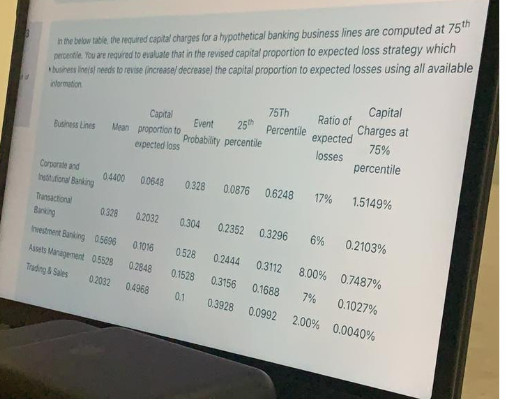

Question: In the below table, the required capital charges for a hypothetical banking business lines are computed at 75th pertestile . You are required to evaluate

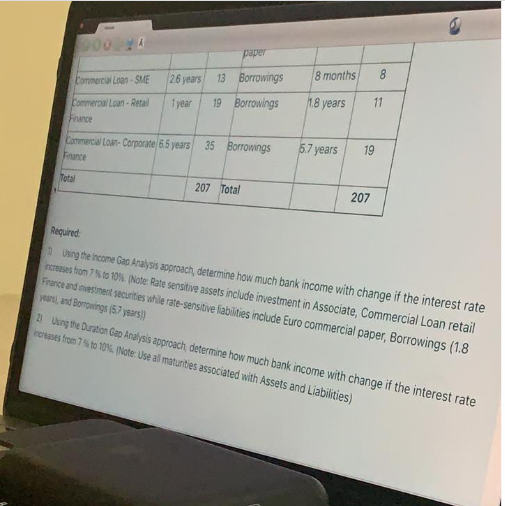

In the below table, the required capital charges for a hypothetical banking business lines are computed at 75th pertestile . You are required to evaluate that in the revised capital proportion to expected loss strategy which business Int's) needs to revise (increase/ decrease the capital proportion to expected losses using all available information Business Lines 75TH Capital Event Mean proportion to Percentile expected loss Probability percentile 25 Ratio of Capital Charges at expected 75% losses percentile Corporate and bufonal Banking 0.4000 0.0648 0328 0.0876 0.6248 17% 1.5149% Transactional 0.328 Bareng hvestment Banking 05696 0.2032 0.304 0.2352 0.3296 6% 0.1056 0.2103% 0.528 Asset Management 05628 Trading Sales 02032 0.2444 02848 0.3112 0.1528 8.00% 0.7487% 04968 0.3156 0.1688 01 7% 0.3928 0.0992 0.1027% 2.00% 0.0040% paper Commerc Loan-SME 8 26 years 8 months 8 13 Borrowings 19 Borrowings 1 year 18 years 11 Commercial Loon-Retail France Comercial Loan-Corporate 6.5 years 35 Borrowings France 67 years 19 Total 207 Total 207 Required 1 Using the income Gap Analysis approach, determine how much bank income with change if the interest rate creases from 7 to 1018. (Note: Rate sensitive assets include investment in Associate, Commercial Loan retail France and investment securities while rate-sensitive abilities include Euro commercial paper, Borrowings (1.8 years, and Borrowings (5.7 years) 2) Using the Duration Gap Analysis approach determine how much bank income with change if the interest rate Frases from 5 to 10%. (Note: Use al matunties associated with Assets and Liabilities) In the below table, the required capital charges for a hypothetical banking business lines are computed at 75th pertestile . You are required to evaluate that in the revised capital proportion to expected loss strategy which business Int's) needs to revise (increase/ decrease the capital proportion to expected losses using all available information Business Lines 75TH Capital Event Mean proportion to Percentile expected loss Probability percentile 25 Ratio of Capital Charges at expected 75% losses percentile Corporate and bufonal Banking 0.4000 0.0648 0328 0.0876 0.6248 17% 1.5149% Transactional 0.328 Bareng hvestment Banking 05696 0.2032 0.304 0.2352 0.3296 6% 0.1056 0.2103% 0.528 Asset Management 05628 Trading Sales 02032 0.2444 02848 0.3112 0.1528 8.00% 0.7487% 04968 0.3156 0.1688 01 7% 0.3928 0.0992 0.1027% 2.00% 0.0040% paper Commerc Loan-SME 8 26 years 8 months 8 13 Borrowings 19 Borrowings 1 year 18 years 11 Commercial Loon-Retail France Comercial Loan-Corporate 6.5 years 35 Borrowings France 67 years 19 Total 207 Total 207 Required 1 Using the income Gap Analysis approach, determine how much bank income with change if the interest rate creases from 7 to 1018. (Note: Rate sensitive assets include investment in Associate, Commercial Loan retail France and investment securities while rate-sensitive abilities include Euro commercial paper, Borrowings (1.8 years, and Borrowings (5.7 years) 2) Using the Duration Gap Analysis approach determine how much bank income with change if the interest rate Frases from 5 to 10%. (Note: Use al matunties associated with Assets and Liabilities)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts