Question: In letter C, I want to know how to get these answers from. Homework Chapter Six Saved Help Save & Exit Submit Check my work

In letter C, I want to know how to get these answers from.

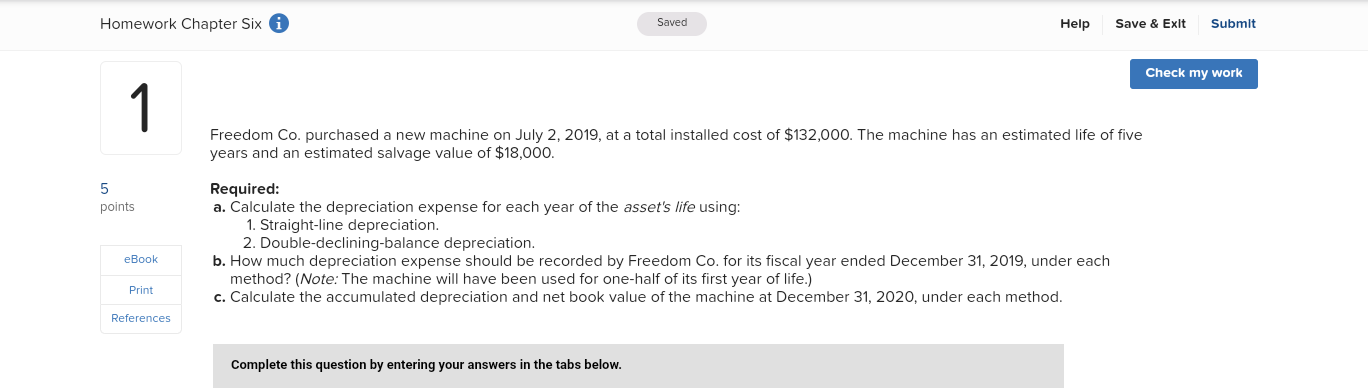

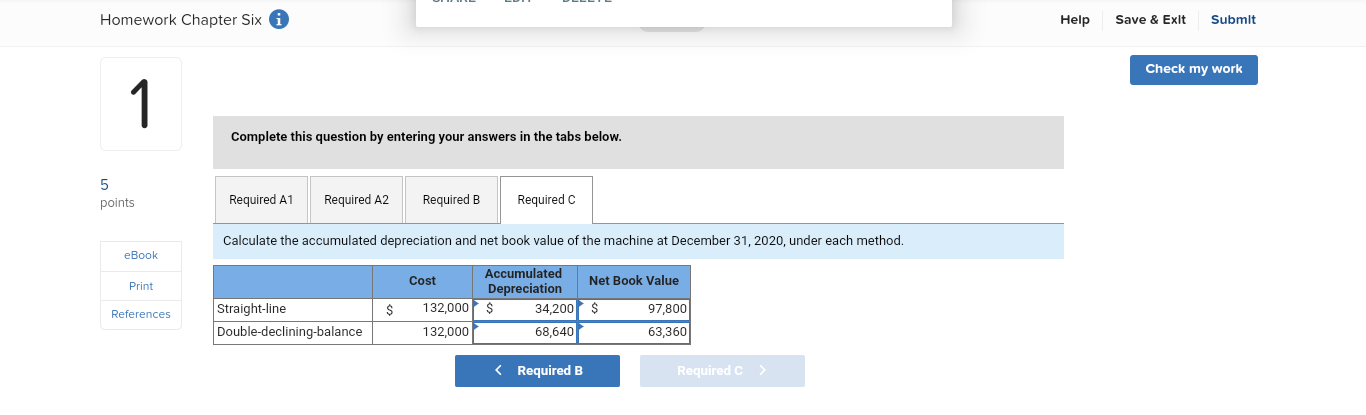

Homework Chapter Six Saved Help Save & Exit Submit Check my work 1 Freedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $132,000. The machine has an estimated life of five years and an estimated salvage value of $18,000. 5 points Required: a. Calculate the depreciation expense for each year of the asset's life using: 1. Straight-line depreciation. 2. Double-declining-balance depreciation. b. How much depreciation expense should be recorded by Freedom Co. for its fiscal year ended December 31, 2019, under each method? (Note: The machine will have been used for one-half of its first year of life.) c. Calculate the accumulated depreciation and net book value of the machine at December 31, 2020, under each method. eBook Print References Complete this question by entering your answers in the tabs below. Homework Chapter Six Help Save & Exit Submit Check my work 1 Complete this question by entering your answers in the tabs below. 5 points Required A1 Required A2 Required B Required Calculate the accumulated depreciation and net book value of the machine at December 31, 2020, under each method. eBook Print Cost Accumulated Net Book Value Depreciation $ 34,200 $ 97,800 68,640 63,360 References $ Straight-line Double-declining-balance 132,000 132,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts