Question: In the current year, Jaslyn started a profitable bookkeeping business as a sole proprietor. Jaslyn made $ 3 8 , 0 0 0 in her

In the current year, Jaslyn started a profitable bookkeeping business as a sole proprietor. Jaslyn made $ in her first year of

operation. What two forms must Jaslyn file for her business?

a Schedules D and E

b Schedules SE and

c Schedules A and C

d Schedules B and

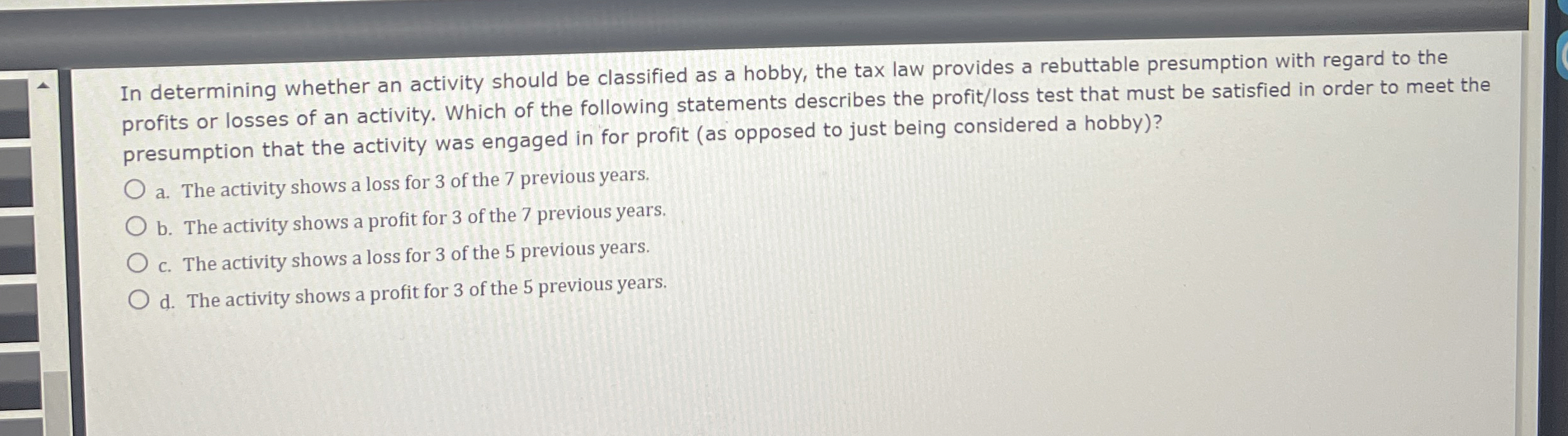

In determining whether an activity should be classified as a hobby, the tax law provides a rebuttable presumption with regard to the

profits or losses of an activity. Which of the following statements describes the profitloss test that must be satisfied in order to meet the

presumption that the activity was engaged in for profit as opposed to just being considered a hobby

a The activity shows a loss for of the previous years.

b The activity shows a profit for of the previous years.

c The activity shows a loss for of the previous years.

d The activity shows a profit for of the previous years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock