Question: IN THE PROBLEM BELOW I USED THE VALUES THE LAST EXPERT GAVE ME AND I GOT PARTS OF THE PROBLEM WRONG. CAN YOU PLEASE HELP

IN THE PROBLEM BELOW I USED THE VALUES THE LAST EXPERT GAVE ME AND I GOT PARTS OF THE PROBLEM WRONG. CAN YOU PLEASE HELP ME CORRECT THESE. PLEASE SHOW THIS NEATLY AND CLEARLY WRITTEN. THANK YOU.

THE PROB;LLEM BELOW HAS THE INCORRECT VALUES FROM THE PREVIOUS EXPERT. CAN YOU HELP ME CORRECT IT.

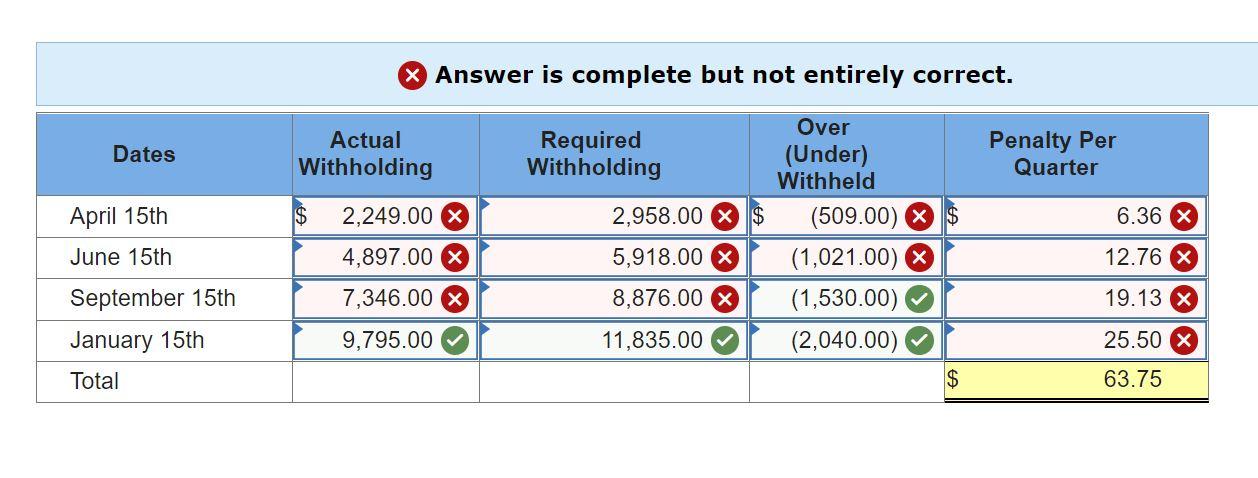

This year Lloyd, a single taxpayer, estimates that his tax liability will be $13,150. Last year, his total tax liability was $17,100. He estimates that his tax withholding from his employer will be $9,795. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal short-term rate is 5 percent. : X Answer is complete but not entirely correct. Dates Actual Withholding Required Withholding Penalty Per Quarter April 15th $ 2,249.00 X 6.36 2,958.00 X 5,918.00 June 15th 4,897.00 X Over (Under) Withheld (509.00) X (1,021.00) X (1,530.00) (2,040.00) $ 12.76 X 7,346.00 X 8,876.00 X 19.13 X September 15th January 15th Total 9,795.00 11,835.00 25.50 X 63.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts