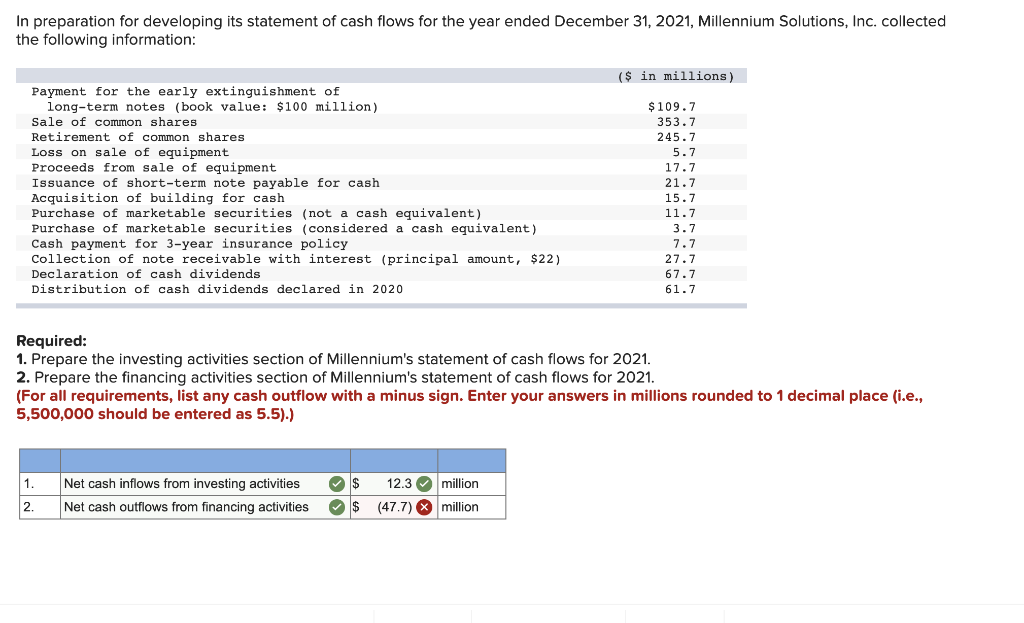

Question: In preparation for developing its statement of cash flows for the year ended December 31, 2021, Millennium Solutions, Inc. collected the following information: ($ in

In preparation for developing its statement of cash flows for the year ended December 31, 2021, Millennium Solutions, Inc. collected the following information: ($ in millions) Payment for the early extinguishment of long-term notes (book value: $ 100 million) Sale of common shares Retirement of common shares Loss on sale of equipment Proceeds from sale of equipment Issuance of short-term note payable for cash Acquisition of building for cash Purchase of marketable securities (not a cash equivalent) Purchase of marketable securities (considered a ca Cash payment for 3-year insurance policy Collection of note receivable with interest (principal amount, $22) Declaration of cash dividends Distribution of cash dividends declared in 2020 $ 109.7 353.7 245.7 5.7 17.7 21.7 15.7 11.7 3.7 7.7 27.7 67.7 61.7 Required: 1. Prepare the investing activities section of Millennium's statement of cash flows for 2021. 2. Prepare the financing activities section of Millennium's statement of cash flows for 2021. (For all requirements, list any cash outflow with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) 1. 2. Net cash inflows from investing activities Net cash outflows from financing activities $ $ 12.3 (47.7) million million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts