Question: In the current tax year David, a 32-year-old single taxpayer, reported itemized deductions of $24,500, comprised of the following amounts. $6,000 of medical expenses (in

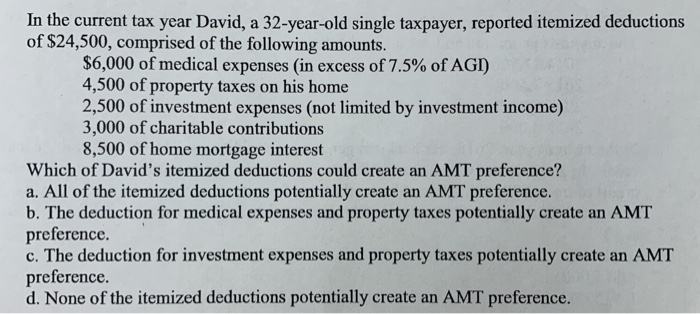

In the current tax year David, a 32-year-old single taxpayer, reported itemized deductions of $24,500, comprised of the following amounts. $6,000 of medical expenses (in excess of 7.5% of AGI) 4,500 of property taxes on his home 2,500 of investment expenses (not limited by investment income) 3,000 of charitable contributions 8,500 of home mortgage interest Which of David's itemized deductions could create an AMT preference? a. All of the itemized deductions potentially create an AMT preference. b. The deduction for medical expenses and property taxes potentially create an AMT preference. c. The deduction for investment expenses and property taxes potentially create an AMT preference. d. None of the itemized deductions potentially create an AMT preference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts