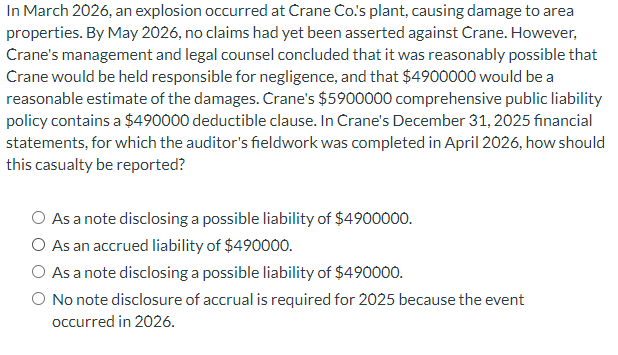

Question: In March 2 0 2 6 , an explosion occurred at Crane Co . ' s plant, causing damage to area properties. By May 2

In March an explosion occurred at Crane Cos plant, causing damage to area properties. By May no claims had yet been asserted against Crane. However, Crane's management and legal counsel concluded that it was reasonably possible that Crane would be held responsible for negligence, and that $ would be a reasonable estimate of the damages. Crane's $ comprehensive public liability policy contains a $ deductible clause. In Crane's December financial statements, for which the auditor's fieldwork was completed in April how should this casualty be reported?

As a note disclosing a possible liability of $

As an accrued liability of $

As a note disclosing a possible liability of $

No note disclosure of accrual is required for because the event occurred in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock