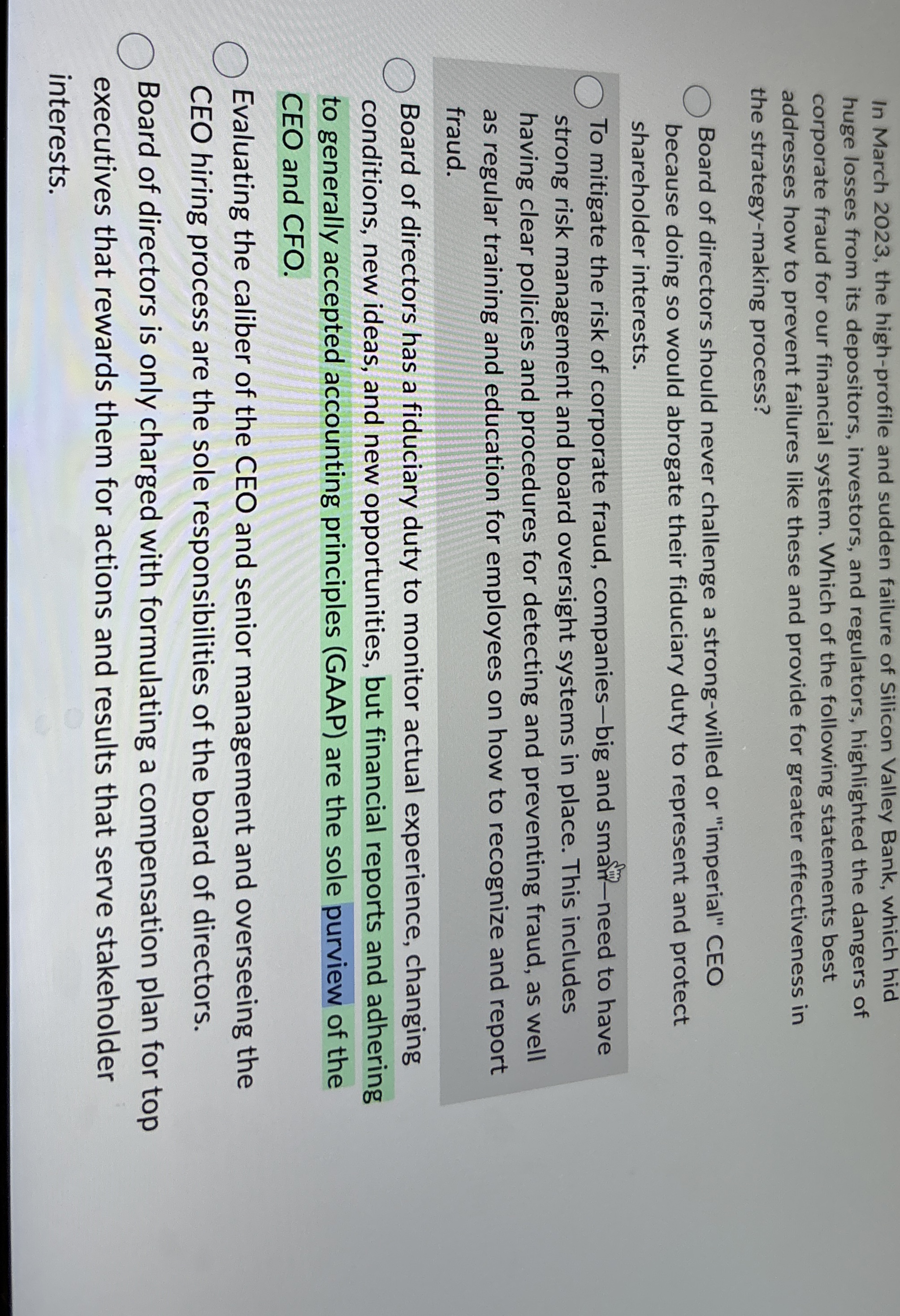

Question: In March 2 0 2 3 , the high - profile and sudden failure of Silicon Valley Bank, which hid huge losses from its depositors,

In March the highprofile and sudden failure of Silicon Valley Bank, which hid

huge losses from its depositors, investors, and regulators, highlighted the dangers of

corporate fraud for our financial system. Which of the following statements best

addresses how to prevent failures like these and provide for greater effectiveness in

the strategymaking process?

Board of directors should never challenge a strongwilled or "imperial" CEO

because doing so would abrogate their fiduciary duty to represent and protect

shareholder interests.

To mitigate the risk of corporate fraud, companiesbig and smafinneed to have

strong risk management and board oversight systems in place. This includes

having clear policies and procedures for detecting and preventing fraud, as well

as regular training and education for employees on how to recognize and report

fraud.

Board of directors has a fiduciary duty to monitor actual experience, changing

conditions, new ideas, and new opportunities, but financial reports and adhering

to generally accepted accounting principles GAAP are the sole purview of the

CEO and CFO.

Evaluating the caliber of the CEO and senior management and overseeing the

CEO hiring process are the sole responsibilities of the board of directors.

Board of directors is only charged with formulating a compensation plan for top

executives that rewards them for actions and results that serve stakeholder

interests.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock