Question: in the Return Logic case [question #3 about the VCs demanding more shares, on a proportional basis, than the founders had anticipated], there appears to

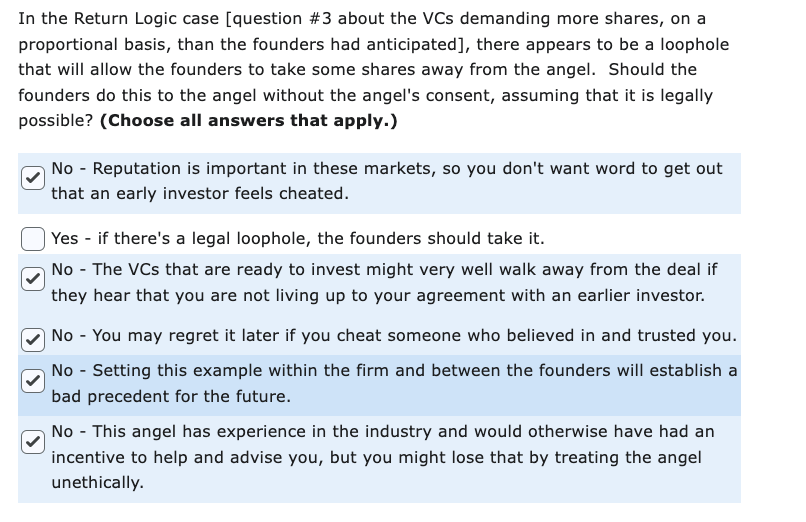

in the Return Logic case [question \#3 about the VCs demanding more shares, on a proportional basis, than the founders had anticipated], there appears to be a loophole hat will allow the founders to take some shares away from the angel. Should the ounders do this to the angel without the angel's consent, assuming that it is legally oossible? (Choose all answers that apply.) No - Reputation is important in these markets, so you don't want word to get out that an early investor feels cheated. Yes - if there's a legal loophole, the founders should take it. No - The VCs that are ready to invest might very well walk away from the deal if they hear that you are not living up to your agreement with an earlier investor. No - You may regret it later if you cheat someone who believed in and trusted you. No - Setting this example within the firm and between the founders will establish a bad precedent for the future. No - This angel has experience in the industry and would otherwise have had an incentive to help and advise you, but you might lose that by treating the angel unethically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts