Question: in the solution how share capital, retained earining and the exchange difference come with these amount? Question: - An entity commenced business on January 1,2019

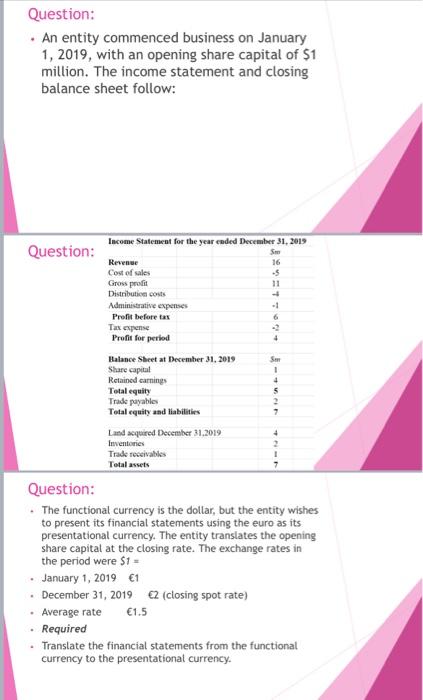

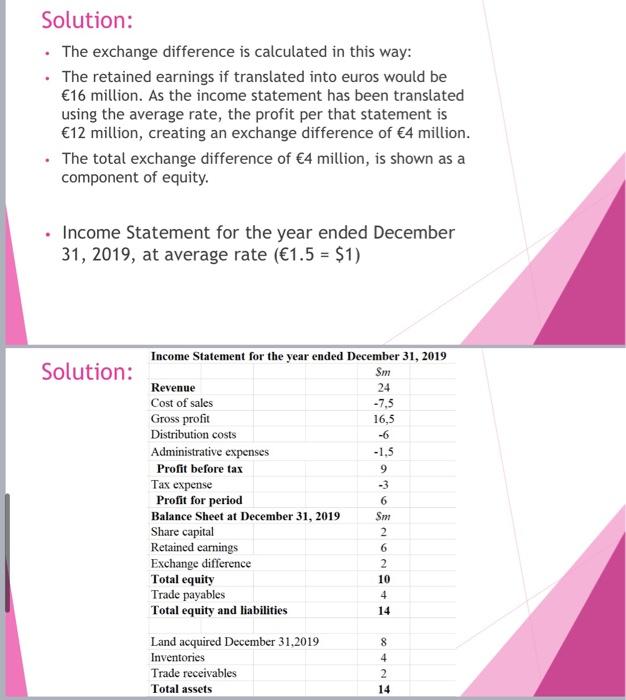

Question: - An entity commenced business on January 1,2019 , with an opening share capital of $1 million. The income statement and closing balance sheet follow: Question: Question: - The functional currency is the dollar, but the entity wishes to present its financial statements using the euro as its presentational currency. The entity translates the opening share capital at the closing rate. The exchange rates in the period were $1= - January 1,20191 - December 31, 2019 e2 (closing spot rate) - Average rate 1.5 - Required - Translate the financial statements from the functional currency to the presentational currency. Solution: - The exchange difference is calculated in this way: - The retained earnings if translated into euros would be 16 million. As the income statement has been translated using the average rate, the profit per that statement is 12 million, creating an exchange difference of 4 million. - The total exchange difference of 4 million, is shown as a component of equity. - Income Statement for the year ended December 31,2019 , at average rate (1.5=$1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts