Question: In proper general journal format, record transactions for the month of October, post to ledger accounts, and prepare a trial balance. In proper general journal

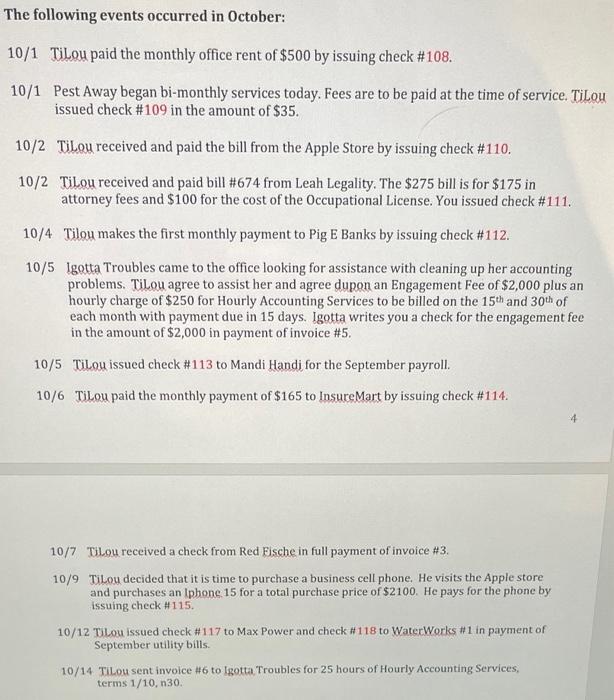

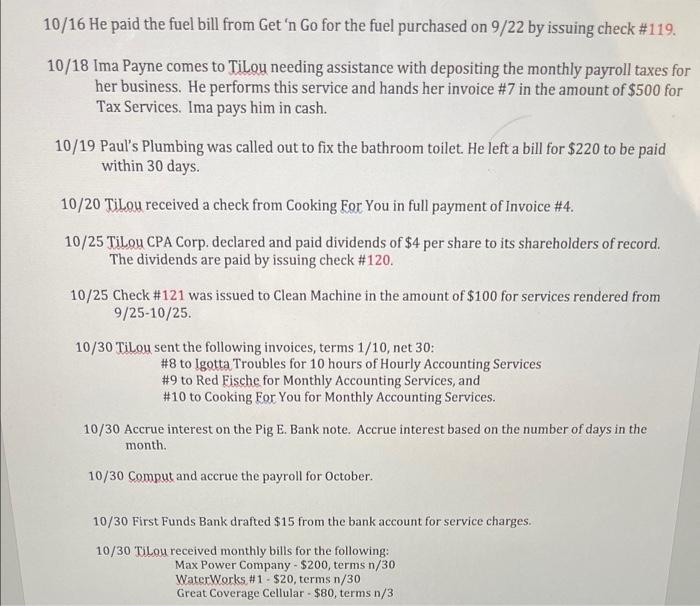

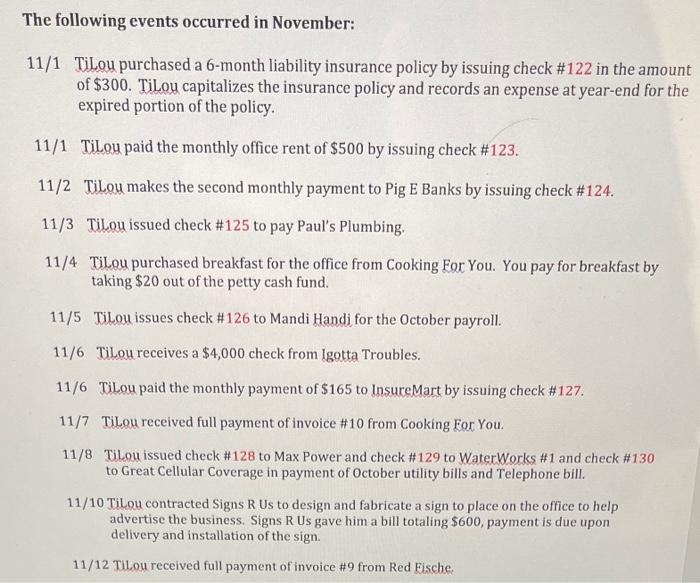

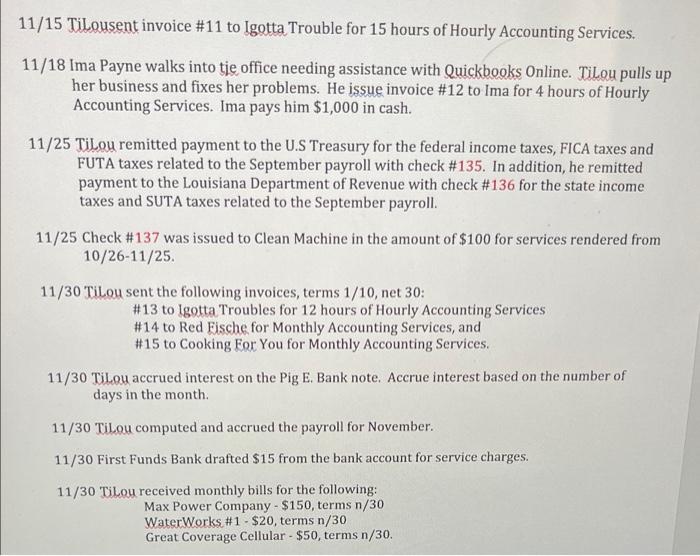

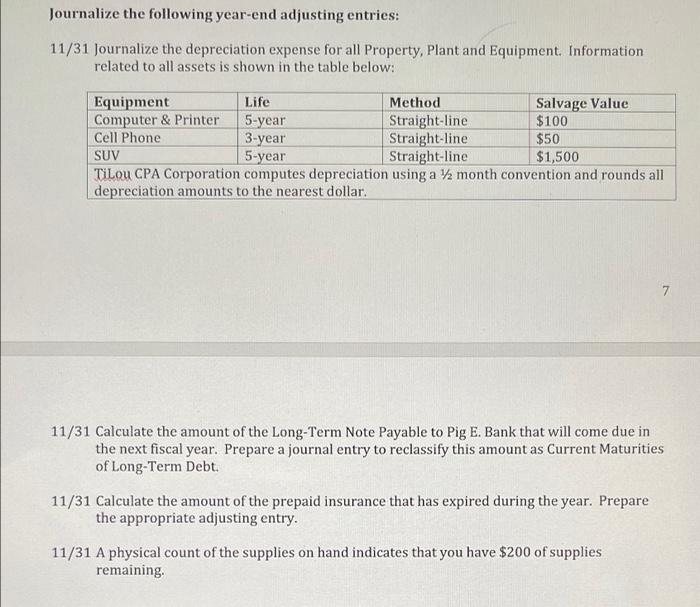

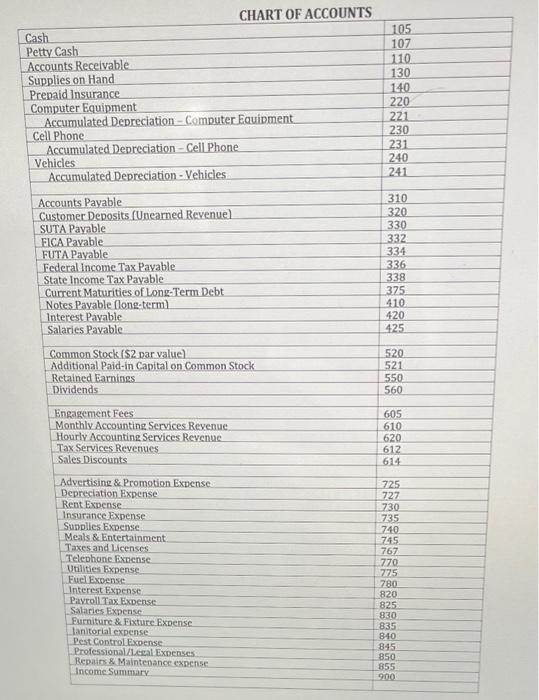

The following events occurred in October: 10/1 TiLou paid the monthly office rent of $500 by issuing check # 108. 10/1 Pest Away began bi-monthly services today. Fees are to be paid at the time of service. Tilou issued check # 109 in the amount of $35. 10/2 TiLou received and paid the bill from the Apple Store by issuing check #110. 10/2 TiLou received and paid bill #674 from Leah Legality. The $275 bill is for $175 in attorney fees and $100 for the cost of the Occupational License. You issued check #111. 10/4 Tilou makes the first monthly payment to Pig E Banks by issuing check #112. 10/5 Igotta Troubles came to the office looking for assistance with cleaning up her accounting problems. TiLou agree to assist her and agree dupon an Engagement Fee of $2,000 plus an hourly charge of $250 for Hourly Accounting Services to be billed on the 15th and 30th of each month with payment due in 15 days. Igotta writes you a check for the engagement fee in the amount of $2,000 in payment of invoice #5. 10/5 Tilou issued check #113 to Mandi Handi for the September payroll. 10/6 TiLou paid the monthly payment of $165 to InsureMart by issuing check #114. 10/7 Tilou received a check from Red Fische in full payment of invoice #3. 10/9 TiLou decided that it is time to purchase a business cell phone. He visits the Apple store and purchases an Iphone 15 for a total purchase price of $2100. He pays for the phone by issuing check #115. 10/12 Tilou issued check # 117 to Max Power and check #118 to WaterWorks #1 in payment of September utility bills. 10/14 TiLou sent invoice #6 to Igotta Troubles for 25 hours of Hourly Accounting Services, terms 1/10,n30. 10/16 He paid the fuel bill from Get 'n Go for the fuel purchased on 9/22 by issuing check #119. 10/18 Ima Payne comes to TiLou needing assistance with depositing the monthly payroll taxes for her business. He performs this service and hands her invoice #7 in the amount of $500 for Tax Services. Ima pays him in cash. 10/19 Paul's Plumbing was called out to fix the bathroom toilet. He left a bill for $220 to be paid within 30 days. 10/20 Tilou received a check from Cooking For You in full payment of Invoice #4. 10/25 TiLou CPA Corp. declared and paid dividends of $4 per share to its shareholders of record. The dividends are paid by issuing check #120. 10/25 Check # 121 was issued to Clean Machine in the amount of $100 for services rendered from 9/25-10/25. 10/30 TiLou sent the following invoices, terms 1/10, net 30: #8 to Igotta Troubles for 10 hours of Hourly Accounting Services #9 to Red Fische for Monthly Accounting Services, and # 10 to Cooking For You for Monthly Accounting Services. 10/30 Accrue interest on the Pig E. Bank note. Accrue interest based on the number of days in the month. 10/30 Comput and accrue the payroll for October. 10/30 First Funds Bank drafted $15 from the bank account for service charges. 10/30 TiLou received monthly bills for the following: Max Power Company - $200, terms n/30 WaterWorks, #1 - $20, terms n/30 Great Coverage Cellular - $80, terms n/3 The following events occurred in November: 11/1 TiLou purchased a 6-month liability insurance policy by issuing check #122 in the amount of $300. TiLou capitalizes the insurance policy and records an expense at year-end for the expired portion of the policy. 11/1 TiLou paid the monthly office rent of $500 by issuing check #123. 11/2 TiLou makes the second monthly payment to Pig E Banks by issuing check #124. 11/3 TiLou issued check #125 to pay Paul's Plumbing. 11/4 TiLou purchased breakfast for the office from Cooking For You. You pay for breakfast by taking $20 out of the petty cash fund. 11/5 TiLou issues check #126 to Mandi Handi for the October payroll. 11/6 Tilou receives a $4,000 check from Igotta Troubles. 11/6 TiLou paid the monthly payment of $165 to InsureMart by issuing check #127. 11/7 Tilou received full payment of invoice #10 from Cooking For You. 11/8 Tilou issued check #128 to Max Power and check #129 to WaterWorks #1 and check #130 to Great Cellular Coverage in payment of October utility bills and Telephone bill. 11/10 TiLou contracted Signs R Us to design and fabricate a sign to place on the office to help advertise the business. Signs R Us gave him a bill totaling $600, payment is due upon delivery and installation of the sign. 11/12 Tilou received full payment of invoice #9 from Red Fische. 11/15 TiLousent invoice #11 to Igotta Trouble for 15 hours of Hourly Accounting Services. 11/18 Ima Payne walks into the office needing assistance with Quickbooks Online. TiLou pulls up her business and fixes her problems. He issue invoice # 12 to Ima for 4 hours of Hourly Accounting Services. Ima pays him $1,000 in cash. 11/25 TiLou remitted payment to the U.S Treasury for the federal income taxes, FICA taxes and FUTA taxes related to the September payroll with check # 135. In addition, he remitted payment to the Louisiana Department of Revenue with check #136 for the state income taxes and SUTA taxes related to the September payroll. 11/25 Check # 137 was issued to Clean Machine in the amount of $100 for services rendered from 10/26-11/25. 11/30 TiLou sent the following invoices, terms 1/10, net 30: # 13 to Igotta Troubles for 12 hours of Hourly Accounting Services #14 to Red Fische for Monthly Accounting Services, and # 15 to Cooking For You for Monthly Accounting Services. 11/30 Tilou accrued interest on the Pig E. Bank note. Accrue interest based on the number of days in the month. 11/30 Tilou computed and accrued the payroll for November. 11/30 First Funds Bank drafted $15 from the bank account for service charges. 11/30 Tilou received monthly bills for the following: Max Power Company - $150, terms n/30 WaterWorks #1 - $20, terms n/30 Great Coverage Cellular - $50, terms n/30. Journalize the following year-end adjusting entries: 11/31 Journalize the depreciation expense for all Property, Plant and Equipment. Information related to all assets is shown in the table below: Equipment Life Method Straight-line Computer & Printer 5-year Salvage Value $100 $50 Cell Phone 3-year Straight-line SUV 5-year Straight-line $1,500 TiLou CPA Corporation computes depreciation using a month convention and rounds all depreciation amounts to the nearest dollar. 11/31 Calculate the amount of the Long-Term Note Payable to Pig E. Bank that will come due in the next fiscal year. Prepare a journal entry to reclassify this amount as Current Maturities of Long-Term Debt. 11/31 Calculate the amount of the prepaid insurance that has expired during the year. Prepare the appropriate adjusting entry. 11/31 A physical count of the supplies on hand indicates that you have $200 of supplies remaining. CHART OF ACCOUNTS Cash Petty Cash Accounts Receivable Supplies on Hand Prepaid Insurance Computer Equipment Accumulated Depreciation - Computer Equipment Cell Phone Accumulated Depreciation - Cell Phone Vehicles Accumulated Depreciation - Vehicles Accounts Payable. Customer Deposits (Unearned Revenue). SUTA Payable FICA Pavable FUTA Payable Federal Income Tax Payable State Income Tax Payable Current Maturities of Long-Term Debt Notes Pavable (long-term). Interest Payable Salaries Pavable Common Stock ($2 par value) Additional Paid-in Capital on Common Stock Retained Earnings Dividends Engagement Fees Monthly Accounting Services Revenue. Hourly Accounting Services Revenue Tax Services Revenues Sales Discounts Advertising & Promotion Expense Depreciation Expense Rent Expense Insurance Expense Supplies Expense. Meals & Entertainment. Taxes and Licenses Telephone Expense Utilities Expense Fuel Expense Interest Expense. Payroll Tax Expense. Salaries Expense Furniture & Fixture Expense Janitorial expense Pest Control Expense Professional/Legal Expenses Repairs & Maintenance expense Income Summary 105 107 110 130 140 220 221 230 231 240 241 310 320 330 332 334 336 338 375 410 420 425 520 521 550 560 605 610 620 612 614 725 727 730 735 740 745 767 770 775 780 820 825 830 835 840 845 850 855 900 The following events occurred in October: 10/1 TiLou paid the monthly office rent of $500 by issuing check # 108. 10/1 Pest Away began bi-monthly services today. Fees are to be paid at the time of service. Tilou issued check # 109 in the amount of $35. 10/2 TiLou received and paid the bill from the Apple Store by issuing check #110. 10/2 TiLou received and paid bill #674 from Leah Legality. The $275 bill is for $175 in attorney fees and $100 for the cost of the Occupational License. You issued check #111. 10/4 Tilou makes the first monthly payment to Pig E Banks by issuing check #112. 10/5 Igotta Troubles came to the office looking for assistance with cleaning up her accounting problems. TiLou agree to assist her and agree dupon an Engagement Fee of $2,000 plus an hourly charge of $250 for Hourly Accounting Services to be billed on the 15th and 30th of each month with payment due in 15 days. Igotta writes you a check for the engagement fee in the amount of $2,000 in payment of invoice #5. 10/5 Tilou issued check #113 to Mandi Handi for the September payroll. 10/6 TiLou paid the monthly payment of $165 to InsureMart by issuing check #114. 10/7 Tilou received a check from Red Fische in full payment of invoice #3. 10/9 TiLou decided that it is time to purchase a business cell phone. He visits the Apple store and purchases an Iphone 15 for a total purchase price of $2100. He pays for the phone by issuing check #115. 10/12 Tilou issued check # 117 to Max Power and check #118 to WaterWorks #1 in payment of September utility bills. 10/14 TiLou sent invoice #6 to Igotta Troubles for 25 hours of Hourly Accounting Services, terms 1/10,n30. 10/16 He paid the fuel bill from Get 'n Go for the fuel purchased on 9/22 by issuing check #119. 10/18 Ima Payne comes to TiLou needing assistance with depositing the monthly payroll taxes for her business. He performs this service and hands her invoice #7 in the amount of $500 for Tax Services. Ima pays him in cash. 10/19 Paul's Plumbing was called out to fix the bathroom toilet. He left a bill for $220 to be paid within 30 days. 10/20 Tilou received a check from Cooking For You in full payment of Invoice #4. 10/25 TiLou CPA Corp. declared and paid dividends of $4 per share to its shareholders of record. The dividends are paid by issuing check #120. 10/25 Check # 121 was issued to Clean Machine in the amount of $100 for services rendered from 9/25-10/25. 10/30 TiLou sent the following invoices, terms 1/10, net 30: #8 to Igotta Troubles for 10 hours of Hourly Accounting Services #9 to Red Fische for Monthly Accounting Services, and # 10 to Cooking For You for Monthly Accounting Services. 10/30 Accrue interest on the Pig E. Bank note. Accrue interest based on the number of days in the month. 10/30 Comput and accrue the payroll for October. 10/30 First Funds Bank drafted $15 from the bank account for service charges. 10/30 TiLou received monthly bills for the following: Max Power Company - $200, terms n/30 WaterWorks, #1 - $20, terms n/30 Great Coverage Cellular - $80, terms n/3 The following events occurred in November: 11/1 TiLou purchased a 6-month liability insurance policy by issuing check #122 in the amount of $300. TiLou capitalizes the insurance policy and records an expense at year-end for the expired portion of the policy. 11/1 TiLou paid the monthly office rent of $500 by issuing check #123. 11/2 TiLou makes the second monthly payment to Pig E Banks by issuing check #124. 11/3 TiLou issued check #125 to pay Paul's Plumbing. 11/4 TiLou purchased breakfast for the office from Cooking For You. You pay for breakfast by taking $20 out of the petty cash fund. 11/5 TiLou issues check #126 to Mandi Handi for the October payroll. 11/6 Tilou receives a $4,000 check from Igotta Troubles. 11/6 TiLou paid the monthly payment of $165 to InsureMart by issuing check #127. 11/7 Tilou received full payment of invoice #10 from Cooking For You. 11/8 Tilou issued check #128 to Max Power and check #129 to WaterWorks #1 and check #130 to Great Cellular Coverage in payment of October utility bills and Telephone bill. 11/10 TiLou contracted Signs R Us to design and fabricate a sign to place on the office to help advertise the business. Signs R Us gave him a bill totaling $600, payment is due upon delivery and installation of the sign. 11/12 Tilou received full payment of invoice #9 from Red Fische. 11/15 TiLousent invoice #11 to Igotta Trouble for 15 hours of Hourly Accounting Services. 11/18 Ima Payne walks into the office needing assistance with Quickbooks Online. TiLou pulls up her business and fixes her problems. He issue invoice # 12 to Ima for 4 hours of Hourly Accounting Services. Ima pays him $1,000 in cash. 11/25 TiLou remitted payment to the U.S Treasury for the federal income taxes, FICA taxes and FUTA taxes related to the September payroll with check # 135. In addition, he remitted payment to the Louisiana Department of Revenue with check #136 for the state income taxes and SUTA taxes related to the September payroll. 11/25 Check # 137 was issued to Clean Machine in the amount of $100 for services rendered from 10/26-11/25. 11/30 TiLou sent the following invoices, terms 1/10, net 30: # 13 to Igotta Troubles for 12 hours of Hourly Accounting Services #14 to Red Fische for Monthly Accounting Services, and # 15 to Cooking For You for Monthly Accounting Services. 11/30 Tilou accrued interest on the Pig E. Bank note. Accrue interest based on the number of days in the month. 11/30 Tilou computed and accrued the payroll for November. 11/30 First Funds Bank drafted $15 from the bank account for service charges. 11/30 Tilou received monthly bills for the following: Max Power Company - $150, terms n/30 WaterWorks #1 - $20, terms n/30 Great Coverage Cellular - $50, terms n/30. Journalize the following year-end adjusting entries: 11/31 Journalize the depreciation expense for all Property, Plant and Equipment. Information related to all assets is shown in the table below: Equipment Life Method Straight-line Computer & Printer 5-year Salvage Value $100 $50 Cell Phone 3-year Straight-line SUV 5-year Straight-line $1,500 TiLou CPA Corporation computes depreciation using a month convention and rounds all depreciation amounts to the nearest dollar. 11/31 Calculate the amount of the Long-Term Note Payable to Pig E. Bank that will come due in the next fiscal year. Prepare a journal entry to reclassify this amount as Current Maturities of Long-Term Debt. 11/31 Calculate the amount of the prepaid insurance that has expired during the year. Prepare the appropriate adjusting entry. 11/31 A physical count of the supplies on hand indicates that you have $200 of supplies remaining. CHART OF ACCOUNTS Cash Petty Cash Accounts Receivable Supplies on Hand Prepaid Insurance Computer Equipment Accumulated Depreciation - Computer Equipment Cell Phone Accumulated Depreciation - Cell Phone Vehicles Accumulated Depreciation - Vehicles Accounts Payable. Customer Deposits (Unearned Revenue). SUTA Payable FICA Pavable FUTA Payable Federal Income Tax Payable State Income Tax Payable Current Maturities of Long-Term Debt Notes Pavable (long-term). Interest Payable Salaries Pavable Common Stock ($2 par value) Additional Paid-in Capital on Common Stock Retained Earnings Dividends Engagement Fees Monthly Accounting Services Revenue. Hourly Accounting Services Revenue Tax Services Revenues Sales Discounts Advertising & Promotion Expense Depreciation Expense Rent Expense Insurance Expense Supplies Expense. Meals & Entertainment. Taxes and Licenses Telephone Expense Utilities Expense Fuel Expense Interest Expense. Payroll Tax Expense. Salaries Expense Furniture & Fixture Expense Janitorial expense Pest Control Expense Professional/Legal Expenses Repairs & Maintenance expense Income Summary 105 107 110 130 140 220 221 230 231 240 241 310 320 330 332 334 336 338 375 410 420 425 520 521 550 560 605 610 620 612 614 725 727 730 735 740 745 767 770 775 780 820 825 830 835 840 845 850 855 900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts