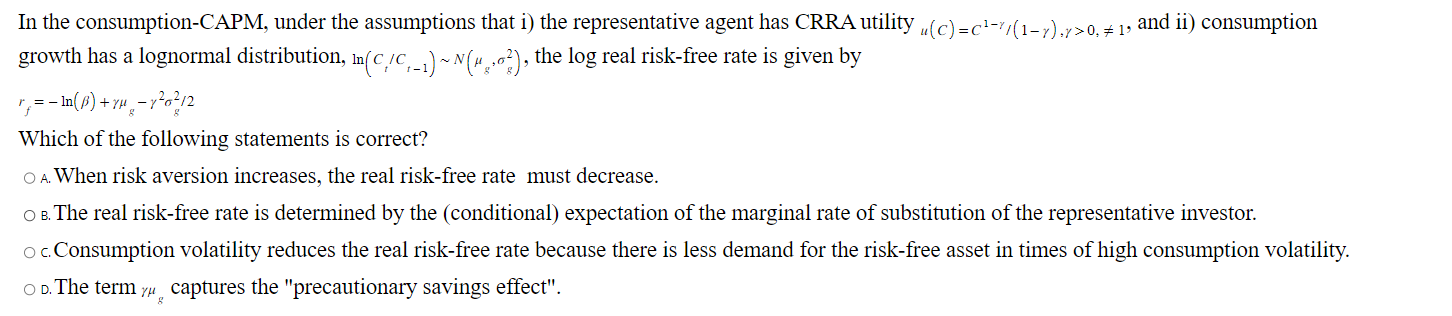

Question: In the consumption-CAPM, under the assumptions that i) the representative agent has CRRA utility u(C)=C1/(1),>0,=1, and ii) consumption growth has a lognormal distribution, ln(Ct/Ct1)N(g,g2), the

In the consumption-CAPM, under the assumptions that i) the representative agent has CRRA utility u(C)=C1/(1),>0,=1, and ii) consumption growth has a lognormal distribution, ln(Ct/Ct1)N(g,g2), the log real risk-free rate is given by rf=ln()+g2g2/2 Which of the following statements is correct? A. When risk aversion increases, the real risk-free rate must decrease. . The real risk-free rate is determined by the (conditional) expectation of the marginal rate of substitution of the representative investor. c. Consumption volatility reduces the real risk-free rate because there is less demand for the risk-free asset in times of high consumption volatility. o. The term g captures the "precautionary savings effect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts