Question: In the supernormal case, however, the expected growth rate is not a constant. Still, you can combine both equations to construct a new formula for

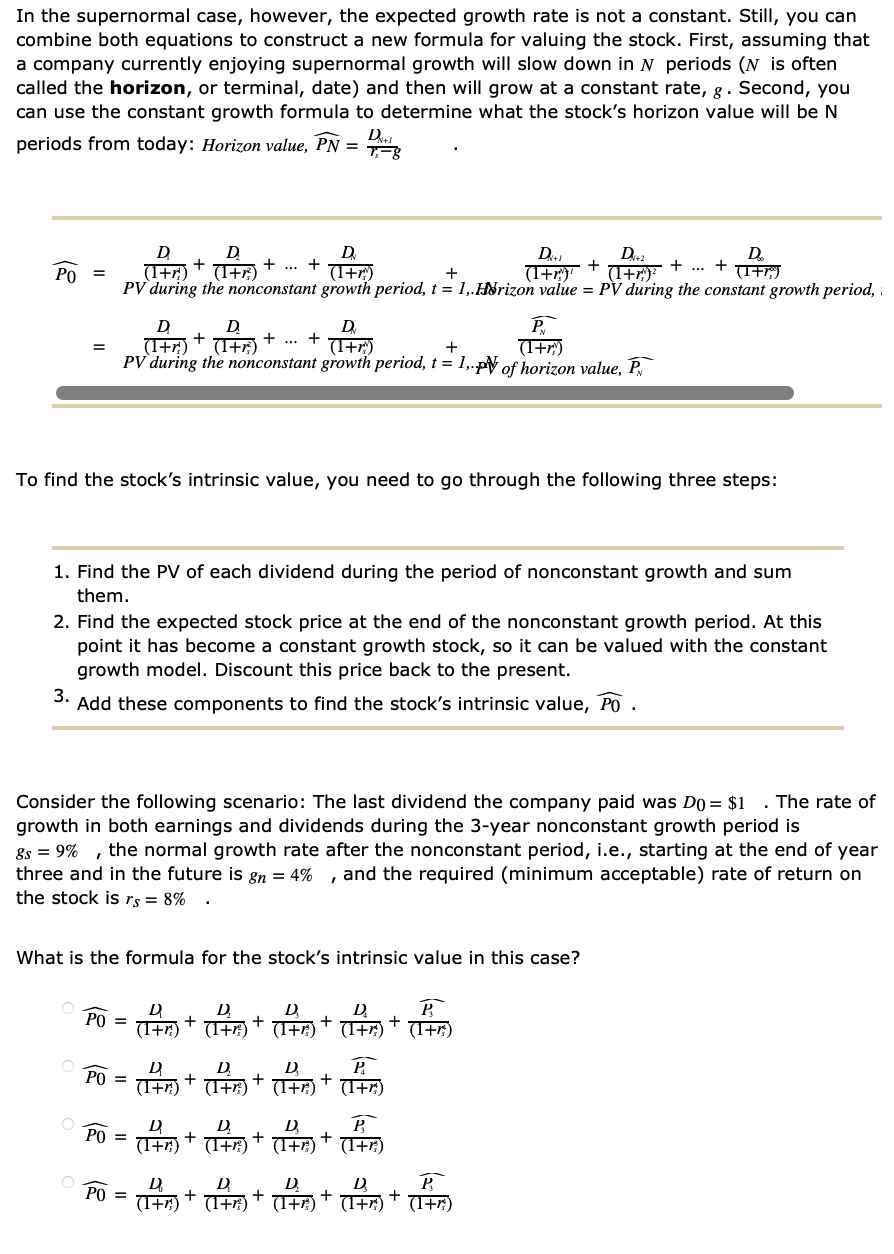

In the supernormal case, however, the expected growth rate is not a constant. Still, you can combine both equations to construct a new formula for valuing the stock. First, assuming that a company currently enjoying supernormal growth will slow down in N periods ( N is often called the horizon, or terminal, date) and then will grow at a constant rate, g. Second, you can use the constant growth formula to determine what the stock's horizon value will be N periods from today: Horizon value, PN=rs+8LN+1 To find the stock's intrinsic value, you need to go through the following three steps: 1. Find the PV of each dividend during the period of nonconstant growth and sum them. 2. Find the expected stock price at the end of the nonconstant growth period. At this point it has become a constant growth stock, so it can be valued with the constant growth model. Discount this price back to the present. 3. Add these components to find the stock's intrinsic value, P0. Consider the following scenario: The last dividend the company paid was D0=$1. The rate of growth in both earnings and dividends during the 3-year nonconstant growth period is gs=9%, the normal growth rate after the nonconstant period, i.e., starting at the end of year three and in the future is gn=4%, and the required (minimum acceptable) rate of return on the stock is rs=8%. What is the formula for the stock's intrinsic value in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts