Question: In the private label operating benchmarks section on p. 7 of each issue of the FIR, the industry- low, industry-average, and industry-high benchmarks for the

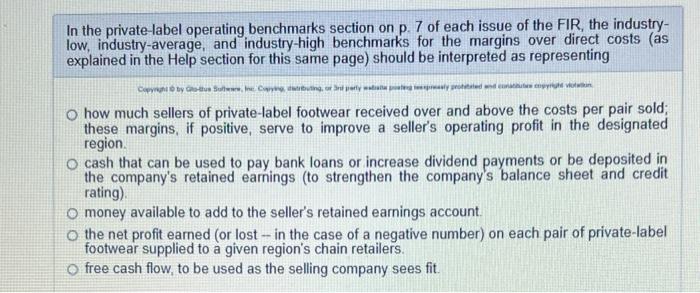

In the private label operating benchmarks section on p. 7 of each issue of the FIR, the industry- low, industry-average, and industry-high benchmarks for the margins over direct costs (as explained in the Help section for this same page) should be interpreted as representing Copy the Sune Carling, flyttede van o how much sellers of private-label footwear received over and above the costs per pair sold; these margins, if positive, serve to improve a seller's operating profit in the designated region o cash that can be used to pay bank loans or increase dividend payments or be deposited in the company's retained earnings (to strengthen the company's balance sheet and credit rating) o money available to add to the seller's retained earnings account. o the net profit earned (or lost - in the case of a negative number) on each pair of private-label footwear supplied to a given region's chain retailers. o free cash flow, to be used as the selling company sees fit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts