Question: In Step 1 I calculated that I will need $135,000 a year in retirement. The prompt tells me that I am to assume I will

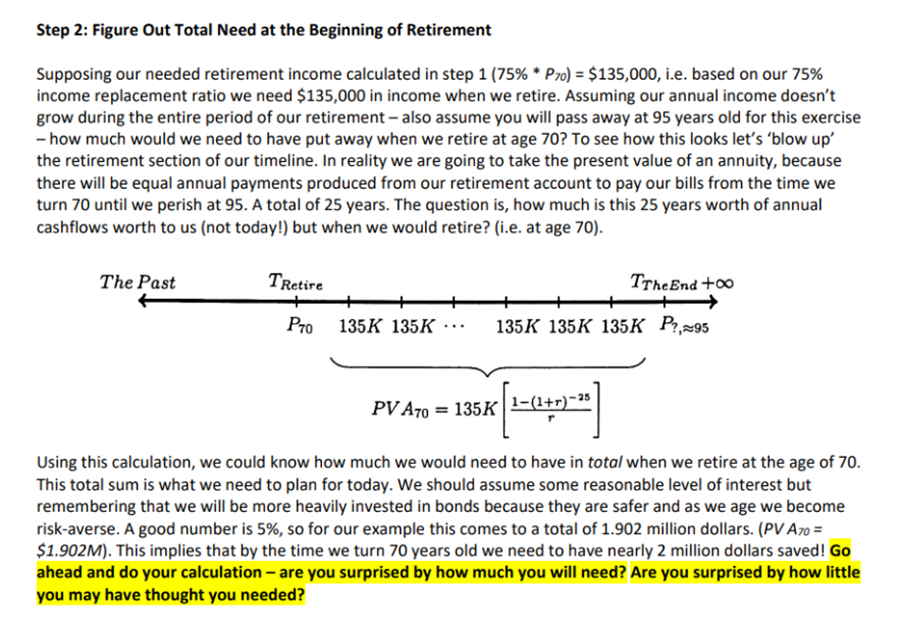

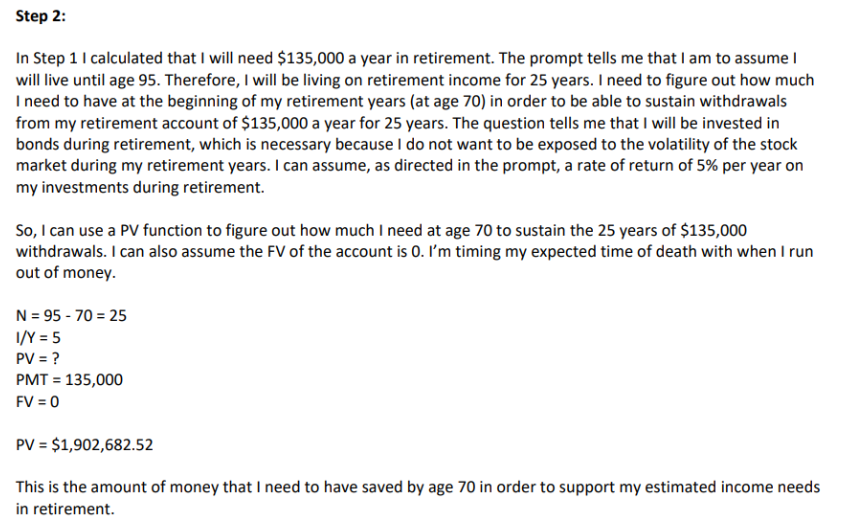

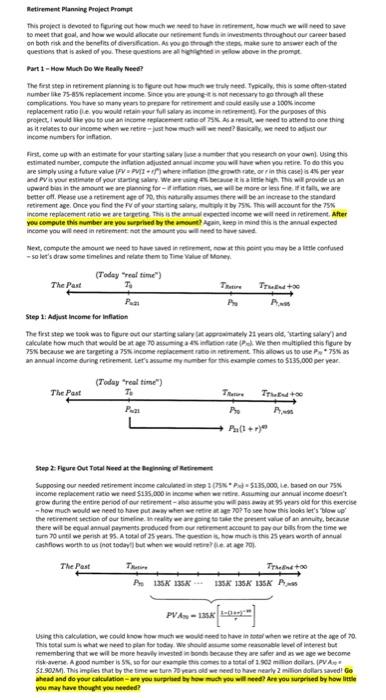

In Step 1 I calculated that I will need $135,000 a year in retirement. The prompt tells me that I am to assume I will live until age 95 . Therefore, I will be living on retirement income for 25 years. I need to figure out how much I need to have at the beginning of my retirement years (at age 70) in order to be able to sustain withdrawals from my retirement account of $135,000 a year for 25 years. The question tells me that I will be invested in bonds during retirement, which is necessary because I do not want to be exposed to the volatility of the stock market during my retirement years. I can assume, as directed in the prompt, a rate of return of 5% per year on my investments during retirement. So, I can use a PV function to figure out how much I need at age 70 to sustain the 25 years of $135,000 withdrawals. I can also assume the FV of the account is 0 . I'm timing my expected time of death with when I run out of money. N=9570=25I/Y=5PV=?PMT=135,000FV=0 PMT=135,000 FV=0 PV=$1,902,682.52 This is the amount of money that I need to have saved by age 70 in order to support my estimated income needs in retirement. Aetirement Plannine Project Prompt so meet that goal, and how we would alocate our retinement fondi in inentments throughout our career baned Dart 1 - Hew Mach Do We Reully Neee? replacement ratio fie, you would irtain pour fud salar as income in netirement, For the parposes of this income numbers for inflation. Step 1: Adjat income for inflation an annual income during retinement. tets ascume ner nmber for this ecample comes to 5135,000 per year. Step 2: Figure Out Total Need at the Beginning of Antirement turn 70 until we perigh at 95 . A total of 25 vean. The ourition is. how much is thin 25 vean worth of annual pou mary have theuple you needed? Step 2: Figure Out Total Need at the Beginning of Retirement Supposing our needed retirement income calculated in step 1(75%P70)=$135,000, i.e. based on our 75% income replacement ratio we need $135,000 in income when we retire. Assuming our annual income doesn't grow during the entire period of our retirement - also assume you will pass away at 95 years old for this exercise - how much would we need to have put away when we retire at age 70? To see how this looks let's 'blow up' the retirement section of our timeline. In reality we are going to take the present value of an annuity, because there will be equal annual payments produced from our retirement account to pay our bills from the time we turn 70 until we perish at 95 . A total of 25 years. The question is, how much is this 25 years worth of annual cashflows worth to us (not today!) but when we would retire? (i.e. at age 70). Using this calculation, we could know how much we would need to have in total when we retire at the age of 70 . This total sum is what we need to plan for today. We should assume some reasonable level of interest but remembering that we will be more heavily invested in bonds because they are safer and as we age we become risk-averse. A good number is 5\%, so for our example this comes to a total of 1.902 million dollars. ( PVA70= $1.902M). This implies that by the time we turn 70 years old we need to have nearly 2 million dollars saved! Go ahead and do your calculation - are you surprised by how much you will need? Are you surprised by how little you may have thought you needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts