Question: In the Roll model trade prices are pt = mt + cdt where mt is the efficient price (mid-price) and dt = 1 is the

In the Roll model trade prices are pt = mt + cdt where mt is the efficient price (mid-price) and dt = 1 is the trade sign (indicator) which shows if the trade is a buy or sell.

The simple Roll model assumes that trade signs are serially uncorrelated: corr(dt, ds) = 0 for t ?= s. In practice, trade signs are correlated, with positive autocorrelation. Suppose that corr(dt, dt?1) = ? > 0 and corr(dt, dt?k) = 0 for k > 1. Suppose that ? > 0 is known. Also, assume that the trade signs dt are uncorrelated with the increments of the efficient price ?mt = ut.

i) Show that V ar(?pt) = 2c2(1 ? ?) + ?u2, Cov(?pt, ?pt?1) = ?c2(1 ? 2?), Cov(?pt, ?pt?2) = ?c2?, and Cov(?pt, ?pt?k) = 0 for k > 2.

ii) Suppose that 0

Hints. For (i), recall the corresponding expressions in the simple Roll 222

model V ar(?pt) = 2c + ?u and Cov(?pt, ?pt?1) = ?c .

Note that the equations above in (i) reduce to these expressions if ? = 0. Repeat the computations for the simple model allowing for the correlation ? and you should get the results stated.

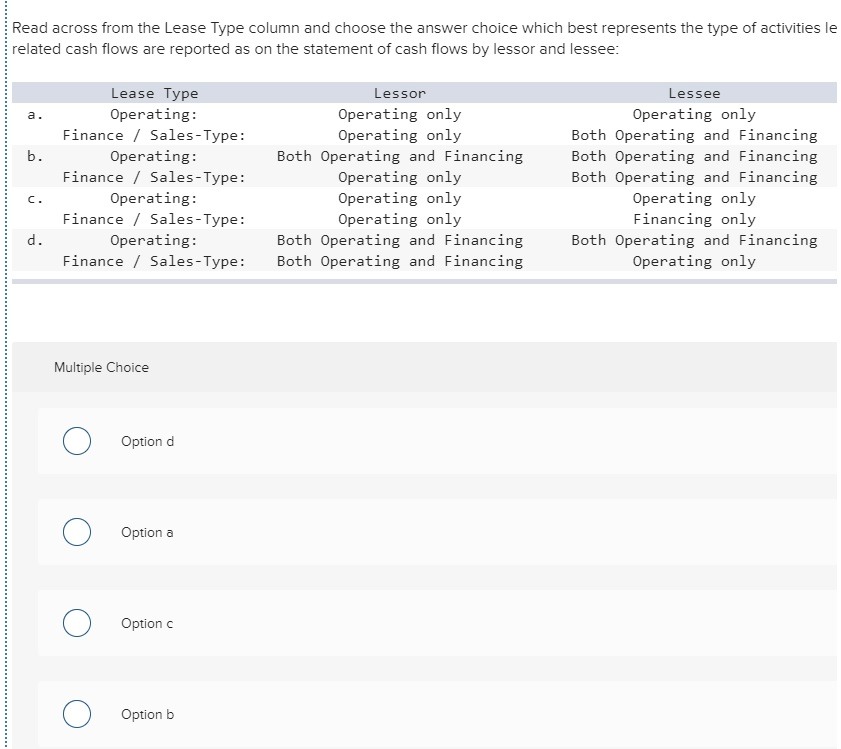

Question 10 1 pts The three major functions in most businesses are: O operations, marketing, and finance O operations, finance, strategy O strategy, finance, operations O marketing, strategy, accounting O finance, marketing, strategyRead across from the Lease Type column and choose the answer choice which best represents the type of activities le related cash ows are reported as on the statement of cash ows by lessor and lessee: Lease Type a. Operating: Finance f SalesType: h. Operating: Finance f Sales-Type: c. Operating: Finance I Sales-Type: d. Operating: Finance f Sales-Type: Multiple Choice 0 Option d Option a Oponb O Q opt-.0: : O Lessor Operating only Operating only Both Operating and Financing Operating only Operating only Operating only Both Operating and Financing Both Operating and Financing Lessee Operating only Both Operating and Financing Both Operating and Financing Both Operating and Financing Operating only Financing only Both Operating and Financing Operating only 5 years Total Mean 2 years Total Std. 2 years Dev. 5 years years 2. Use analysis of variance (one way ANOVA) to test for any significant differences between salary and position at the .05 level of significance. Ignore the effect of years of experience. 5 years 5 years years 3. Use analysis of variance (one-way ANOVA) to test for any significant differences between salary and years of experience at the .05 level of significance. Ignore the effect of position. ience and in total. Use the d you in answering the other 4. Based on your total analysis, provide management with a summary conclusion to answer these basic questions: Is there a relationship between salary and position? is there a relationship between salary and years of experience? Explain. Your response should be at least 100 words in length