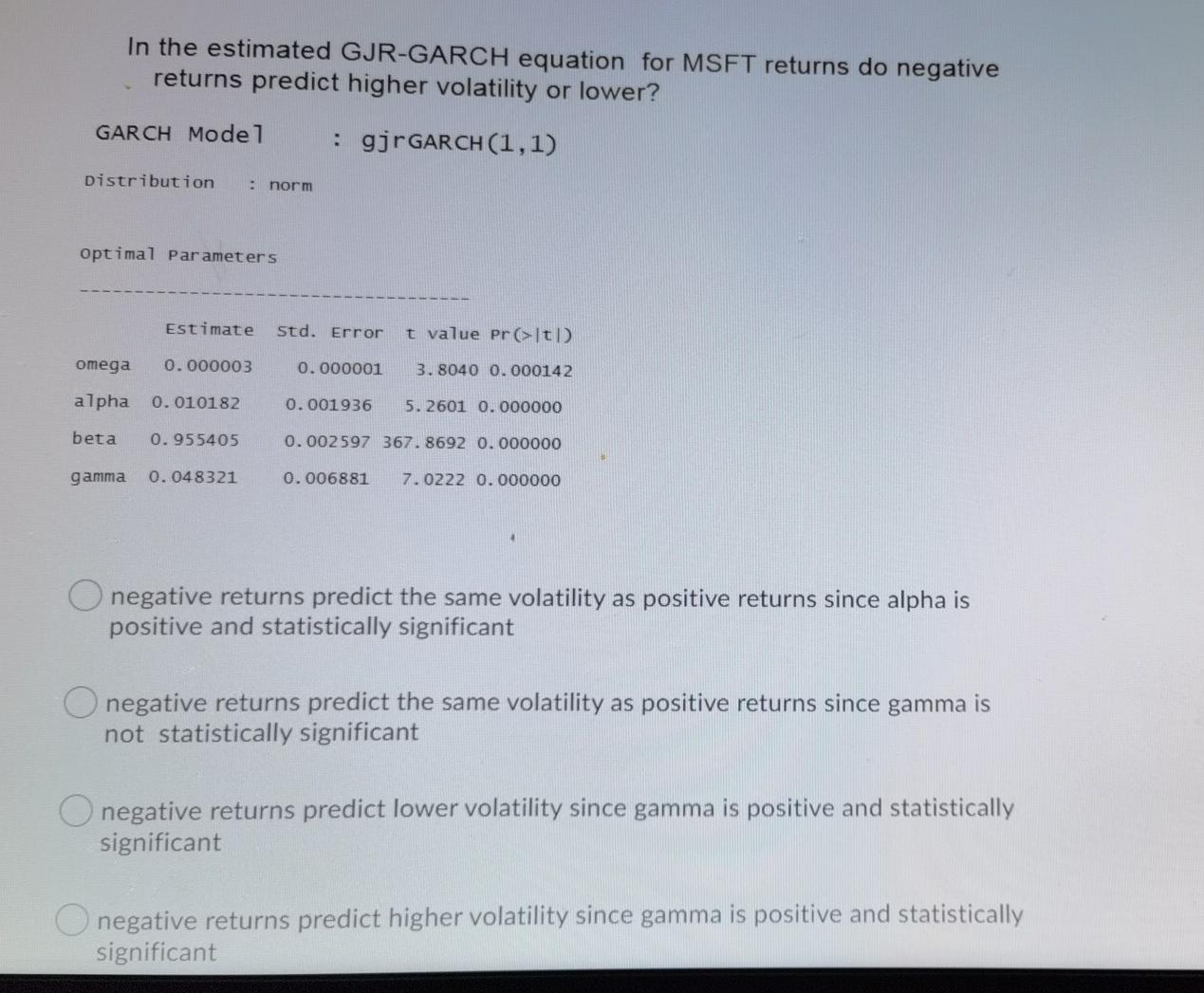

Question: In the estimated GJR-GARCH equation for MSFT returns do negative returns predict higher volatility or lower? GARCH Model : gjrGARCH (1,1) distribution : norm optimal

In the estimated GJR-GARCH equation for MSFT returns do negative returns predict higher volatility or lower? GARCH Model : gjrGARCH (1,1) distribution : norm optimal parameters Estimate Std. Error t value pret omega 0.000003 0.000001 3.8040 0.000142 alpha 0.010182 0.001936 5. 2601 0.000000 beta 0.955405 0.002597 367.8692 0.000000 gamma 0.048321 0.006881 7.0222 0.000000 negative returns predict the same volatility as positive returns since alpha is positive and statistically significant negative returns predict the same volatility as positive returns since gamma is not statistically significant negative returns predict lower volatility since gamma is positive and statistically significant negative returns predict higher volatility since gamma is positive and statistically significant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts