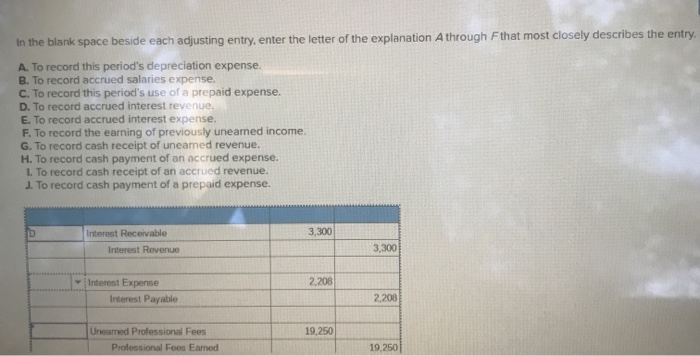

Question: In the blank space beside each adjusting entry, enter the letter of the explanation Athrough F that most closely describes the entry. A. To record

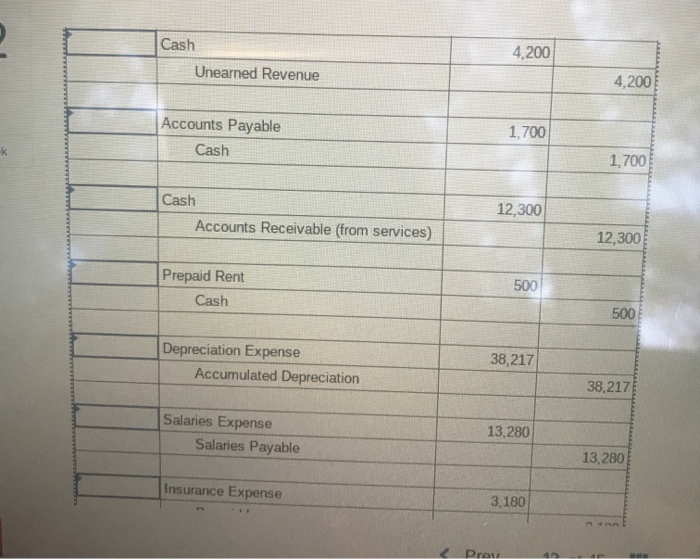

In the blank space beside each adjusting entry, enter the letter of the explanation Athrough F that most closely describes the entry. A. To record this period's depreciation expense. B. To record accrued salaries expense. C. To record this period's use of a prepaid expense. D. To record accrued interest revenue. E. To record accrued interest expense. F. To record the earning of previously unearned income. G. To record cash receipt of uneamed revenue. H. To record cash payment of an accrued expense. 1. To record cash receipt of an accrued revenue. J. To record cash payment of a prepaid expense. Interest Receivable Interest Revenue 3,300 2,208 Interest Expense Interest Payable 2.208 19.250 Uneamed Professional Fees Professional Foos Eamed 19.2501 4,200 Cash Unearned Revenue 4,200 1,700 Accounts Payable Cash 1,700 12,300 Cash Accounts Receivable (from services) 12,300 500 Prepaid Rent Cash 500 38,217 Depreciation Expense Accumulated Depreciation 38,217 13,280 Salaries Expense Salaries Payable 13,280 Insurance Expense 3,180

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts