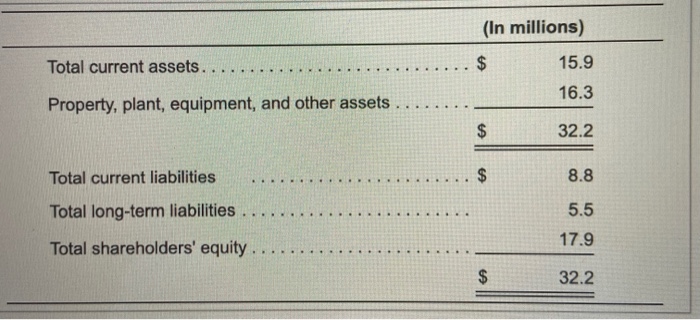

Question: (In millions) Total current assets. ... $ 15.9 16.3 Property, plant, equipment, and other assets $ 32.2 Total current liabilities CA 8.8 Total long-term liabilities

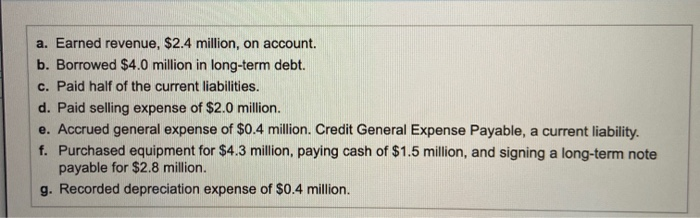

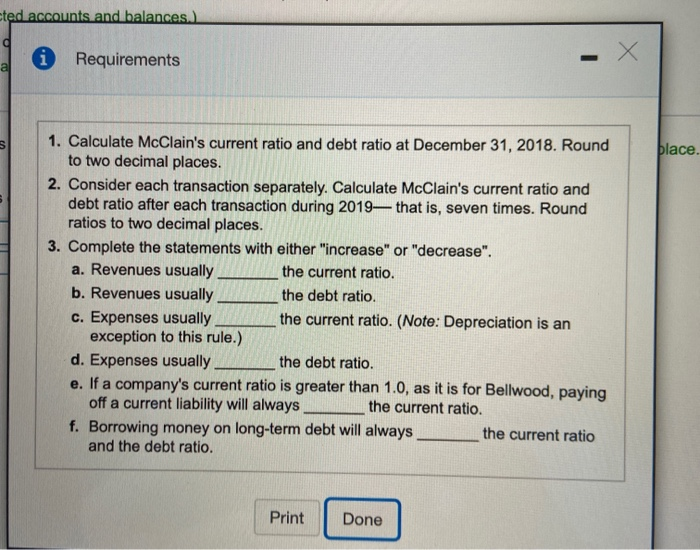

(In millions) Total current assets. ... $ 15.9 16.3 Property, plant, equipment, and other assets $ 32.2 Total current liabilities CA 8.8 Total long-term liabilities .. 5.5 Total shareholders' equity. ... 17.9 $ 32.2 a. Earned revenue, $2.4 million, on account. b. Borrowed $4.0 million in long-term debt. c. Paid half of the current liabilities. d. Paid selling expense of $2.0 million. e. Accrued general expense of $0.4 million. Credit General Expense Payable, a current liability. f. Purchased equipment for $4.3 million, paying cash of $1.5 million, and signing a long-term note payable for $2.8 million. g. Recorded depreciation expense of $0.4 million. ted accounts and balances.) i Requirements a place. 1. Calculate McClain's current ratio and debt ratio at December 31, 2018. Round to two decimal places. 2. Consider each transaction separately. Calculate McClain's current ratio and debt ratio after each transaction during 2019that is, seven times. Round ratios to two decimal places. 3. Complete the statements with either "increase" or "decrease". a. Revenues usually the current ratio. b. Revenues usually the debt ratio. c. Expenses usually the current ratio. (Note: Depreciation is an exception to this rule.) d. Expenses usually the debt ratio. e. If a company's current ratio is greater than 1.0, as it is for Bellwood, paying off a current liability will always the current ratio. f. Borrowing money on long-term debt will always the current ratio and the debt ratio. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts