Question: In python please. I'm struggling to get my white spaces to match up and I don't know how to add commas in the top. I've

In python please. I'm struggling to get my white spaces to match up and I don't know how to add commas in the top. I've been messing with my code for close to 2 hrs now and I just don't know what to do. I can explain any of the marks if needed.

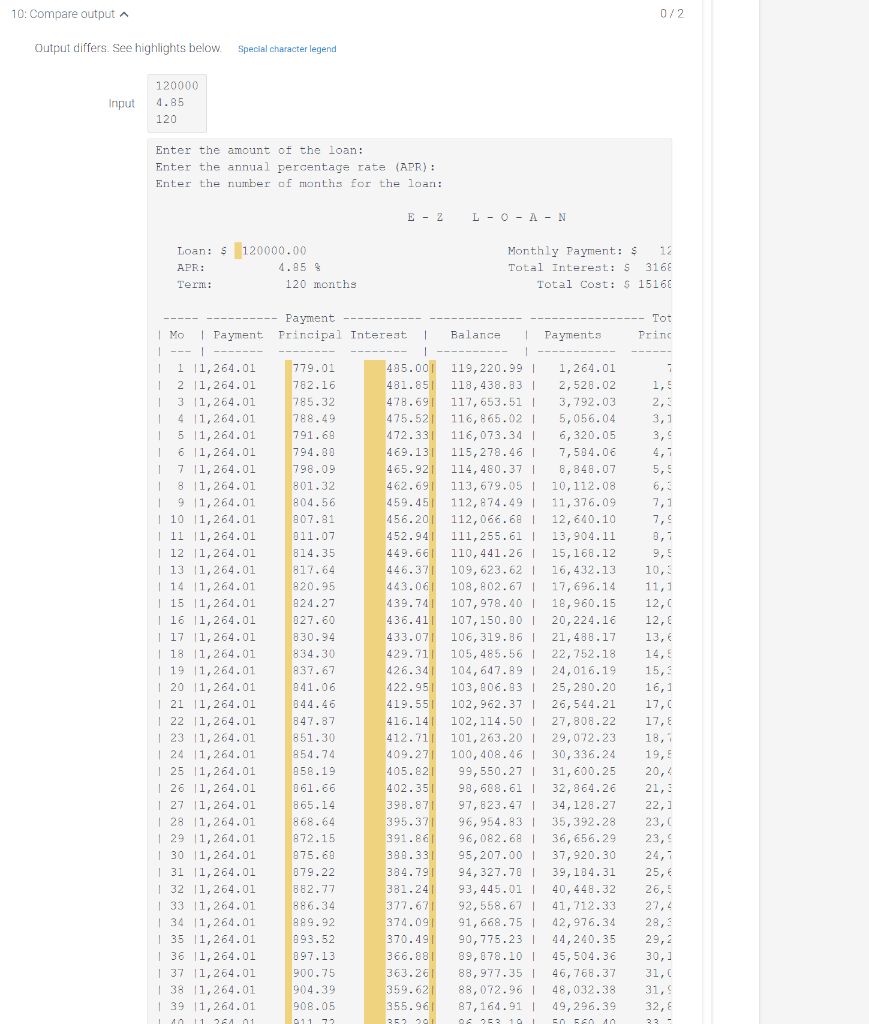

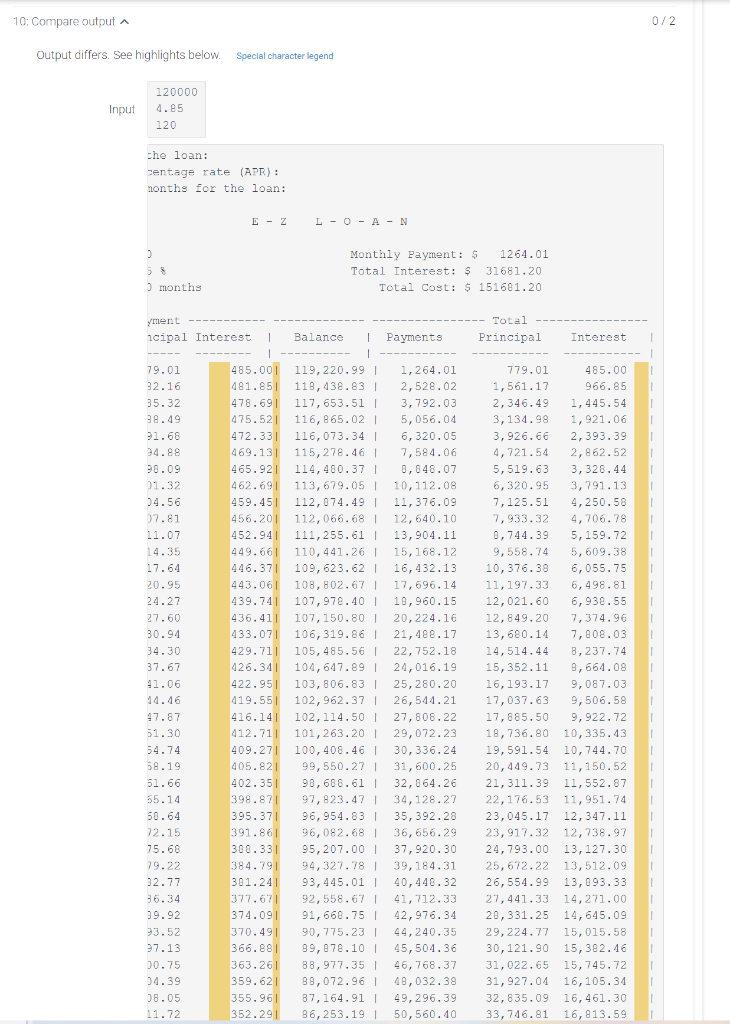

My output:

my output slide over to see the end of the marks:

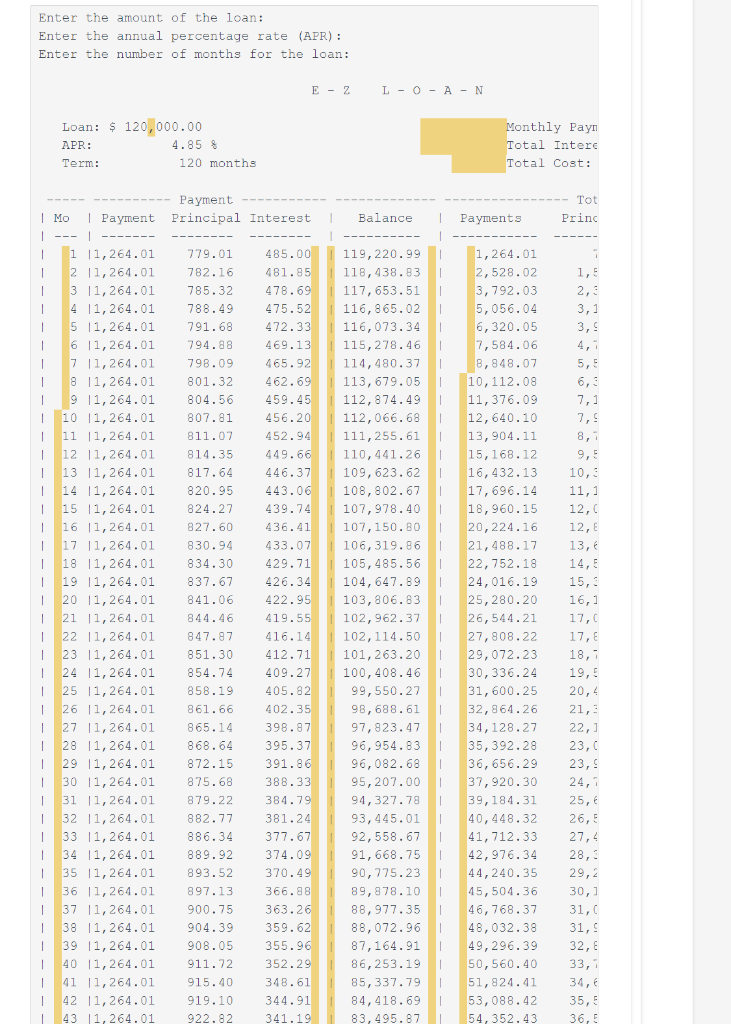

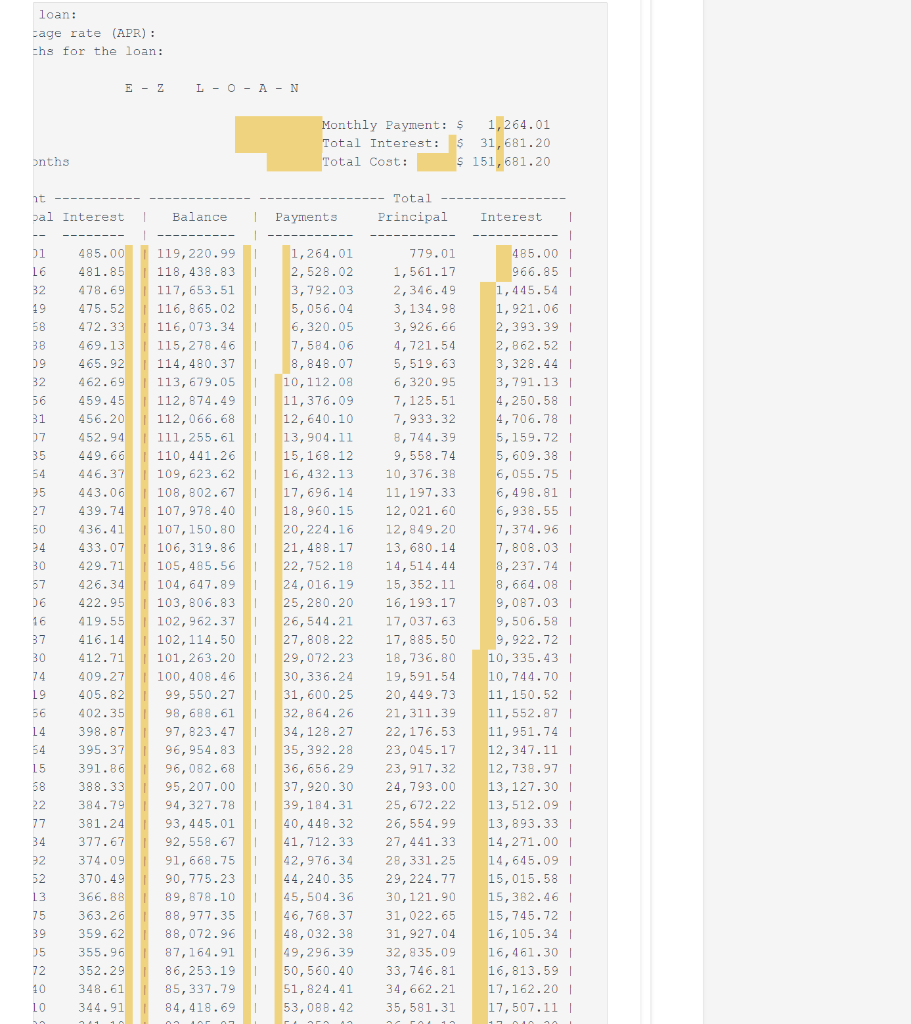

what it wants as my output:

what it wants scrolled over:

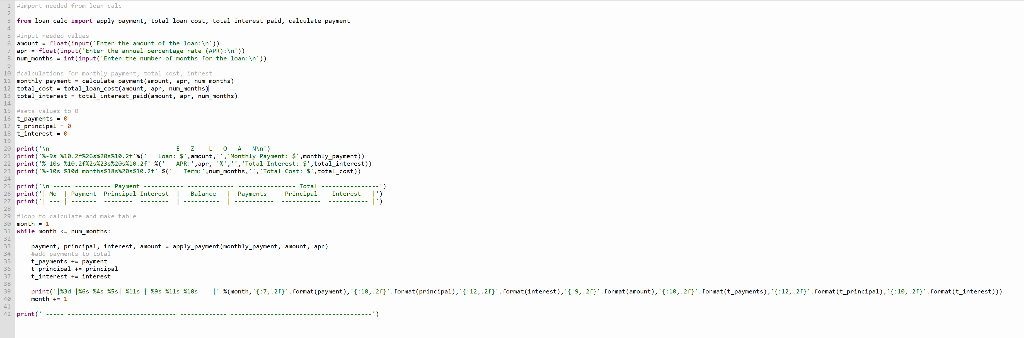

my code:

10: Compare output A 0/2 Output differs. See highlights below. Special character legend Input 120000 4.85 120 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - 2 L - O - A - N Loan: $ 120000.00 APR: 4.85 % Term: 120 months Monthly Payment: $ Total Interest: S 3168 Total Cost: S 15166 Tot Prind 7 1,5 2,3 3,1 3,9 5,5 7,1 7,9 8,7 9,5 10, 11,1 12, 12,6 13,6 Payment | Mo | Payment Principal Interest | Balance 1 Payments 1 ---------- 1 1 1 1,264.01 779.01 485.00 119,220.99 1,264.01 1 2 11,264.01 782.16 481.85 118,438.83 2,528.02 1 3 1,264.01 785.32 478.69 117,653.51 3,792.03 1 4 11,264.01 788.49 475.521 116,865.02 | 5,056.04 1 5 11,264.01 791.68 472.331 116,073.341 6,320.05 1 6 11,264.01 794.80 469.13 115,278.461 7,504.06 17 11,264.01 798.09 465.921 114, 480.37 | 8,848.07 T8 11,264.01 801.32 462.691 113, 679.05 10,112.08 1 9 11,264.01 804.56 459.45 112,874.49 11,376.09 10 11,264.01 807.81 456.20 112,066.68 12,640.10 | 11 11,264.01 011.07 452.94 111,255.61 | 13,904.11 | 12 |1, 264.01 814.35 449.661 110,441.26 15,168.12 | 13 1,264.01 817.64 446.371 109,623.62 | 109,623.62 16,432.13 | 141,264.01 820.95 443.06 108, 802.67 | 17,696.14 | 15 1,264.01 824.27 439.741 107,978.40 | 18,960.15 | 16 11,264.01 827.60 436.41 107,150.00 20,224.16 | 17 |1, 264.01 830.94 433.071 106,319.86 21,488.17 | 18 11,264.01 834.30 429.71 105,485.56 22,752.18 | 19 1,264.01 837.67 426.34 104,647.89 24,016.19 | 20 (1,264.01 841.06 422.951 103,806.93 | 25,200.20 | 21 11,264.01 844.46 419.55 102,962.37 | 26,544.21 | 22 1, 264.01 847.87 416.14 102, 114.50 27,808.22 | 23 11,264.01 851.30 412.711 101,263.20 | 101,263.20 29,072.23 | 24 1,264.01 854.74 409.27 100,408.46 | 30,336.24 | 25 1,264.01 858.19 405.821 99,550.27 31,600.25 | 26 11,264.01 861.66 402.35 98,688.611 32,864.26 | 27 11,264.01 865.14 398.871 97,823.47 | 34,128.27 | 28 11,264.01 868.64 395.371 96,954.831 35, 392.28 | 29 1,264.01 872.15 391.86 96,082.68 36,656.29 | 30 1,264.01 875.60 399.331 95,207.00 37,920.30 31 11,264.01 879.22 384.79 94,327.78 | 39,184.31 | 32 1,264.01 882.77 381.24 93,445.01 | 40,448.32 | 33 1,264.01 886.34 377.67 92,558.67 | 41,712.33 | 34 11,264.01 889.92 374.09 91,668.75 42,976.34 | 35 1,264.01 893.52 370.491 90, 775.231 44,240.35 | 36 11,264.01 897.13 366.88 89,878.101 45,504.36 | 37 1,264.01 900.75 363.261 88,977.351 46,768.37 | 38 /1,264.01 904.39 359.62 88,072.961 48,032.38 | 39 11,264.01 908.05 355.961 87,164.91 1 49,296.39 2641 011 72 352 29 50 560 10 14,5 15, 16,1 17,0 17, 18, 19,5 20,4 21,3 22,] 23, 23, 24,7 25, 26,5 27,4 29, 29,2 30,2 31, 31, 32, 33 10 11 10: Compare output A 0/2 Output differs. See highlights below. Special character legend Input 120000 4.85 120 che loan: centage rate (APR): months for the loan: E - Z L - O - A - N D Monthly Payment: $ 1264.01 Total Interest: $ 31681.20 Total Cost: $ 151681.20 months yment Total icipal Interest Balance 1 Payments Principal Interest 485.000 481.85 478.69 475.52 472.331 469.131 465.921 462.691 459.45) 19.01 32.16 3620 35.32 38.49 91.66 94.88 98.09 01.32 04.56 07.81 192 11.07 14.35 17.64 20.95 24.27 27.60 30.94 34.30 37.67 456.201 452.94 449.661 446.37 443.061 439.741 436.41 433.071 429.711 426.341 422.951 419.551 416.14 412.711 409.271 11.06 119,220.99 118,438.83 117,653.51 116,865.02 116,073.34 115,278.461 114,480.37 113,679.05 112,874.491 112,066.68 111, 255.61 110,441.26 109,623.62 108, 802.67 107,978.40 107,150.80 106,319.86 105,485.56 104,647.89 103,806.83 102,962.37 102,114.50 1 101,263.20 100,408.461 408 1 00 550.27 98,688.611 97,823.471 96,954.83 96,082.681 95,207.00 94,327.78 93,445.01 1 92,558.67 91,668.75 90, 775.23 89,878.10 88,977.351 88,072.96 87, 164.91 86,253.19 1,264.01 2,528.02 3,792.03 5,056.04 6,320.05 7,584.06 8,848.07 10, 112.08 11,376.09 12,640.10 13,904.11 22 15, 168.12 16,432.13 17,696.14 18,960.15 20,224.16 21,488.17 22,752.18 24,016.19 25,280.20 26,541.21 27,808.22 29,072.23 30,336.24 31,600.25 32,864.26 34,128.27 20 35, 392.28 36,656.29 37,920.30 39,184.31 40,448.32 41,712.33 42,976.34 44,240.35 45,504.36 46, 768.37 48,032.38 49,296.39 50, 560.40 779.01 485.00 1,561.17 966.85 2,346.49 1,445.54 3,134.98 1,921.06 3,926.66 2,393.39 4,721.54 2,862.52 5,519.63 3,328.44 6,320.95 3,791.13 7, 125.51 4,250.58 7,933.32 4,706.78 8,744.39 5, 159.72 9,558.74 5, 609.38 22 20 10,376.38 6,055.75 11, 197.33 6,498.81 *** 12,021.60 6,938.55 12,849.20 7,374.96 13,680.14 7,808.03 14,514.44 8,237.74 15,352.11 8,661.08 16,193.17 9,087.03 17,037.63 9,506.58 17,885.50 9,922.72 18,736.80 10,335.43 19,591.54 10,744.70 20,449.73 11,150.52 1.211.20 21, 311.39 11,552.87 22,176.53 11,951.74 23,045.17 12,347.11 23,917.32 12,738.97 24,793.00 13,127.30 25,672.22 13,512.09 26,554.99 13,093.33 27,441.33 14,271.00 28,331.25 14,645.09 29,224.77 15,015.58 30,121.90 15,382.46 31,022.65 15,745.72 31,927.04 16,105.34 32,835.09 16,461.30 33,746.81 16,813.59 14.16 47.87 51.30 405.821 54.74 58.19 51.66 55.14 50.64 72.15 75.68 19.22 32.77 36.34 39.92 93.52 97.13 00.75 04.39 08.05 11.72 19 20 402.35 398.871 395.371 391.861 308.331 384.791 301.24 377.671 374.091 370.49 366.88 363.26 359.62 355.96 352.29 Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L- O - A - N Loan: $ 120,000.00 APR: 4.85 % Term: 120 months Monthly Payn Total Intere Total Cost: Tot Princ Balance Payments 1 1 1 1 1 1,5 2,3 3,1 3,5 5,5 1 7,1 7,9 8,7 1 1 1 1 10,5 11,1 12, 12, 13, 1 1 1 1 Payment Mo | Payment Principal Interest --- 1 11,264.01 779.01 485.00 2 11,264.01 782.16 481.85 3 11,264.01 785.32 478.69 4 11,264.01 788.49 475.52 5 11,264.01 791.68 472.33 6 11,264.01 794.88 469.13 7 11,264.01 798.09 465.92 8 11,264.01 801.32 462.69 9 11,264.01 804.56 459.45 10 11,264.01 807.81 456.20 11 11,264.01 811.07 452.94 12 11,264.01 814.35 449.66 13 11,264.01 817.64 446.37 14 11,264.01 820.95 443.06 15 11,264.01 824.27 439.74 16 11,264.01 827.60 436.41 17 11,264.01 830.94 433.07 18 11,264.01 834.30 429.71 19 11,264.01 837.67 426.34 20 11,264.01 841.06 422.95 21 11,264.01 844.46 419.55 22 11,264.01 847.87 416.14 23 11,264.01 851.30 412.71 24 11,264.01 854.74 409.27 25 11,264.01 858.19 405.82 26 11,264.01 861.66 402.35 27 11,264.01 865.14 398.87 28 11,264.01 868.64 395.37 29 11,264.01 872.15 391.86 30 11,264.01 875.68 388.33 31 11,264.01 879.22 384.79 32 11,264.01 882.77 381.24 33 11,264.01 886.34 377.67 34 11,264.01 889.92 374.09 35 11,264.01 893.52 370.49 36 11,264.01 897.13 366.88 37 11,264.01 900.75 363.26 38 11,264.01 904.39 359.62 39 11,264.01 908.05 355.96 40 11,264.01 911.72 352.29 41 11,264.01 915.40 348.61 42 11,264.01 919.10 344.91 43 1,264.01 922.82 341.19 1 1 1 1 119,220.99 118,438.83 117,653.51 116, 865.02 116,073.34 115,278.46 114,480.37 113,679.05 112,874.49 112,066.68 111,255.61 110,441.26 109,623.62 108, 802.67 107,978.40 107,150.80 106,319.86 105,485.56 1 104,647.89 103,806.83 102,962.37 102,114.50 101, 263.20 100,408.46 99,550.27 98,688.61 97,823.47 96,954.83 96,082.68 95,207.00 94,327.78 93,445.01 92,558.67 91,668.75 90,775.23 89,878.10 88,977.35 88,072.96 87, 164.91 86,253.19 85,337.79 84,418.69 83,495.87 1, 264.01 2,528.02 3,792.03 5,056.04 6,320.05 7,584.06 8,848.07 10, 112.08 11,376.09 12,640.10 13,904.11 15, 168.12 16,432.13 17,696.14 18,960.15 20,224.16 21,488.17 22,752.18 24,016.19 25,280.20 26,544.21 27,808.22 29,072.23 30,336.24 31,600.25 32,864.26 34, 128.27 35, 392.28 36,656.29 37,920.30 39,184.31 40,448.32 41,712.33 42,976.34 44, 240.35 45,504.36 46,768.37 48,032.38 49,296.39 50,560.40 51,824.41 53,088.42 54, 352.43 1 1 1 1 1 1 15, 16,1 17, 17, E 18, 19,5 20,4 21,3 22,] 23, 23,9 24,1 25, 26,5 27,4 28, 29,2 30, 31, 31,5 32, E 33,1 34, 35,5 36,5 1 1 1 1 1 1 1 1 loan: cage rate (APR) : Chs for the loan: E - Z L-O - A - N Monthly Payment: $ 1,264.01 Total Interest: $ 31,681.20 Total Cost: $ 151,681.20 onths ht bal Interest Total Principal Balance Payments -- 01 16 32 19 58 38 09 32 56 B1 07 35 64 95 27 50 24 30 67 DO 485.00 481.85 478.69 475.52 472.33 469.13 465.92 462.69 459.45 456.20 452.94 449.66 446.37 443.06 439.74 436.41 433.07 429.71 426.34 422.95 419.55 416.14 412.71 409.27 405.82 402.35 398.87 395.37 391.86 388.33 384.79 381.24 377.67 374.09 370.49 366.88 363.26 359.62 355.96 352.29 348.61 344.91 119,220.99 118,438.83 117,653.51 116, 865.02 116,073.34 115,278.46 114,480.37 113, 679.05 112,874.49 112,066.68 111,255.61 110,441.26 109,623.62 108, 802.67 107,978.40 107,150.80 106,319.86 105,485.56 104,647.89 103,806.83 102,962.37 102, 114.50 101,263.20 100,408.46 99,550.27 98,688.61 97,823.47 96,954.83 96,082.68 95,207.00 94,327.78 93,445.01 92,558.67 91,668.75 90, 775.23 89,878.10 88,977.35 88,072.96 87,164.91 86,253.19 85,337.79 84,418.69 1,264.01 2,528.02 3,792.03 5,056.04 6,320.05 7,584.06 8,848.07 10,112.08 11,376.09 12, 640.10 13,904.11 15,168.12 16,432.13 17,696.14 18,960.15 20,224.16 21,488.17 22,752.18 24,016.19 25, 280.20 26,544.21 27,808.22 29,072.23 30,336.24 31,600.25 32,864.26 34,128.27 35,392.28 36,656.29 37,920.30 39,184.31 40, 448.32 41,712.33 42,976.34 44,240.35 45,504.36 46,768.37 48,032.38 49,296.39 50, 560.40 51,824.41 53,088.42 37 30 74 19 Interest | 485.00 966.85 1,445.54 1,921.06 2,393.39 2,862.52 3,328.44 3,791.131 4,250.58 | 4,706.78 5,159.72 5,609.38 6,055.751 6,498.81 | 6,938.55 | 7,374.961 7,808.03 8,237.74 1 8,664.08 9,087.03 9,506.58 9,922.721 10,335.43 10,744.70 11,150.52 11,552.87 11,951.74 12,347.111 12,738.971 13,127.301 13,512.09 13,893.33 14,271.00 14,645.09 | 15,015.58 15,382.46 15,745.72 16,105.34 16,461.30 16,813.59 17,162.201 17,507.11 | 779.01 1,561.17 2,346.49 3, 134.98 3,926.66 4,721.54 5,519.63 6,320.95 7,125.51 7,933.32 8,744.39 9,558.74 10,376.38 11,197.33 12,021.60 12,849.20 13,680.14 14,514.44 15, 352.11 16,193.17 17,037.63 17,885.50 18,736.80 19,591.54 20,449.73 21,311.39 22,176.53 23,045.17 23,917.32 24,793.00 25,672.22 26,554.99 27, 441.33 28,331.25 29,224.77 30,121.90 31,022.65 31,927.04 32,835.09 33, 746.81 34,662.21 35,581.31 56 14 64 15 68 22 77 34 22 52 13 75 39 05 72 10 10 ir por JJ fru Lulu = " 1 frv. lan cul cepurl weply WL, Llul low ca, lo lleres puid, c.ll.l. Le puran Hinp. uw van w . the wont of the la wy. LUL.np-' tu thu ul rut (APO nur_onthe - Intimp. Enter the number or month for the loan 19 calculation for monthly pater, botal cost, intrert 11 ly payment - cw.culte barn, er, run rata 12 total cost - total_100_Count, purunth) 1: te el interest podiumunt, ap, nun antha 15 valuext - 1. Erine.pl 18 interest printin print". De 113.2 10. : s'ut,',Monty Payunt: path Y MART! 22 primis le 1.10.2F2:223.20.2.8.2 (NRX'Tull Interests, totul interest:) print - 5101 ra thesis1.sts Terenurunthr, Cart: 5,-ENT_Fant) 7 printin.......... Payern ..................................... Tere! .......... 5 print' ! PUL I'rinnip.l Lulere Baluar.......... 2 print --- --- --- --- 30 His het date the 39.1 while nth syrent, principal, interent, sunt pily Myrunt:nthly Myrunt, sunt, app: wil www Lu Lulu t_nyants --- princisulinel t_1A - interest 1 1930 19.5L 5.11 Il RC i Seonth, 1:7,21) forest peyvent, 18, 20, portprincipal,'? 12, 27). Om interest:,'? 9,27 Torestront, T:18,207 Torestitynents), 1:13, 21) Porrstit_principal), ':19, 21; forestituinterest.) enth - 1 print! 1 71 99 10: Compare output A 0/2 Output differs. See highlights below. Special character legend Input 120000 4.85 120 Enter the amount of the loan: Enter the annual percentage rate (APR): Enter the number of months for the loan: E - 2 L - O - A - N Loan: $ 120000.00 APR: 4.85 % Term: 120 months Monthly Payment: $ Total Interest: S 3168 Total Cost: S 15166 Tot Prind 7 1,5 2,3 3,1 3,9 5,5 7,1 7,9 8,7 9,5 10, 11,1 12, 12,6 13,6 Payment | Mo | Payment Principal Interest | Balance 1 Payments 1 ---------- 1 1 1 1,264.01 779.01 485.00 119,220.99 1,264.01 1 2 11,264.01 782.16 481.85 118,438.83 2,528.02 1 3 1,264.01 785.32 478.69 117,653.51 3,792.03 1 4 11,264.01 788.49 475.521 116,865.02 | 5,056.04 1 5 11,264.01 791.68 472.331 116,073.341 6,320.05 1 6 11,264.01 794.80 469.13 115,278.461 7,504.06 17 11,264.01 798.09 465.921 114, 480.37 | 8,848.07 T8 11,264.01 801.32 462.691 113, 679.05 10,112.08 1 9 11,264.01 804.56 459.45 112,874.49 11,376.09 10 11,264.01 807.81 456.20 112,066.68 12,640.10 | 11 11,264.01 011.07 452.94 111,255.61 | 13,904.11 | 12 |1, 264.01 814.35 449.661 110,441.26 15,168.12 | 13 1,264.01 817.64 446.371 109,623.62 | 109,623.62 16,432.13 | 141,264.01 820.95 443.06 108, 802.67 | 17,696.14 | 15 1,264.01 824.27 439.741 107,978.40 | 18,960.15 | 16 11,264.01 827.60 436.41 107,150.00 20,224.16 | 17 |1, 264.01 830.94 433.071 106,319.86 21,488.17 | 18 11,264.01 834.30 429.71 105,485.56 22,752.18 | 19 1,264.01 837.67 426.34 104,647.89 24,016.19 | 20 (1,264.01 841.06 422.951 103,806.93 | 25,200.20 | 21 11,264.01 844.46 419.55 102,962.37 | 26,544.21 | 22 1, 264.01 847.87 416.14 102, 114.50 27,808.22 | 23 11,264.01 851.30 412.711 101,263.20 | 101,263.20 29,072.23 | 24 1,264.01 854.74 409.27 100,408.46 | 30,336.24 | 25 1,264.01 858.19 405.821 99,550.27 31,600.25 | 26 11,264.01 861.66 402.35 98,688.611 32,864.26 | 27 11,264.01 865.14 398.871 97,823.47 | 34,128.27 | 28 11,264.01 868.64 395.371 96,954.831 35, 392.28 | 29 1,264.01 872.15 391.86 96,082.68 36,656.29 | 30 1,264.01 875.60 399.331 95,207.00 37,920.30 31 11,264.01 879.22 384.79 94,327.78 | 39,184.31 | 32 1,264.01 882.77 381.24 93,445.01 | 40,448.32 | 33 1,264.01 886.34 377.67 92,558.67 | 41,712.33 | 34 11,264.01 889.92 374.09 91,668.75 42,976.34 | 35 1,264.01 893.52 370.491 90, 775.231 44,240.35 | 36 11,264.01 897.13 366.88 89,878.101 45,504.36 | 37 1,264.01 900.75 363.261 88,977.351 46,768.37 | 38 /1,264.01 904.39 359.62 88,072.961 48,032.38 | 39 11,264.01 908.05 355.961 87,164.91 1 49,296.39 2641 011 72 352 29 50 560 10 14,5 15, 16,1 17,0 17, 18, 19,5 20,4 21,3 22,] 23, 23, 24,7 25, 26,5 27,4 29, 29,2 30,2 31, 31, 32, 33 10 11 10: Compare output A 0/2 Output differs. See highlights below. Special character legend Input 120000 4.85 120 che loan: centage rate (APR): months for the loan: E - Z L - O - A - N D Monthly Payment: $ 1264.01 Total Interest: $ 31681.20 Total Cost: $ 151681.20 months yment Total icipal Interest Balance 1 Payments Principal Interest 485.000 481.85 478.69 475.52 472.331 469.131 465.921 462.691 459.45) 19.01 32.16 3620 35.32 38.49 91.66 94.88 98.09 01.32 04.56 07.81 192 11.07 14.35 17.64 20.95 24.27 27.60 30.94 34.30 37.67 456.201 452.94 449.661 446.37 443.061 439.741 436.41 433.071 429.711 426.341 422.951 419.551 416.14 412.711 409.271 11.06 119,220.99 118,438.83 117,653.51 116,865.02 116,073.34 115,278.461 114,480.37 113,679.05 112,874.491 112,066.68 111, 255.61 110,441.26 109,623.62 108, 802.67 107,978.40 107,150.80 106,319.86 105,485.56 104,647.89 103,806.83 102,962.37 102,114.50 1 101,263.20 100,408.461 408 1 00 550.27 98,688.611 97,823.471 96,954.83 96,082.681 95,207.00 94,327.78 93,445.01 1 92,558.67 91,668.75 90, 775.23 89,878.10 88,977.351 88,072.96 87, 164.91 86,253.19 1,264.01 2,528.02 3,792.03 5,056.04 6,320.05 7,584.06 8,848.07 10, 112.08 11,376.09 12,640.10 13,904.11 22 15, 168.12 16,432.13 17,696.14 18,960.15 20,224.16 21,488.17 22,752.18 24,016.19 25,280.20 26,541.21 27,808.22 29,072.23 30,336.24 31,600.25 32,864.26 34,128.27 20 35, 392.28 36,656.29 37,920.30 39,184.31 40,448.32 41,712.33 42,976.34 44,240.35 45,504.36 46, 768.37 48,032.38 49,296.39 50, 560.40 779.01 485.00 1,561.17 966.85 2,346.49 1,445.54 3,134.98 1,921.06 3,926.66 2,393.39 4,721.54 2,862.52 5,519.63 3,328.44 6,320.95 3,791.13 7, 125.51 4,250.58 7,933.32 4,706.78 8,744.39 5, 159.72 9,558.74 5, 609.38 22 20 10,376.38 6,055.75 11, 197.33 6,498.81 *** 12,021.60 6,938.55 12,849.20 7,374.96 13,680.14 7,808.03 14,514.44 8,237.74 15,352.11 8,661.08 16,193.17 9,087.03 17,037.63 9,506.58 17,885.50 9,922.72 18,736.80 10,335.43 19,591.54 10,744.70 20,449.73 11,150.52 1.211.20 21, 311.39 11,552.87 22,176.53 11,951.74 23,045.17 12,347.11 23,917.32 12,738.97 24,793.00 13,127.30 25,672.22 13,512.09 26,554.99 13,093.33 27,441.33 14,271.00 28,331.25 14,645.09 29,224.77 15,015.58 30,121.90 15,382.46 31,022.65 15,745.72 31,927.04 16,105.34 32,835.09 16,461.30 33,746.81 16,813.59 14.16 47.87 51.30 405.821 54.74 58.19 51.66 55.14 50.64 72.15 75.68 19.22 32.77 36.34 39.92 93.52 97.13 00.75 04.39 08.05 11.72 19 20 402.35 398.871 395.371 391.861 308.331 384.791 301.24 377.671 374.091 370.49 366.88 363.26 359.62 355.96 352.29 Enter the amount of the loan: Enter the annual percentage rate (APR) : Enter the number of months for the loan: E - Z L- O - A - N Loan: $ 120,000.00 APR: 4.85 % Term: 120 months Monthly Payn Total Intere Total Cost: Tot Princ Balance Payments 1 1 1 1 1 1,5 2,3 3,1 3,5 5,5 1 7,1 7,9 8,7 1 1 1 1 10,5 11,1 12, 12, 13, 1 1 1 1 Payment Mo | Payment Principal Interest --- 1 11,264.01 779.01 485.00 2 11,264.01 782.16 481.85 3 11,264.01 785.32 478.69 4 11,264.01 788.49 475.52 5 11,264.01 791.68 472.33 6 11,264.01 794.88 469.13 7 11,264.01 798.09 465.92 8 11,264.01 801.32 462.69 9 11,264.01 804.56 459.45 10 11,264.01 807.81 456.20 11 11,264.01 811.07 452.94 12 11,264.01 814.35 449.66 13 11,264.01 817.64 446.37 14 11,264.01 820.95 443.06 15 11,264.01 824.27 439.74 16 11,264.01 827.60 436.41 17 11,264.01 830.94 433.07 18 11,264.01 834.30 429.71 19 11,264.01 837.67 426.34 20 11,264.01 841.06 422.95 21 11,264.01 844.46 419.55 22 11,264.01 847.87 416.14 23 11,264.01 851.30 412.71 24 11,264.01 854.74 409.27 25 11,264.01 858.19 405.82 26 11,264.01 861.66 402.35 27 11,264.01 865.14 398.87 28 11,264.01 868.64 395.37 29 11,264.01 872.15 391.86 30 11,264.01 875.68 388.33 31 11,264.01 879.22 384.79 32 11,264.01 882.77 381.24 33 11,264.01 886.34 377.67 34 11,264.01 889.92 374.09 35 11,264.01 893.52 370.49 36 11,264.01 897.13 366.88 37 11,264.01 900.75 363.26 38 11,264.01 904.39 359.62 39 11,264.01 908.05 355.96 40 11,264.01 911.72 352.29 41 11,264.01 915.40 348.61 42 11,264.01 919.10 344.91 43 1,264.01 922.82 341.19 1 1 1 1 119,220.99 118,438.83 117,653.51 116, 865.02 116,073.34 115,278.46 114,480.37 113,679.05 112,874.49 112,066.68 111,255.61 110,441.26 109,623.62 108, 802.67 107,978.40 107,150.80 106,319.86 105,485.56 1 104,647.89 103,806.83 102,962.37 102,114.50 101, 263.20 100,408.46 99,550.27 98,688.61 97,823.47 96,954.83 96,082.68 95,207.00 94,327.78 93,445.01 92,558.67 91,668.75 90,775.23 89,878.10 88,977.35 88,072.96 87, 164.91 86,253.19 85,337.79 84,418.69 83,495.87 1, 264.01 2,528.02 3,792.03 5,056.04 6,320.05 7,584.06 8,848.07 10, 112.08 11,376.09 12,640.10 13,904.11 15, 168.12 16,432.13 17,696.14 18,960.15 20,224.16 21,488.17 22,752.18 24,016.19 25,280.20 26,544.21 27,808.22 29,072.23 30,336.24 31,600.25 32,864.26 34, 128.27 35, 392.28 36,656.29 37,920.30 39,184.31 40,448.32 41,712.33 42,976.34 44, 240.35 45,504.36 46,768.37 48,032.38 49,296.39 50,560.40 51,824.41 53,088.42 54, 352.43 1 1 1 1 1 1 15, 16,1 17, 17, E 18, 19,5 20,4 21,3 22,] 23, 23,9 24,1 25, 26,5 27,4 28, 29,2 30, 31, 31,5 32, E 33,1 34, 35,5 36,5 1 1 1 1 1 1 1 1 loan: cage rate (APR) : Chs for the loan: E - Z L-O - A - N Monthly Payment: $ 1,264.01 Total Interest: $ 31,681.20 Total Cost: $ 151,681.20 onths ht bal Interest Total Principal Balance Payments -- 01 16 32 19 58 38 09 32 56 B1 07 35 64 95 27 50 24 30 67 DO 485.00 481.85 478.69 475.52 472.33 469.13 465.92 462.69 459.45 456.20 452.94 449.66 446.37 443.06 439.74 436.41 433.07 429.71 426.34 422.95 419.55 416.14 412.71 409.27 405.82 402.35 398.87 395.37 391.86 388.33 384.79 381.24 377.67 374.09 370.49 366.88 363.26 359.62 355.96 352.29 348.61 344.91 119,220.99 118,438.83 117,653.51 116, 865.02 116,073.34 115,278.46 114,480.37 113, 679.05 112,874.49 112,066.68 111,255.61 110,441.26 109,623.62 108, 802.67 107,978.40 107,150.80 106,319.86 105,485.56 104,647.89 103,806.83 102,962.37 102, 114.50 101,263.20 100,408.46 99,550.27 98,688.61 97,823.47 96,954.83 96,082.68 95,207.00 94,327.78 93,445.01 92,558.67 91,668.75 90, 775.23 89,878.10 88,977.35 88,072.96 87,164.91 86,253.19 85,337.79 84,418.69 1,264.01 2,528.02 3,792.03 5,056.04 6,320.05 7,584.06 8,848.07 10,112.08 11,376.09 12, 640.10 13,904.11 15,168.12 16,432.13 17,696.14 18,960.15 20,224.16 21,488.17 22,752.18 24,016.19 25, 280.20 26,544.21 27,808.22 29,072.23 30,336.24 31,600.25 32,864.26 34,128.27 35,392.28 36,656.29 37,920.30 39,184.31 40, 448.32 41,712.33 42,976.34 44,240.35 45,504.36 46,768.37 48,032.38 49,296.39 50, 560.40 51,824.41 53,088.42 37 30 74 19 Interest | 485.00 966.85 1,445.54 1,921.06 2,393.39 2,862.52 3,328.44 3,791.131 4,250.58 | 4,706.78 5,159.72 5,609.38 6,055.751 6,498.81 | 6,938.55 | 7,374.961 7,808.03 8,237.74 1 8,664.08 9,087.03 9,506.58 9,922.721 10,335.43 10,744.70 11,150.52 11,552.87 11,951.74 12,347.111 12,738.971 13,127.301 13,512.09 13,893.33 14,271.00 14,645.09 | 15,015.58 15,382.46 15,745.72 16,105.34 16,461.30 16,813.59 17,162.201 17,507.11 | 779.01 1,561.17 2,346.49 3, 134.98 3,926.66 4,721.54 5,519.63 6,320.95 7,125.51 7,933.32 8,744.39 9,558.74 10,376.38 11,197.33 12,021.60 12,849.20 13,680.14 14,514.44 15, 352.11 16,193.17 17,037.63 17,885.50 18,736.80 19,591.54 20,449.73 21,311.39 22,176.53 23,045.17 23,917.32 24,793.00 25,672.22 26,554.99 27, 441.33 28,331.25 29,224.77 30,121.90 31,022.65 31,927.04 32,835.09 33, 746.81 34,662.21 35,581.31 56 14 64 15 68 22 77 34 22 52 13 75 39 05 72 10 10 ir por JJ fru Lulu = " 1 frv. lan cul cepurl weply WL, Llul low ca, lo lleres puid, c.ll.l. Le puran Hinp. uw van w . the wont of the la wy. LUL.np-' tu thu ul rut (APO nur_onthe - Intimp. Enter the number or month for the loan 19 calculation for monthly pater, botal cost, intrert 11 ly payment - cw.culte barn, er, run rata 12 total cost - total_100_Count, purunth) 1: te el interest podiumunt, ap, nun antha 15 valuext - 1. Erine.pl 18 interest printin print". De 113.2 10. : s'ut,',Monty Payunt: path Y MART! 22 primis le 1.10.2F2:223.20.2.8.2 (NRX'Tull Interests, totul interest:) print - 5101 ra thesis1.sts Terenurunthr, Cart: 5,-ENT_Fant) 7 printin.......... Payern ..................................... Tere! .......... 5 print' ! PUL I'rinnip.l Lulere Baluar.......... 2 print --- --- --- --- 30 His het date the 39.1 while nth syrent, principal, interent, sunt pily Myrunt:nthly Myrunt, sunt, app: wil www Lu Lulu t_nyants --- princisulinel t_1A - interest 1 1930 19.5L 5.11 Il RC i Seonth, 1:7,21) forest peyvent, 18, 20, portprincipal,'? 12, 27). Om interest:,'? 9,27 Torestront, T:18,207 Torestitynents), 1:13, 21) Porrstit_principal), ':19, 21; forestituinterest.) enth - 1 print! 1 71 99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts