Question: In the last problem set, we explored progressive taxation. A tax is progressive when it takes a higher percentage of income as income increases. In

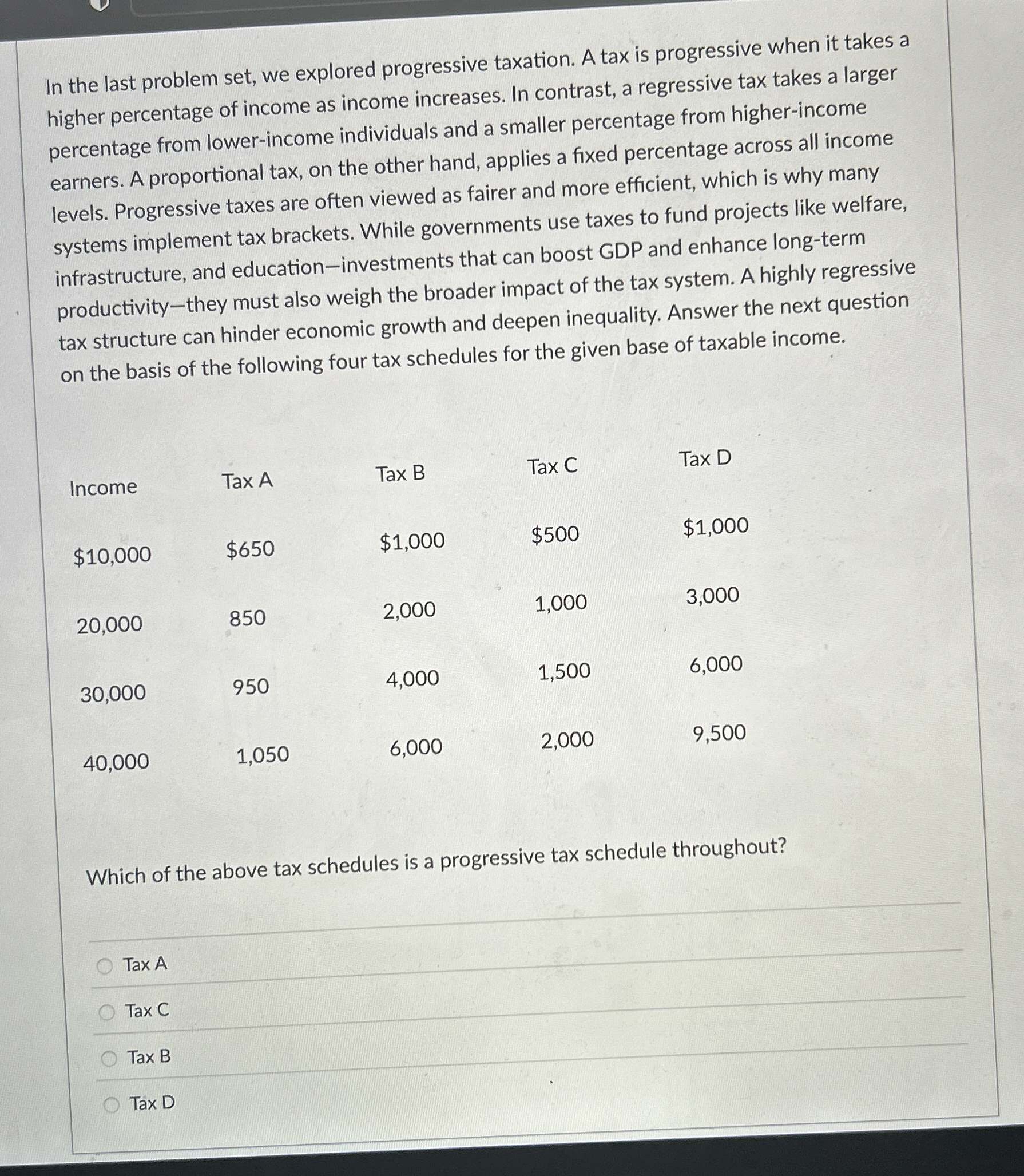

In the last problem set, we explored progressive taxation. A tax is progressive when it takes a higher percentage of income as income increases. In contrast, a regressive tax takes a larger percentage from lowerincome individuals and a smaller percentage from higherincome earners. A proportional tax, on the other hand, applies a fixed percentage across all income levels. Progressive taxes are often viewed as fairer and more efficient, which is why many systems implement tax brackets. While governments use taxes to fund projects like welfare, infrastructure, and educationinvestments that can boost GDP and enhance longterm productivitythey must also weigh the broader impact of the tax system. A highly regressive tax structure can hinder economic growth and deepen inequality. Answer the next question on the basis of the following four tax schedules for the given base of taxable income.

tableIncomeTax Tax BTax CTax D$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock