Question: In the following case study, you will be utilizing the balance sheets from two separate companies to make an investment decision. Imagine that you

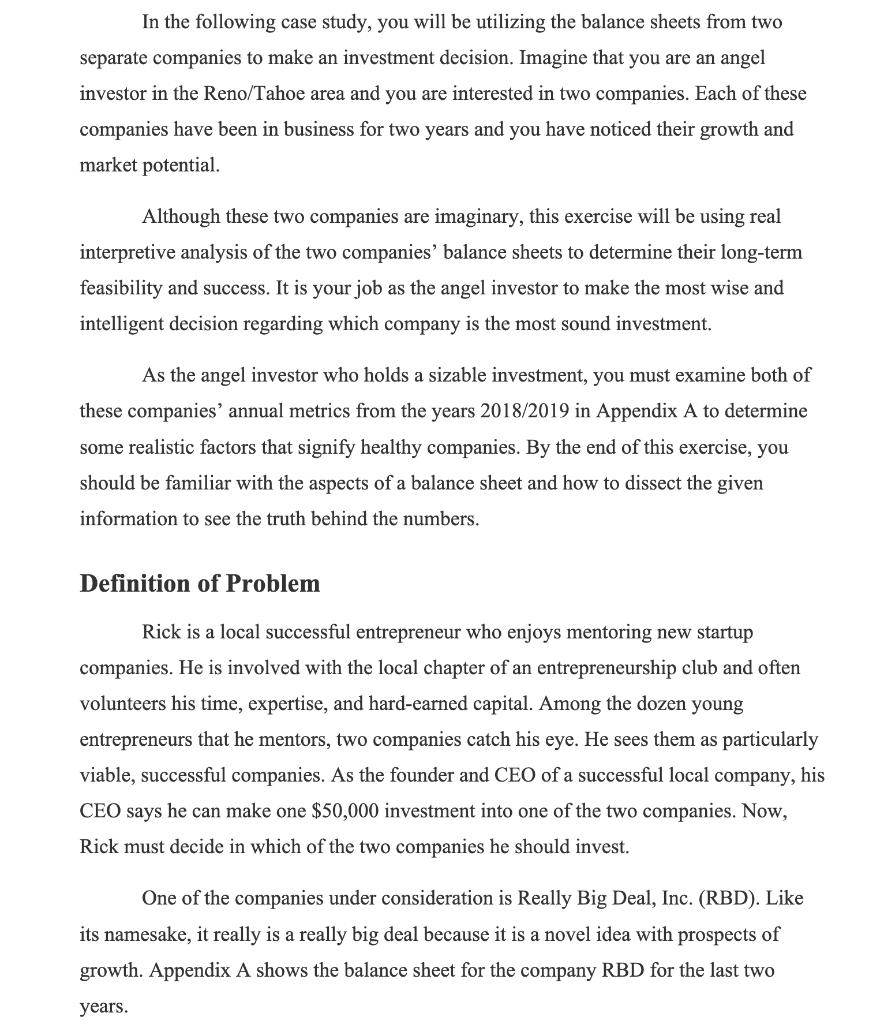

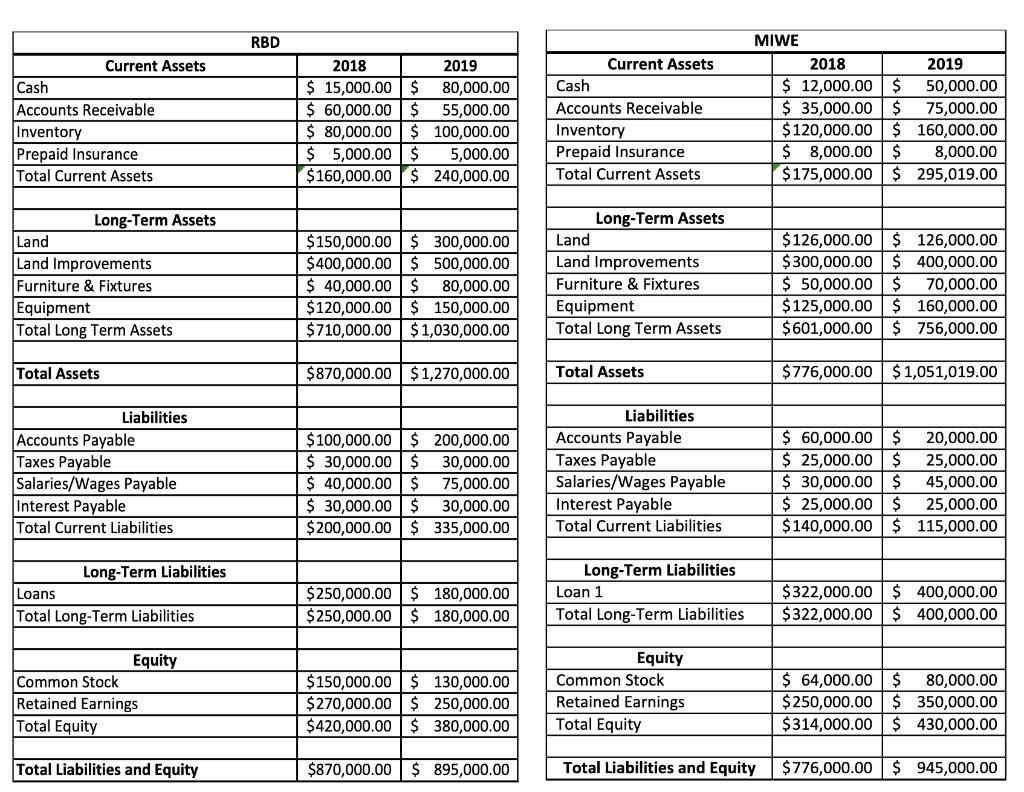

In the following case study, you will be utilizing the balance sheets from two separate companies to make an investment decision. Imagine that you are an angel investor in the Reno/Tahoe area and you are interested in two companies. Each of these companies have been in business for two years and you have noticed their growth and market potential. Although these two companies are imaginary, this exercise will be using real interpretive analysis of the two companies' balance sheets to determine their long-term feasibility and success. It is your job as the angel investor to make the most wise and intelligent decision regarding which company is the most sound investment. As the angel investor who holds a sizable investment, you must examine both of these companies' annual metrics from the years 2018/2019 in Appendix A to determine some realistic factors that signify healthy companies. By the end of this exercise, you should be familiar with the aspects of a balance sheet and how to dissect the given information to see the truth behind the numbers. Definition of Problem Rick is a local successful entrepreneur who enjoys mentoring new startup companies. He is involved with the local chapter of an entrepreneurship club and often volunteers his time, expertise, and hard-earned capital. Among the dozen young entrepreneurs that he mentors, two companies catch his eye. He sees them as particularly viable, successful companies. As the founder and CEO of a successful local company, his CEO says he can make one $50,000 investment into one of the two companies. Now, Rick must decide in which of the two companies he should invest. One of the companies under consideration is Really Big Deal, Inc. (RBD). Like its namesake, it really is a really big deal because it is a novel idea with prospects of growth. Appendix A shows the balance sheet for the company RBD for the last two years. The second company is Most Incredible Wall Ever, LLC (MIWE), who has invented a technolody that can build walls in commercial buildings cheaper and faster than any other competitors. Because this is a new technology unlike this world has ever seen, it has prospects of becoming the next impacting product yielding sizable returns in a construction market that is continuing to see growth. However, it is also very risky with an easy possibility to be the next Napster or Palm Pilot, losing the entire investment. Calculate profitability and efficiency ratios and explain what each ratio means for the investor. Current Assets Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Long-Term Assets Land Land Improvements Furniture & Fixtures Equipment Total Long Term Assets Total Assets Liabilities Accounts Payable Taxes Salaries/Wages Payable Interest Payable Total Current Liabilities. Long-Term Liabilities Loans Total Long-Term Liabilities Equity Common Stock Retained Earnings Total Equity Total Liabilities and Equity RBD 2018 2019 $ 15,000.00 $ 80,000.00 $ 60,000.00 $ 55,000.00 $ 80,000.00 $ 100,000.00 $5,000.00 $ 5,000.00 $160,000.00 $ 240,000.00 $150,000.00 $ 300,000.00 $400,000.00 $ 500,000.00 $ 40,000.00 $ 80,000.00 $120,000.00 $ 150,000.00 $710,000.00 $1,030,000.00 $870,000.00 $1,270,000.00 $100,000.00 $ 200,000.00 $ 30,000.00 $ 30,00 $ 40,000.00 $ 75,000.00 $ 30,000.00 $ 30,000.00 $200,000.00 $ 335,000.00 $250,000.00 $ 180,000.00 $250,000.00 $ 180,000.00 $150,000.00 $ 130,000.00 $270,000.00 $ 250,000.00 $420,000.00 $ 380,000.00 $870,000.00 $ 895,000.00 Current Assets Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Long-Term Assets Land Land Improvements Furniture & Fixtures Equipment Total Long Term Assets Total Assets Liabilities Accounts Payable Taxes Payable Salaries/Wages Payable Interest Payable Total Current Liabilities Long-Term Liabilities Loan 1 Total Long-Term Liabilities MIWE Equity Common Stock Retained Earnings Total Equity Total Liabilities and Equity 2018 2019 50,000.00 $ 12,000.00 $ $ 35,000.00 $ 75,000.00 $120,000.00 $ 160,000.00 $ 8,000.00 $ 8,000.00 $175,000.00 $ 295,019.00 $126,000.00 $ 126,000.00 $300,000.00 $ 400,000.00 $50,000.00 $ 70,000.00 $125,000.00 $ 160,000.00 $601,000.00 $ 756,000.00 $776,000.00 $1,051,019.00 $ 60,000.00 $ 20,000.00 $ 25,000.00 $ 25,000.00 $ 30,000.00 $ 45,000.00 $ 25,000.00 $ 25,000.00 $140,000.00 $ 115,000.00 $322,000.00 $ 400,000.00 $322,000.00 $ 400,000.00 $ 64,000.00 $ 80,000.00 $250,000.00 $ 350,000.00 $314,000.00 $430,000.00 $776,000.00 $ 945,000.00

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Profitability Ratios Return on Assets ROA This ratio measures the companys ability to generate profits from its assets It is calculated as Net IncomeT... View full answer

Get step-by-step solutions from verified subject matter experts