Question: In Problem #1 above, (put the data from 1 below) assume the risk-free rate during the 24-year period was 2.5% per year. Calculate the following:

In Problem #1 above, (put the data from 1 below) assume the risk-free rate during the 24-year period was 2.5% per year. Calculate the following: measures and show your results in the table below: please show your work A) Annualized volatility of XYZ Fund & S&P 500 B) Annualized risk premium of XYZ Fund & S&P 500 C) Sharpe Ratio of the XYZ Fund & S&P 500

| XYZ Fund | S&P 500 | |

| Stdev | ||

| Risk Premium | ||

| Sharpe Ratio |

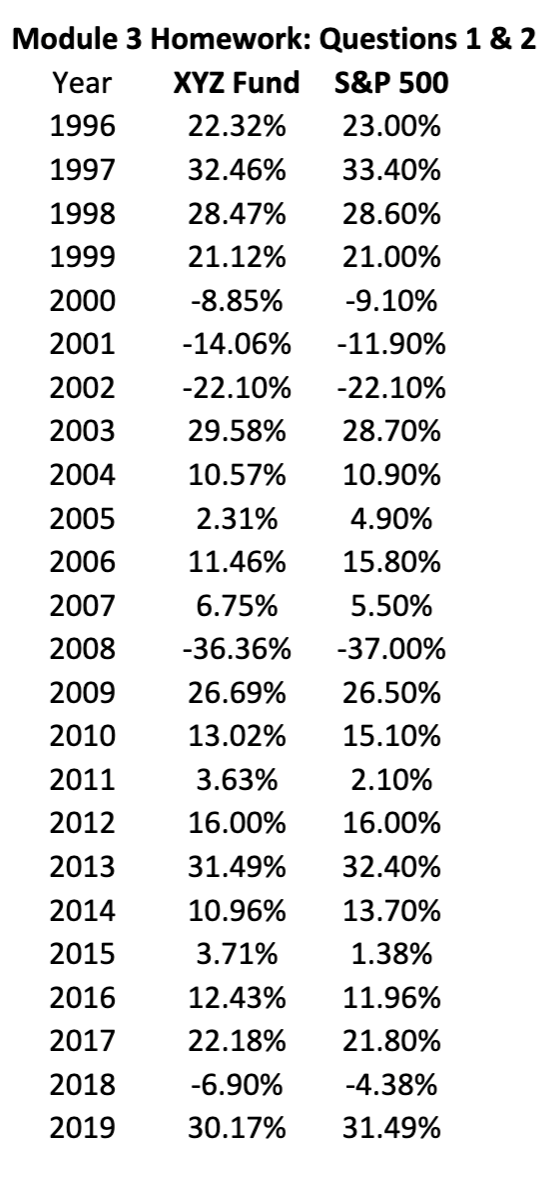

Module 3 Homework: Questions 1 & 2 Year XYZ Fund S&P 500 1996 22.32% 23.00% 1997 32.46% 33.40% 1998 28.47% 28.60% 1999 21.12% 21.00% 2000 -8.85% -9.10% 2001 -14.06% -11.90% 2002 -22.10% -22.10% 2003 29.58% 28.70% 2004 10.57% 10.90% 2005 2.31% 4.90% 2006 11.46% 15.80% 2007 6.75% 5.50% 2008 -36.36% -37.00% 2009 26.69% 26.50% 2010 13.02% 15.10% 2011 3.63% 2.10% 2012 16.00% 16.00% 2013 31.49% 32.40% 2014 10.96% 13.70% 2015 3.71% 1.38% 2016 12.43% 11.96% 2017 22.18% 21.80% 2018 -6.90% -4.38% 2019 30.17% 31.49%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts