Question: In the current year, Melissa Wright moved from Toronto to Vancouver to start a new business. In the current fiscal year, the business generated income

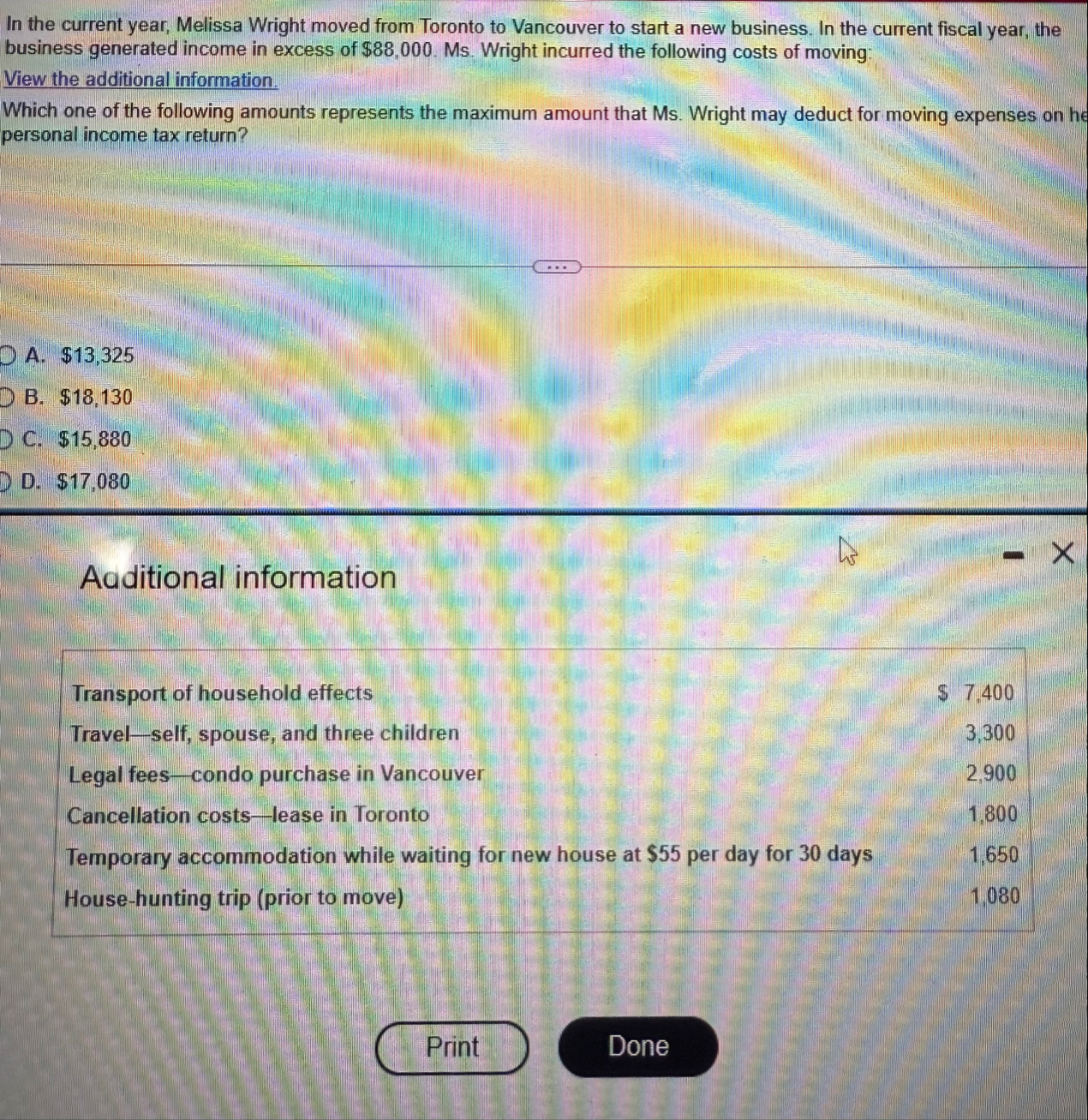

In the current year, Melissa Wright moved from Toronto to Vancouver to start a new business. In the current fiscal year, the business generated income in excess of $ Ms Wright incurred the following costs of moving:

View the additional information.

Which one of the following amounts represents the maximum amount that Ms Wright may deduct for moving expenses on he personal income tax return?

A $

B $

C $

D $

Additional information

Transport of household effects

$

Travelself, spouse, and three children

Legal feescondo purchase in Vancouver

Cancellation costslease in Toronto

Temporary accommodation while waiting for new house at $ per day for days

Househunting trip prior to move

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock