Question: In problem one you make the same investment. However, you do not have $7,200 to invest so you open a margin account. You are able

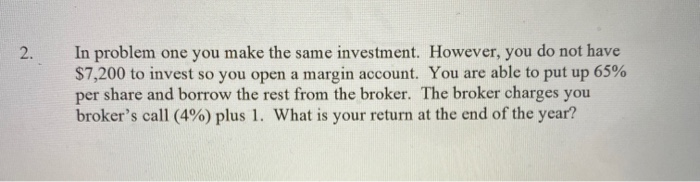

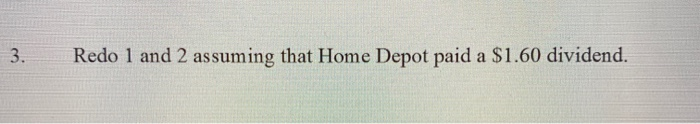

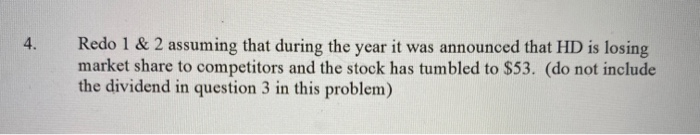

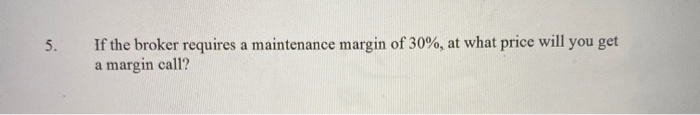

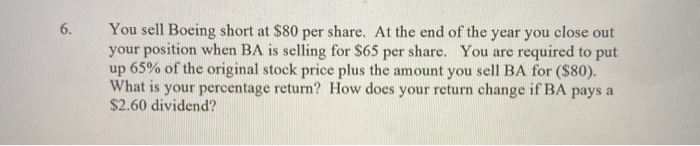

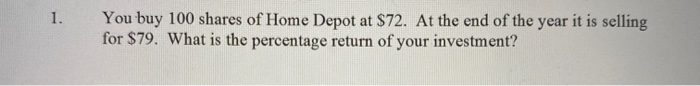

In problem one you make the same investment. However, you do not have $7,200 to invest so you open a margin account. You are able to put up 65% per share and borrow the rest from the broker. The broker charges you broker's call (4%) plus 1. What is your return at the end of the year? 3. Redo 1 and 2 assuming that Home Depot paid a $1.60 dividend. 4. Redo 1 & 2 assuming that during the year it was announced that HD is losing! market share to competitors and the stock has tumbled to $53. (do not include the dividend in question 3 in this problem) If the broker requires a maintenance margin of 30%, at what price will you get a margin call? You sell Boeing short at $80 per share. At the end of the year you close out your position when BA is selling for $65 per share. You are required to put up 65% of the original stock price plus the amount you sell BA for ($80). What is your percentage return? How does your return change if BA pays a $2.60 dividend? 1. You buy 100 shares of Home Depot at $72. At the end of the year it is selling for $79. What is the percentage return of your investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts