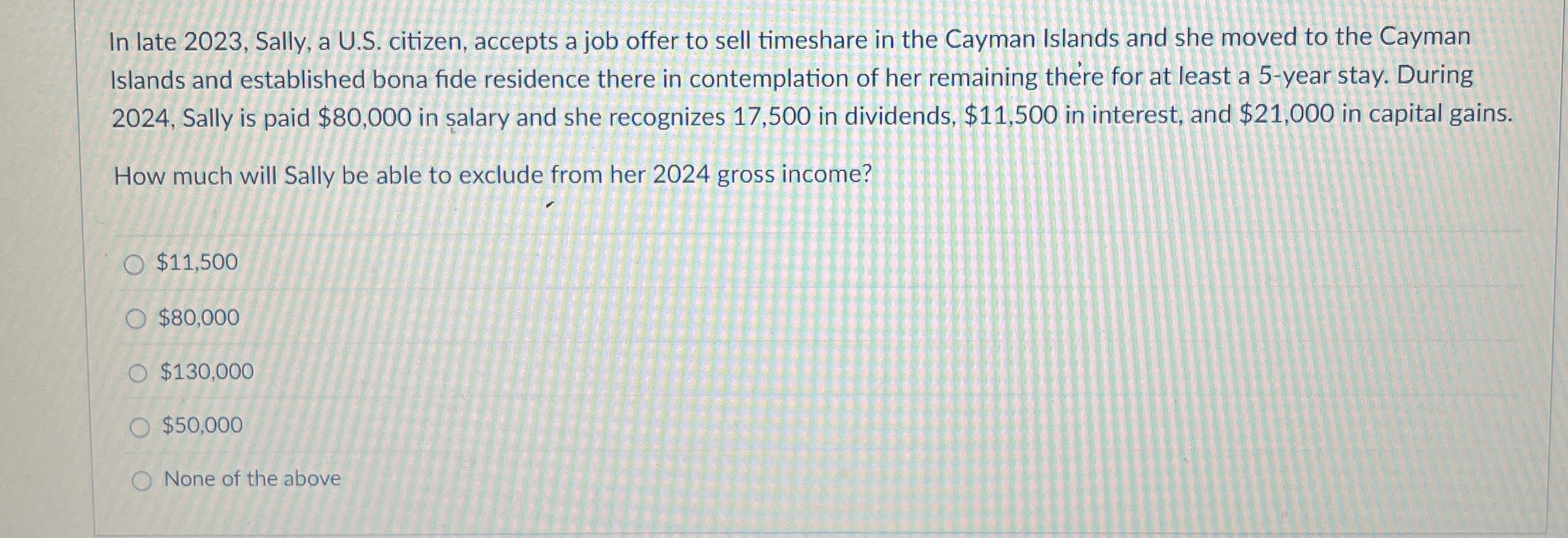

Question: In late 2 0 2 3 , Sally, a U . S . citizen, accepts a job offer to sell timeshare in the Cayman Islands

In late Sally, a US citizen, accepts a job offer to sell timeshare in the Cayman Islands and she moved to the Cayman Islands and established bona fide residence there in contemplation of her remaining there for at least a year stay. During Sally is paid $ in salary and she recognizes in dividends, $ in interest, and $ in capital gains.

How much will Sally be able to exclude from her gross income?

$

$

$

$

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock