 per share. If you owned 100 shares immediately before the split, how many shares did you own after the stock split? Number of Shares What was the most likely price of the shares after the stock split? (Round stock price to 2 decimal places, c.8. 2.12.) Share prices How would Dollarama record or report this stock split? (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit June 2018 What was the most likely price of the shares after the stock split? (Round stock price to 2 decimal places, e.g. 2.12.) Share price $ How would Dollarama record or report this stock split? (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Date June 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts