Question: In the following table, the return, risk and beta numbers for three portfolios, the market portfolio and the T-bills are given. Using these, calculate the

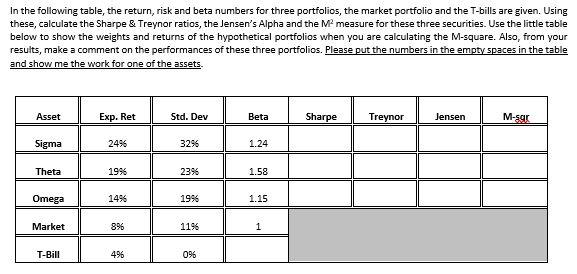

In the following table, the return, risk and beta numbers for three portfolios, the market portfolio and the T-bills are given. Using these, calculate the Sharpe \& Treynor ratios, the Jensen's Alpha and the M2 measure for these three securities. Use the little table below to show the weights and returns of the hypothetical portfolios when you are calculating the M-square. Also, from your results, make a comment on the performances of these three portfolios. Please put the numbers in the empty spaces in the table and show me the work for one of the assets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock