Question: In the Excel assignment, Hongyi asked you to optimize various portfolios using the 3 stocks: Santos, CSR, and JB Hi-Fi. After reviewing the analysis that

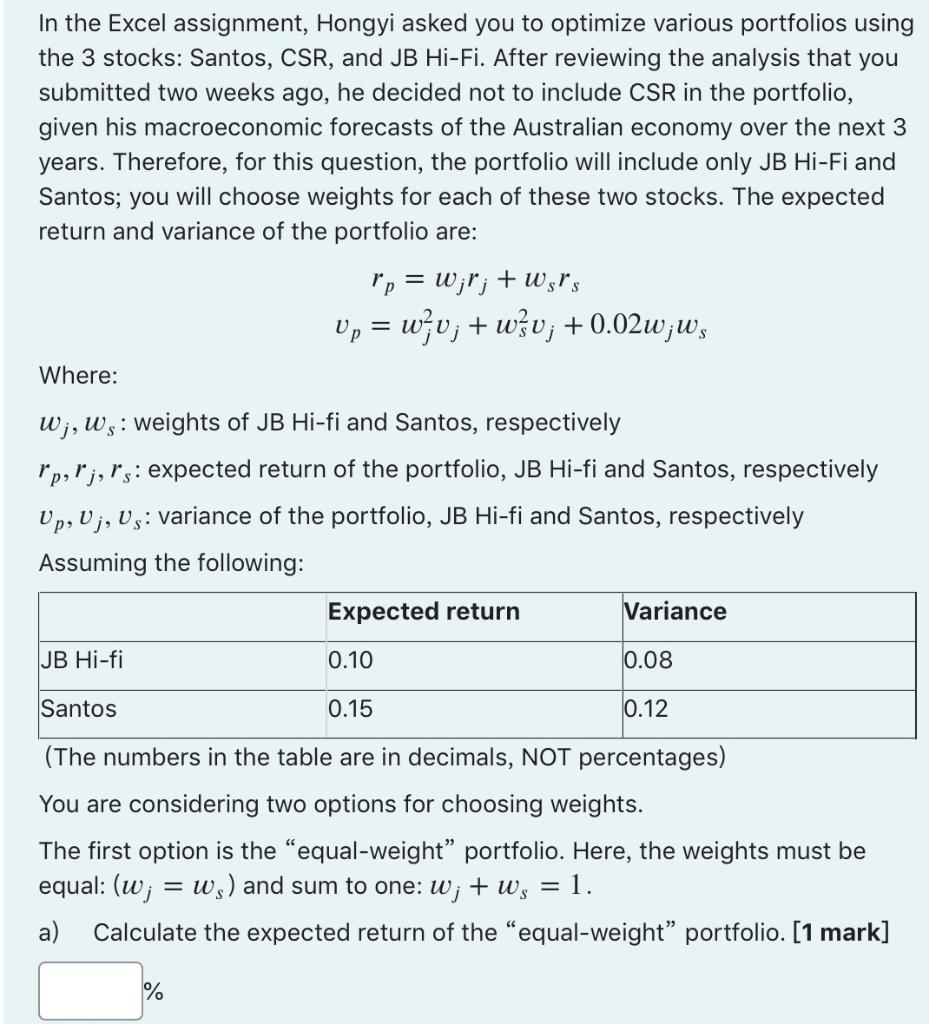

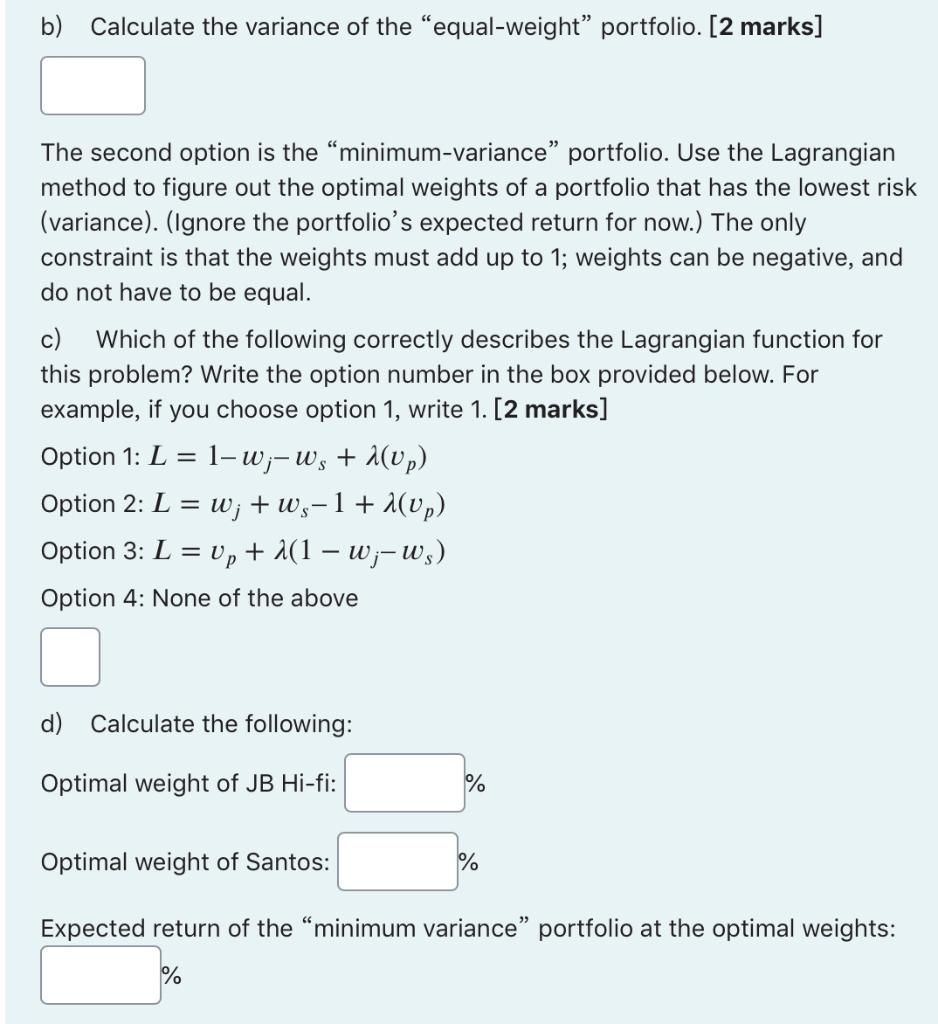

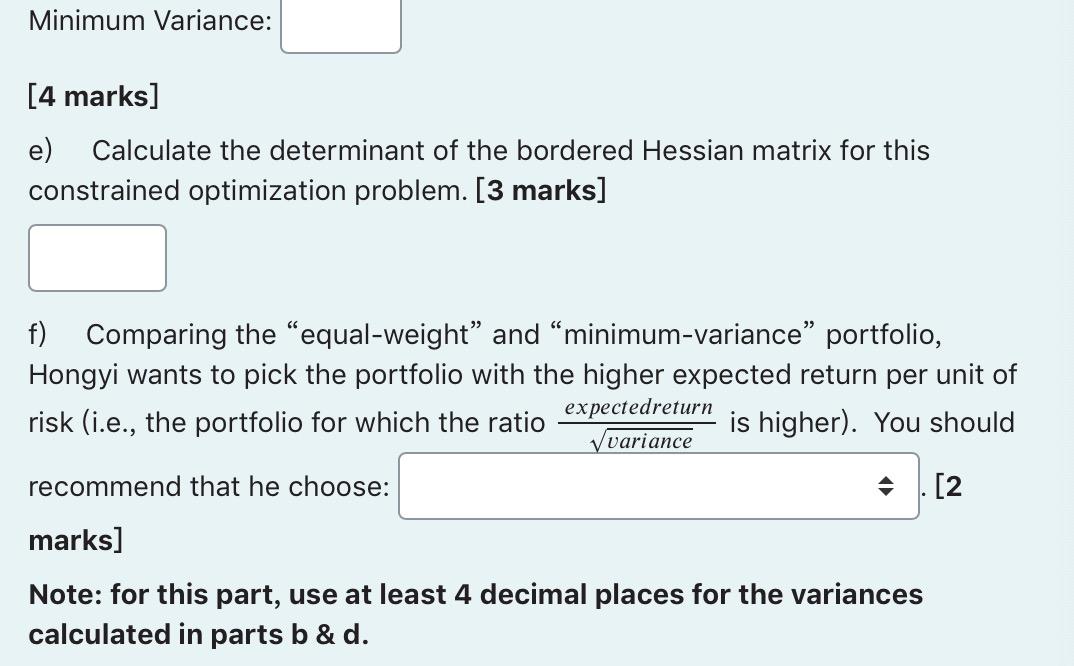

In the Excel assignment, Hongyi asked you to optimize various portfolios using the 3 stocks: Santos, CSR, and JB Hi-Fi. After reviewing the analysis that you submitted two weeks ago, he decided not to include CSR in the portfolio, given his macroeconomic forecasts of the Australian economy over the next 3 years. Therefore, for this question, the portfolio will include only JB Hi-Fi and Santos; you will choose weights for each of these two stocks. The expected return and variance of the portfolio are: "p = w;!; + wers Un = w;v; + wv; +0.02w;W, Where: Wj, ws: weights of JB Hi-fi and Santos, respectively rp, lj, rs: expected return of the portfolio, JB Hi-fi and Santos, respectively Up, Uj, Us: variance of the portfolio, JB Hi-fi and Santos, respectively Assuming the following: Expected return Variance JB Hi-fi 0.10 0.08 Santos 0.15 0.12 (The numbers in the table are in decimals, NOT percentages) You are considering two options for choosing weights. The first option is the "equal-weight portfolio. Here, the weights must be equal: (w; = ws) and sum to one: W; + W, = 1. a) Calculate the expected return of the "equal-weight portfolio. [1 mark] = % b) Calculate the variance of the equal-weight portfolio. [2 marks] The second option is the "minimum-variance portfolio. Use the Lagrangian method to figure out the optimal weights of a portfolio that has the lowest risk (variance). (Ignore the portfolio's expected return for now.) The only constraint is that the weights must add up to 1; weights can be negative, and do not have to be equal. c) Which of the following correctly describes the Lagrangian function for this problem? Write the option number in the box provided below. For example, if you choose option 1, write 1. [2 marks] Option 1: L = 1-W;-W, + (Up) Option 2: L = W; + w,-1+lUp) Option 3: L = Up + 2(1 W;-ws) Option 4: None of the above = = d) Calculate the following: Optimal weight of JB Hi-fi: % Optimal weight of Santos: % Expected return of the minimum variance" portfolio at the optimal weights: % Minimum Variance: [4 marks] e) Calculate the determinant of the bordered Hessian matrix for this constrained optimization problem. [3 marks] f) Comparing the equal-weight and minimum-variance portfolio, Hongyi wants to pick the portfolio with the higher expected return per unit of risk (i.e., the portfolio for which the ratio expectedreturn is higher). You should variance recommend that he choose: * . [2 marks] Note: for this part, use at least 4 decimal places for the variances calculated in parts b & d. In the Excel assignment, Hongyi asked you to optimize various portfolios using the 3 stocks: Santos, CSR, and JB Hi-Fi. After reviewing the analysis that you submitted two weeks ago, he decided not to include CSR in the portfolio, given his macroeconomic forecasts of the Australian economy over the next 3 years. Therefore, for this question, the portfolio will include only JB Hi-Fi and Santos; you will choose weights for each of these two stocks. The expected return and variance of the portfolio are: "p = w;!; + wers Un = w;v; + wv; +0.02w;W, Where: Wj, ws: weights of JB Hi-fi and Santos, respectively rp, lj, rs: expected return of the portfolio, JB Hi-fi and Santos, respectively Up, Uj, Us: variance of the portfolio, JB Hi-fi and Santos, respectively Assuming the following: Expected return Variance JB Hi-fi 0.10 0.08 Santos 0.15 0.12 (The numbers in the table are in decimals, NOT percentages) You are considering two options for choosing weights. The first option is the "equal-weight portfolio. Here, the weights must be equal: (w; = ws) and sum to one: W; + W, = 1. a) Calculate the expected return of the "equal-weight portfolio. [1 mark] = % b) Calculate the variance of the equal-weight portfolio. [2 marks] The second option is the "minimum-variance portfolio. Use the Lagrangian method to figure out the optimal weights of a portfolio that has the lowest risk (variance). (Ignore the portfolio's expected return for now.) The only constraint is that the weights must add up to 1; weights can be negative, and do not have to be equal. c) Which of the following correctly describes the Lagrangian function for this problem? Write the option number in the box provided below. For example, if you choose option 1, write 1. [2 marks] Option 1: L = 1-W;-W, + (Up) Option 2: L = W; + w,-1+lUp) Option 3: L = Up + 2(1 W;-ws) Option 4: None of the above = = d) Calculate the following: Optimal weight of JB Hi-fi: % Optimal weight of Santos: % Expected return of the minimum variance" portfolio at the optimal weights: % Minimum Variance: [4 marks] e) Calculate the determinant of the bordered Hessian matrix for this constrained optimization problem. [3 marks] f) Comparing the equal-weight and minimum-variance portfolio, Hongyi wants to pick the portfolio with the higher expected return per unit of risk (i.e., the portfolio for which the ratio expectedreturn is higher). You should variance recommend that he choose: * . [2 marks] Note: for this part, use at least 4 decimal places for the variances calculated in parts b & d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts