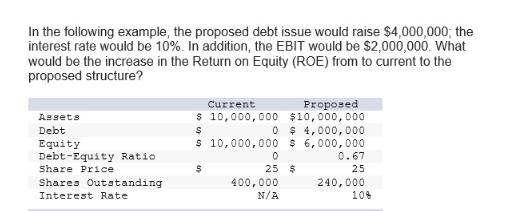

Question: In the following example, the proposed debt issue would raise $4,000,000; the interest rate would be 10%. In addition, the EBIT would be $2,000,000.

In the following example, the proposed debt issue would raise $4,000,000; the interest rate would be 10%. In addition, the EBIT would be $2,000,000. What would be the increase in the Return on Equity (ROE) from to current to the proposed structure? Assets Debt Equity Debt-Equity Ratio Share Price Shares Outstanding Interest Rate Proposed $10,000,000 0 $4,000,000 Current $ 10,000,000 $ $ 10,000,000 $ 6,000,000 0 25 $ 400,000 N/A 0.67 25 240,000 10%

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

To calculate the increase in Return on Equity ROE from the current to the proposed structure we need ... View full answer

Get step-by-step solutions from verified subject matter experts