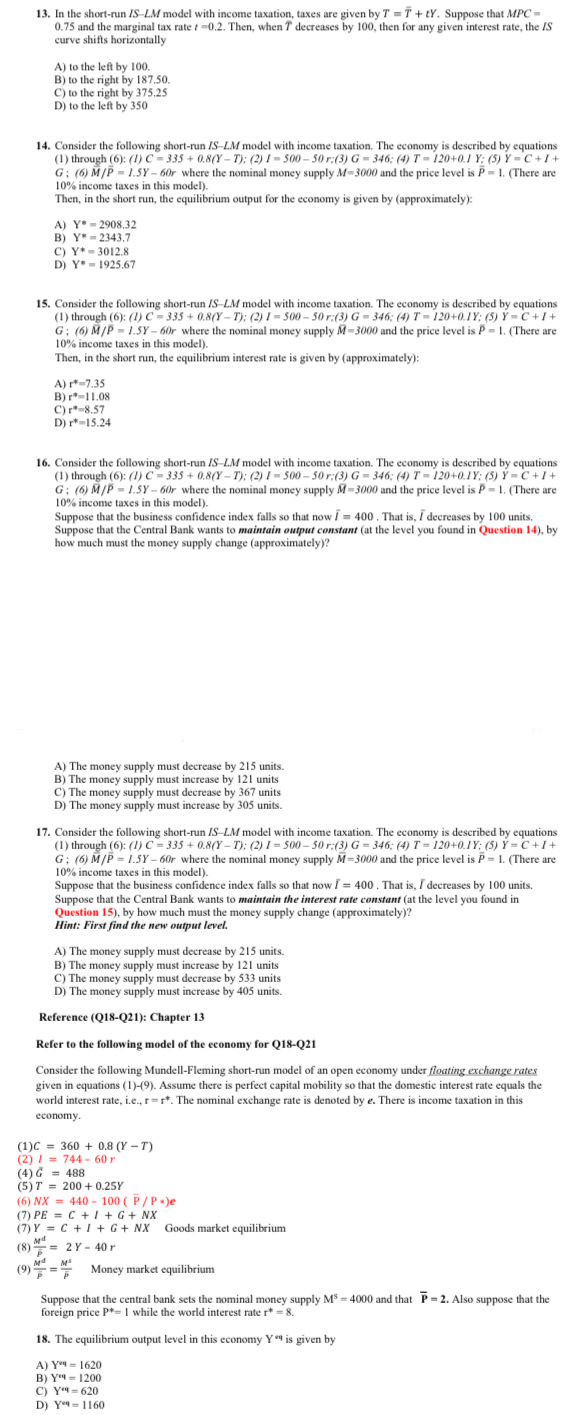

Question: In the short - run I S - L M model with income taxation, taxes are given by T ? b = a r (

In the shortrun model with income taxation, taxes are given by Suppose that and the marginal tax rate Then, when decreases by then for any given interest rate, the curve shifts horizontally

A to the left by

B to the right by

C to the right by

D to the left by

Consider the following shortrun model with income taxation. The economy is described by equations through : I; ; ; I,; ; bar where the nominal moncy supply and the price level is There are income taxes in this model

Then, in the short run, the equilibrium output for the economy is given by approximately:

A

B

C

D

Consider the following shortrun model with income taxation. The economy is described by equations through : I; ;; ; ; bar where the nominal money supply and the price level is There are income taxes in this model

Then, in the short run, the equilibrium interest rate is given by approximately:

A

B

C

D

Consider the following shortrun model with income taxation. The economy is described by equations through : I; ; ; ; ; bar where the nominal money supply and the price level is There are income taxes in this model

Suppose that the business confidence index falls so that now That is decreases by units. Suppose that the Central Bank wants to maintain output constant at the level you found in Question by how much must the money supply change approximately

A The money supply must decrease by units.

B The money supply must increase by units

C The money supply must decrease by units

D The money supply must increase by units.

Consider the following shortrun model with income taxation. The economy is described by equations through : l; ; ; ; ; bar where the nominal money supply and the price level is There are income taxes in this model

Suppose that the business confidence index falls so that now That is I decreases by units. Suppose that the Central Bank wants to maintain the interest rate constant at the level you found in Question by how much must the money supply change approximately

Hint: First find the new output level.

A The money supply must decrease by units.

B The money supply must increase by units

C The money supply must decrease by units

D The money supply must increase by units.

Reference QQ: Chapter

Refer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock