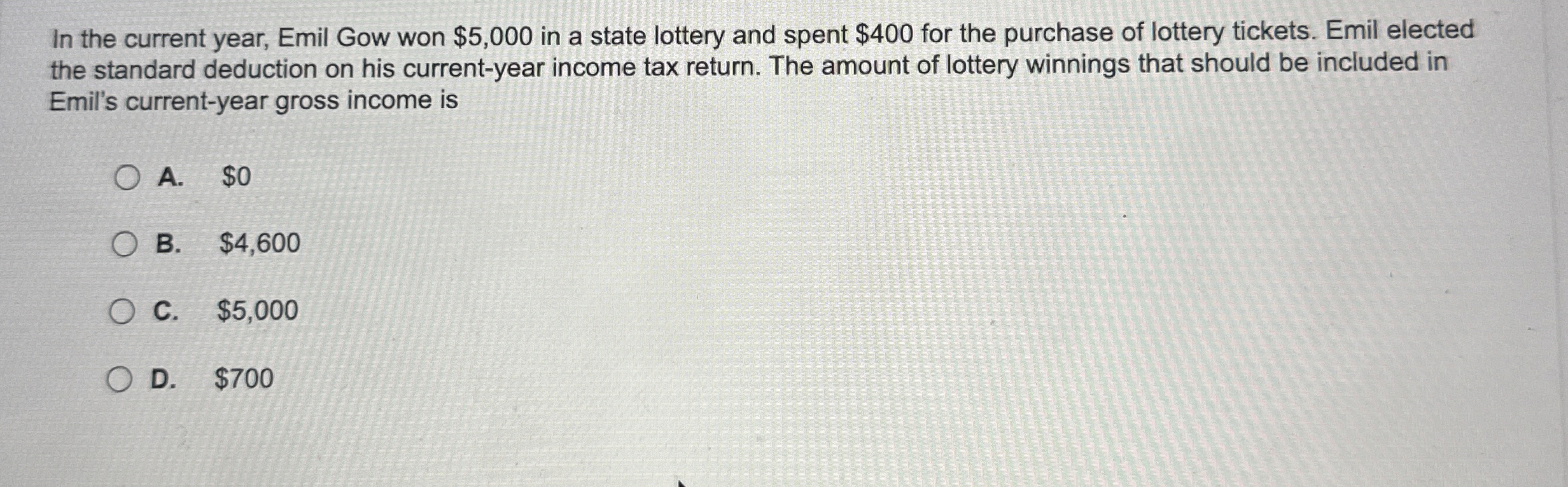

Question: In the current year, Emil Gow won $ 5 , 0 0 0 in a state lottery and spent $ 4 0 0 for the

In the current year, Emil Gow won $ in a state lottery and spent $ for the purchase of lottery tickets. Emil elected

the standard deduction on his currentyear income tax return. The amount of lottery winnings that should be included in

Emil's currentyear gross income is

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock