Question: In the third table, you will be using the price to earnings ratio (P/E) along with the average expected earnings per share provided by the

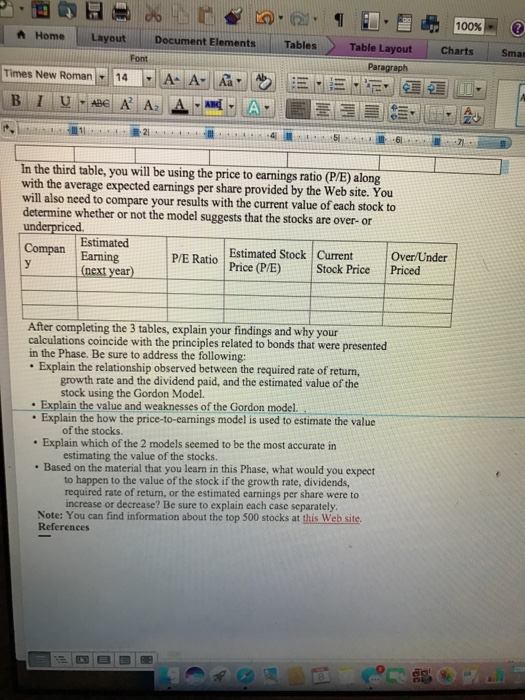

In the third table, you will be using the price to earnings ratio (P/E) along with the average expected earnings per share provided by the Web site. You will also need to compare your results with the current value of each stock to determine whether or not the model suggests that the stocks are over- or underpriced. After completing the 3 tables, explain your findings and why your calculations coincide with the principles related to bonds that were presented in the Phase. Be sure to address the following: Explain the relationship observed between the required rate of return, growth rate and the dividend paid, and the estimated value of the stock using the Gordon Model. Explain the value and weaknesses of the Gordon model. Explain the how the price-to-earnings model is used to estimate the value of the stocks. Explain which of the 2 models seemed to be the most accurate in estimating the value of the stocks. Based on the material that you learn in this Phase, what would you expect to happen to the value of the stock if the growth rate, dividends, required rate of return, or the estimated earnings per share were to increase or decrease? Be sure to explain each case separately. In the third table, you will be using the price to earnings ratio (P/E) along with the average expected earnings per share provided by the Web site. You will also need to compare your results with the current value of each stock to determine whether or not the model suggests that the stocks are over- or underpriced. After completing the 3 tables, explain your findings and why your calculations coincide with the principles related to bonds that were presented in the Phase. Be sure to address the following: Explain the relationship observed between the required rate of return, growth rate and the dividend paid, and the estimated value of the stock using the Gordon Model. Explain the value and weaknesses of the Gordon model. Explain the how the price-to-earnings model is used to estimate the value of the stocks. Explain which of the 2 models seemed to be the most accurate in estimating the value of the stocks. Based on the material that you learn in this Phase, what would you expect to happen to the value of the stock if the growth rate, dividends, required rate of return, or the estimated earnings per share were to increase or decrease? Be sure to explain each case separately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts